Zima Purple provides readers the weekly pulse on the largest information round NFTs. Be a part of our neighborhood and take the journey with us by subscribing right here:

Hey everybody! Right here’s what we bought for you this week:

Information

Market

Collectibles

Gaming

+ The Zima Purple Podcast

The official Yuga Labs Otherside Twitter account introduced that the primary tech demo for Otherside might be on July sixteenth.

That is nice as a result of, after all of the Otherside hype (and fuel charges), a quick video launched a couple of month in the past is all we’ve bought to go off of.

This announcement has led to a whole lot of hypothesis on Otherdeed land NFTs. For Otherdeed holders and potential consumers, so much is driving on how properly this demo is acquired.

An essential factor to look at is Koda NFTs positioned on Otherdeed land plots. The ground for plots with Kodas is ~2.8 ETH whereas the ground for ones with a Koda is nineteen.5 ETH. Easy subtraction reveals us that Koda NFTs are already value over 16 ETH. This helps the hypothesis that Koda NFTs will almost definitely have vital utility inside Otherside.

OpenSea partnered up with an NFT assortment referred to as Zoonies to debut its Launchpad expertise in mid-July. Different NFT marketplaces like Magic Eden have already discovered nice success with their launch pads so it’s about time for OpenSea to begin providing their very own.

What’s a launch pad?

Launchpads assist initiatives with the whole lot that goes into launching an NFT undertaking like minting contracts, whitelist administration, market help, and a bunch of providers round advertising.

Exchanges like Magic Eden, and now OpenSea primarily provide these providers as a method to attract collections over to their platform.

In associated information

OpenSea Co-founder Alex Atallah will depart the corporate on July thirtieth. His reasoning for leaving is predicated on his want to return to constructing initiatives from 0 to 1.

Atallah based OpenSea in 2018 with CEO Devin Finzer. His stake within the firm is at the moment value an estimated $2.2B. He’ll stay on the board.

Raoul Pal is the founding father of Actual Imaginative and prescient and probably the most well-known commentators within the crypto business (take heed to Andrew’s episode on Actual Imaginative and prescient right here.) Pal simply teamed up with Delphi Digital’s Kevin Kelly and the longtime leisure & media exec David Pemsel to begin a brand new token studio referred to as ScienceMagic.Studios.

Token studio?

Pal has lengthy been speaking in regards to the $63T in intangible property sitting on company steadiness sheets. This contains issues like IP, music, trend, motion pictures/e book/TV franchises, and sports activities.

Pal, Kelley, and Pemsel consider that they might help large manufacturers transfer into Web3 in the precise method – by using make the most of web3 applied sciences resembling NFTs and social tokens to extend interplay with followers and communities.

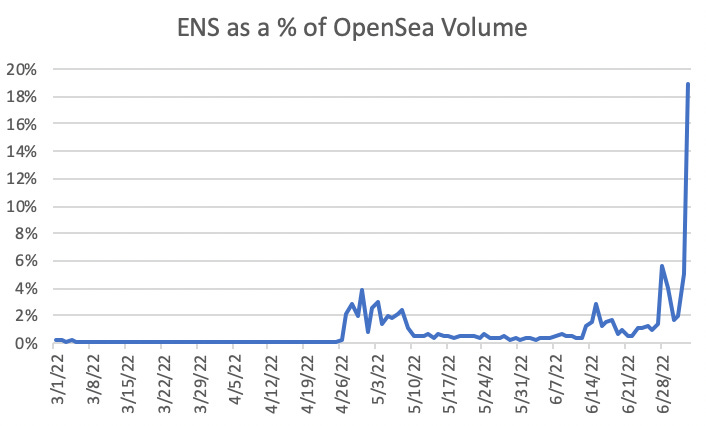

This week, ENS domains accounted for ~20% of OpenSea’s buying and selling quantity.

Numerous “golf equipment” have been established round completely different units of numeric ENS domains.

Notable golf equipment:

-

999 Membership – three digit numeric (000-999) —> 36ETH Flooring

-

Arabic 999 Membership – three digit arabic numerals —> 4.7ETH Flooring

-

10k Membership – 4 digit numeric (0000-9999)—> 2ETH Flooring

-

999 CN Membership – three digit Chinese language numerals —> 1.3 ETH Flooring

The collector narrative round numeric ens names is choosing up a whole lot of steam. Twitter is now crammed with “I really like my 000.eth greater than my punk” kind commentary.

“The worth an asset is outlined by those that worth it & are keen to assign worth to it- not those that sit on the sidelines and say it needs to be nugatory”

– DCInvestor

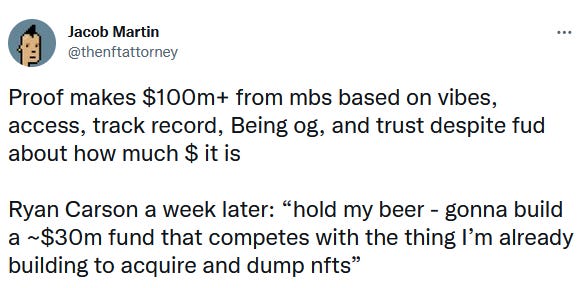

As soon as upon a time, Ryan Carson was the COO of Proof Collective, the NFT collector neighborhood based by Kevin Rose. Then, solely every week after Proof launched Moonbirds, he left to begin his personal NFT fund, 121G.

