In an in depth evaluation shared together with his 788,000 followers on X (previously Twitter), famend analyst Pentoshi has forecasted a extra restrained outlook for the present crypto bull run, suggesting that it might not mirror the explosive development seen in earlier cycles. His insights present a deep dive into the underlying elements that would mood the market’s efficiency.

Why Crypto Traders Have To Count on Diminishing Returns

Pentoshi started his evaluation by stating, “This cycle ought to have the most important diminishing returns of any cycle,” attributing this prediction to a number of key market circumstances. Primarily, he famous that the bottom market capitalization for cryptocurrencies has elevated considerably in every successive cycle, setting a better place to begin that makes additional exponential development more and more difficult.

“Every cycle has set a flooring about 10x the earlier lows when it comes to market cap,” Pentoshi defined. He supplied a historic context, recounting that when he entered the crypto market in 2017, the market cap for altcoins was solely round $12-15 billion, a determine that ballooned to over $1 trillion throughout peak intervals. He argued, “That development isn’t repeatable,” declaring that the decentralized finance (DeFi) sector, which was then nascent, performed a major position in driving earlier cycles’ distinctive returns.

One other important issue Pentoshi highlighted is the dramatic improve within the variety of altcoins and the corresponding market dilution. “Right this moment, nonetheless, there are much more alts, and much more dilution,” he remarked, indicating that the proliferation of recent tokens spreads funding thinner throughout the market, decreasing the potential for particular person tokens to attain substantial worth will increase.

Pentoshi additionally touched upon the demographic shifts in crypto possession. He contrasted the early days of crypto adoption, when roughly 2% of People had been concerned out there, to the current, the place over 25% of People have some type of crypto funding. “It simply requires extra capital to maneuver the markets, and there’ll proceed to be much more alts, spreading it out additional,” he famous, emphasizing the logistical and monetary challenges of replicating previous development charges in a way more saturated market.

An often-overlooked side of market dynamics, based on Pentoshi, is the position of token liquidity and its affect on worth stability. He detailed that lately, tokens amounting to about $250 million had been unlocked each day, although not essentially offered. “Assuming all of them acquired offered, that’s the inflows you’d want simply to maintain costs steady for twenty-four hours,” he defined, highlighting the fragile steadiness required to take care of present market ranges, not to mention drive costs upward.

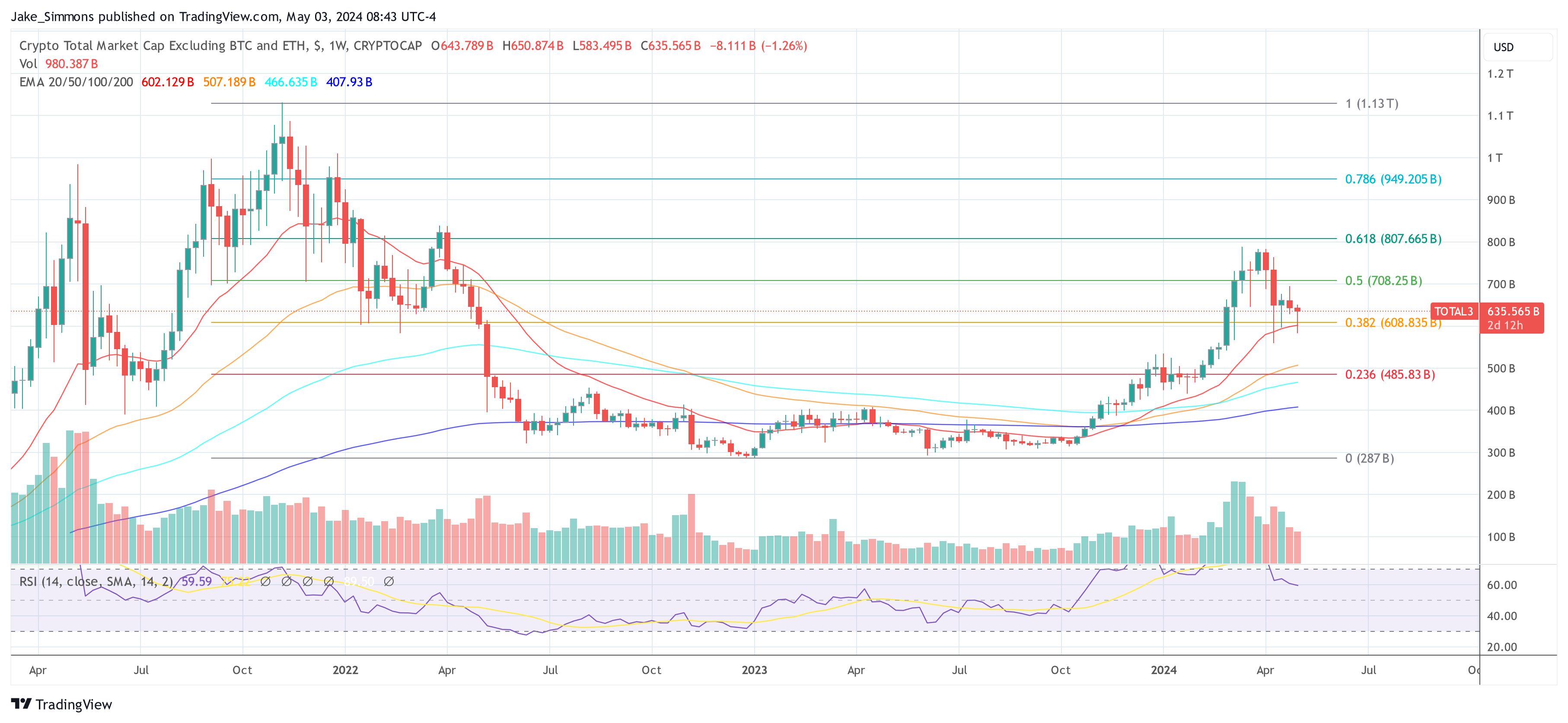

Wanting ahead, Pentoshi was conservative in his expectations for the Total3 index, which tracks the highest 125 altcoins (excludes Bitcoin and Ethereum). He estimated, “My greatest guess is that this cycle we don’t see Complete 3 go 2x previous the 21′ cycle ATH. So 2.2T max for Total3.” This projection underscores his broader thesis that whereas the market continues to supply each day alternatives, the period of “simple, outsized positive aspects” is likely to be behind us.

Pentoshi concluded his evaluation with recommendation for buyers, suggesting a extra cautious method to market participation. “In case you consider the cycle is 50% over, you need to be taking out greater than you’re placing in and increase some money and shopping for different property with decrease threat within the meantime,” he suggested, stressing the significance of securing positive aspects and diversifying holdings to mitigate threat.

Reflecting on the psychological features of investing, he added, “Most individuals by no means actually study. As a result of when you can’t management your greed, and defeat it, you’re destined to offer again your positive aspects repeatedly.” His parting phrases had been a reminder of the cyclical and infrequently predatory nature of monetary markets, urging buyers to safe income and defend themselves from foreseeable downturns.

At press time, TOTAL3 stood at $635.565 billion, which remains to be greater than -43 % under the final cycle excessive.

Featured picture from iStock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual threat.