Bitcoin (BTC) has been battered by a relentless bear market over the previous month, with its value tumbling 20% from its document highs. Nevertheless, amidst the carnage, glimmers of hope emerge as outstanding analysts predict a possible backside forming across the present $57,000 mark.

Powerful Opening Month For Bitcoin

The beginning of Might has not been sort to Bitcoin. The once-dominant cryptocurrency has seen a gentle decline, plunging again to ranges final witnessed in March earlier than its monumental surge to $73,700. This latest value drop represents probably the most vital decline of this cycle, elevating considerations a couple of extended bear market.

The ache extends past Bitcoin, with the broader altcoin market feeling the tremors. Litecoin (LTC), the silver to Bitcoin’s gold, has mirrored the downward pattern, shedding a staggering 25% of its worth up to now month. Whereas traditionally seen as a extra secure various to Bitcoin, Litecoin appears to be tethered to its large brother’s destiny on this present downturn.

Discovering The Backside: Bullish Predictions Floor

Regardless of the prevailing gloom, a refrain of optimism is rising from the crypto evaluation neighborhood. A number of heavyweight analysts consider Bitcoin might have discovered its footing across the present value vary of $56,000 to $58,000.

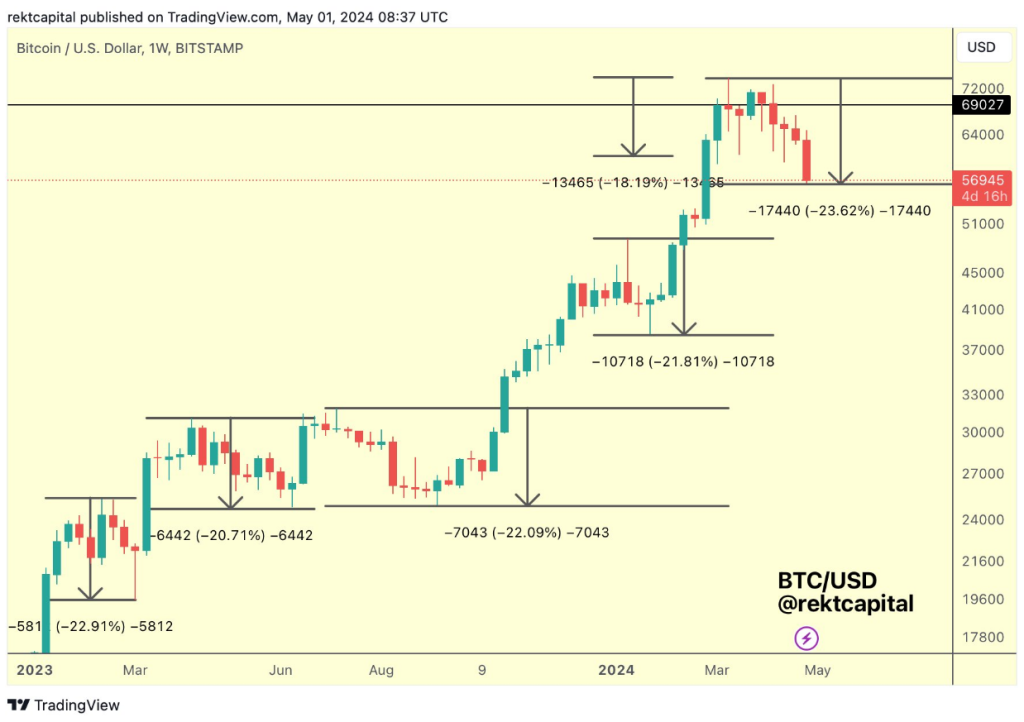

Rekt Capital, a preferred crypto analyst, emphasizes a historic sample the place comparable 20% dips have been adopted by vital rebounds. Michaël van de Poppe, one other well-respected voice, echoes this sentiment, suggesting Bitcoin could also be nearing the top of its value consolidation section. He cautions of potential short-term fluctuations however highlights the $56,000 to $58,000 zone as a vital help degree.

That is formally the deepest retrace within the cycle (-23.6%)$BTC #BitcoinHalving #Bitcoin pic.twitter.com/Gcapbl0Nu6

— Rekt Capital (@rektcapital) Might 1, 2024

Uncertainty Looms As Market Awaits Fed Choice

Whereas analyst optimism is a welcome signal, a cloud of uncertainty hangs over the crypto market. The upcoming Federal Reserve determination on rates of interest might considerably influence investor sentiment and, consequently, Bitcoin’s value trajectory. A extra hawkish stance from the Fed might set off additional promoting, whereas a dovish method may present the tailwind wanted for a Bitcoin rebound.

Associated Studying: Ethereum Charges Dive: Will This Spark A Surge In Community Exercise?

Buckle Up For A Bumpy Experience

The subsequent few weeks will likely be essential for Bitcoin and the broader cryptocurrency market. The Federal Reserve’s determination and investor response to the present value stoop will seemingly dictate the short-term route. Whereas bullish sentiment suggests a possible reversal, the inherent volatility of the crypto market means traders ought to brace for a bumpy journey.

Featured picture from Pixabay, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site solely at your personal danger.