On-chain knowledge reveals the brand new whale entrants within the Bitcoin market now maintain nearly twice as a lot because the veterans. Right here’s what could possibly be behind this shift.

Bitcoin Beginner Whale Holdings Have Been Quickly Rising Not too long ago

In a brand new put up on X, CryptoQuant founder and CEO Ki Younger Ju has mentioned about how the holdings of the brand new whales compares in opposition to the previous ones available in the market proper now.

The on-chain indicator of curiosity right here is the “Realized Cap,” which, briefly, retains monitor of the entire quantity of capital that the buyers have used to buy their Bitcoin.

This capitalization mannequin is in distinction to the standard market cap, which merely measures the entire worth that the holders as an entire are carrying based mostly on the present spot value.

Within the context of the present subject, the Realized Cap of all the market isn’t of curiosity, however moderately particularly that of two segments: the short-term holder whales and long-term holder whales.

Whales are outlined as entities on the community who’re holding at the least 1,000 BTC of their steadiness. On the present alternate fee, this quantity is value $66.6 million, so the whales are clearly fairly large holders. Due to these giant holdings, these buyers can maintain some affect available in the market.

Primarily based on holding time, the whales will be subdivided into two classes. The short-term holder (STH) whales are those that acquired their cash inside the previous 155 days, whereas the long-term holder (LTH) whales have been holding since longer than this timespan.

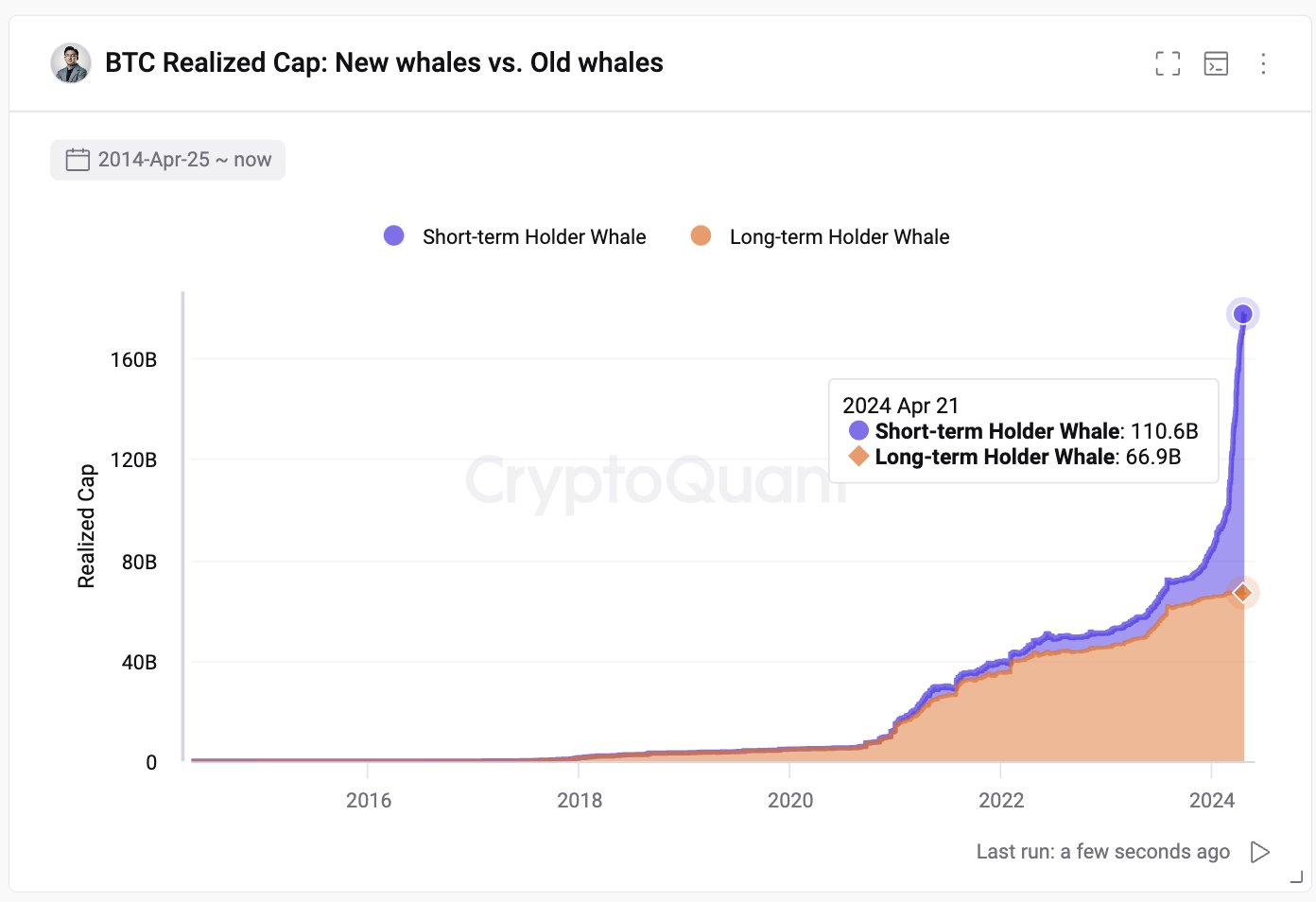

Now, right here is the chart shared by Ju that reveals the Realized Cap breakdown between these two Bitcoin whale cohorts:

Seems just like the metric has shot up for the STH whales just lately | Supply: @ki_young_ju on X

As is seen within the above graph, the Realized Cap of the STH whales has traditionally not been too completely different from that of the LTH whales, however that seems to have modified just lately.

The metric has pulled away for these new whales this 12 months with some very sharp development, as its worth has now reached the $110.6 billion mark. Which means the STH whales have collectively purchased their cash at an preliminary funding of a whopping $110.6 billion.

The Realized Cap of the LTH whales, however, has continued its traditional trajectory, floating round $66.9 billion at the moment. Which means there may be now an enormous hole between the indicator for these two cohorts.

However what’s the explanation behind the sudden emergence of this brand-new development? As talked about earlier than, the STH cutoff stands at 155 days, which signifies that the Realized Cap of the STH whales would signify the entire worth of the purchases made by the whales over the past 5 months.

Prior to now 5 months, there was one occasion particularly that has stood out, which has additionally by no means been current in any of the prior cycles: the approval of the spot exchange-traded funds (ETFs).

The spot ETFs present an alternate mode of funding into the asset via a signifies that’s acquainted to conventional buyers. These funds have been bringing in some unprecedented demand into BTC and as their holdings additionally fall underneath the 155 days mark, they’d rely as STH whales.

Bitcoin has additionally been rallying this 12 months, so all this new funding would have needed to buy at comparatively excessive costs, thus inflicting the Realized Cap, which correlates to direct capital flows, to inflate even additional.

BTC Value

Bitcoin is now buying and selling at $66,400 after witnessing a surge of greater than 6% over the previous week.

The worth of the asset appears to have been total consolidating sideways just lately | Supply: BTCUSD on TradingView

Featured picture from Todd Cravens on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.