A latest report has revealed an upcoming vital occasion that can see the expiration of a notable quantity of Bitcoin (BTC) and Ethereum (ETH) choices contracts.

Bitcoin And Ethereum Choices Contract Set To Expire

World choices buying and selling service platform Greeks.dwell, took to X (previously Twitter) to share knowledge relating to the expiration of the crypto belongings.

In keeping with the platform, about 37,000 BTC choices with a notional worth of $1.58 billion are set to run out. As well as, Bitcoin’s present put-call ratio stands at 1.02 with a “Maxpain” level of $42,000.

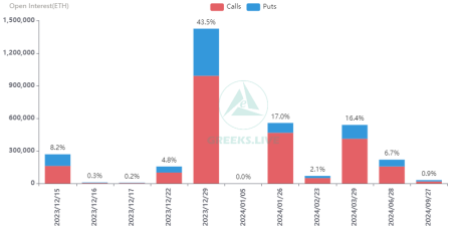

In the meantime, for Ethereum, the info reveals that about 268,000 choices valued at $610 million are set to run out quickly. As well as, the present put-call ratio for ETH stand at 0.66, with a “maxpain” level of $2,250. The put up learn:

Dec. 15 Choices Knowledge. 37,000 BTC choices are about to run out with a Put Name Ratio of 1.02, a Maxpain level of $42,000, and a notional worth of $1.58 billion. 268,000 ETH choices are attributable to expire with a Put Name Ratio of 0.66, a Maxpain level of $2,250, and a notional worth of $610 million.

Notably, the put-call ratio, to place it merely, contrasts the buying and selling quantity of put and name choices. A ratio greater than 1 signifies a better variety of places (promote) than calls (purchase) choices, implying a destructive outlook amongst merchants.

Moreover, the worth at which the best variety of choices would expire nugatory is named the utmost ache (Maxpain) level.

Greeks.dwell asserted that this week noticed a decline available in the market, with BTC dropping near $40,000 at one level. In consequence, many hedge their positions, which led to a higher proportion of Put than Name positions this week. The bulk of buying and selling remains to be focused on Bitcoin choices even with the decline.

The platform additionally highlighted that the Implied Volatility (IV) has remained fairly flat for a few month now. As well as, vital possibility strikes are nonetheless happening.

The Crypto Property Set To See Substantial Influx

Cryptocurrency analyst Ali has lately revealed that billions of influx are set to be poured into Bitcoin and Ethereum. The analyst shared this important info with the crypto neighborhood in an X put up on Thursday, December 14.

In keeping with Ali, over $19.7 billion is about to circulation into the 2 main gamers within the cryptocurrency market. He additionally added that this capital influx is similar to what we noticed in December 2020.

The X put up was accompanied by a chart displaying a digital rationalization of an analogous state of affairs. Ali additional highlighted that after the state of affairs, the worth of BTC moved from $18,000 to $65,000.

With billions of {dollars} flooding into the 2 main crypto, the market is likely to be poised for additional earnings.

Featured picture from iStock, chart by Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal threat.