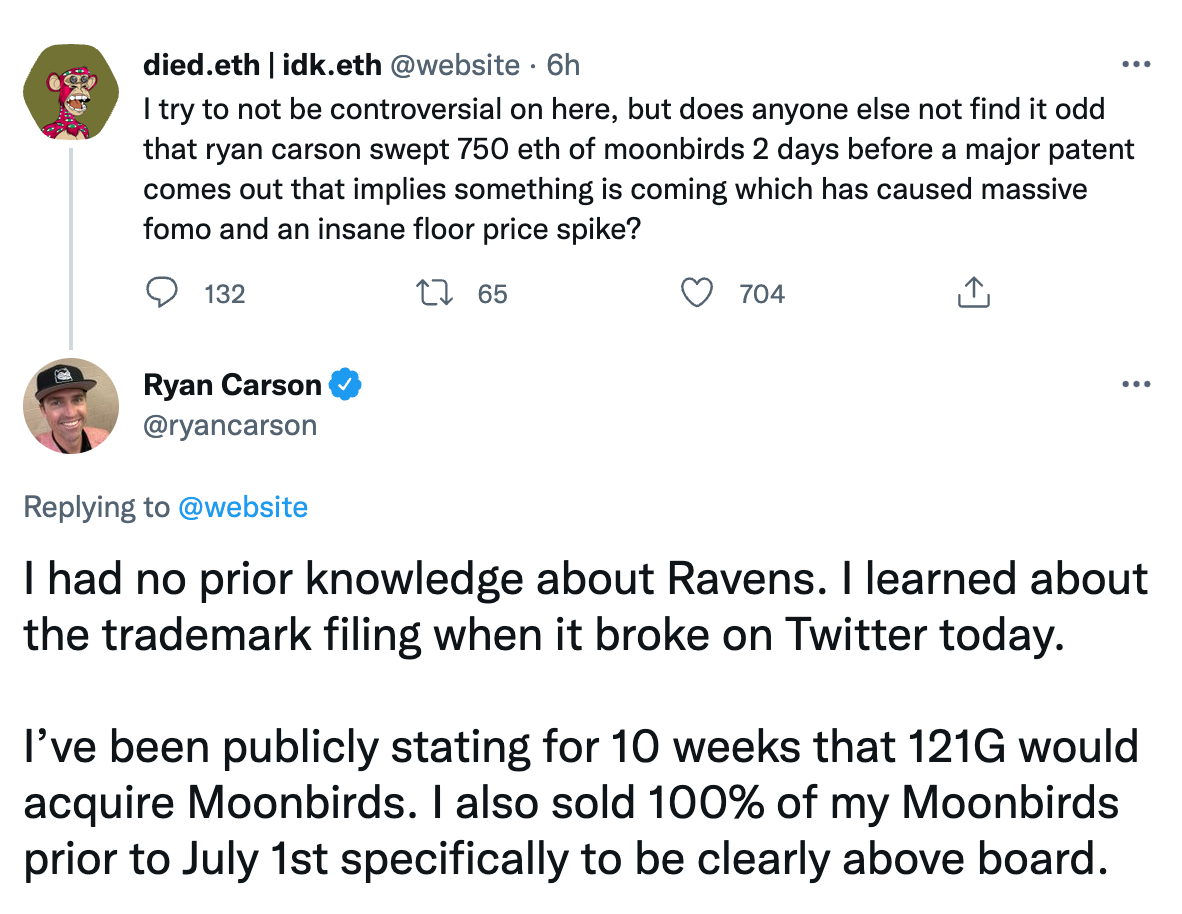

Carson was criticized for fixed Twitter commentary and hypothesis concerning the Moonbirds worth. He additionally acquired a ton of backlash for his supposed Moonbirds insider buying and selling after sweeping up the Moonbirds flooring previous to the rarity reveal.

Regardless of all of the damaging vibes surrounding Carson, his relationship with Kevin Rose seems to nonetheless be stable.

Quick ahead to now

To keep away from any battle of curiosity between his private portfolio and his fund’s portfolio, Carson bought all of his Proof passes and Moonbirds. This contains promoting his ultra-rare cosmic Moonbird for 143.69ETH.

Now on Friday, 121G made its first capital deployment….to brush up 34 Moonbirds

Doing so on this market is a little bit odd, however Carson mentioned they did not wish to get entrance run when requested why they weren’t simply shopping for in slowly.

However, to Carson’s credit score, 121G may be very a lot staying on thesis. On their web site, they define their three-pillar technique:

-

Excessive-quality new initiatives lead by vetted groups

-

One-of-ones

-

Proof and Moonbirds

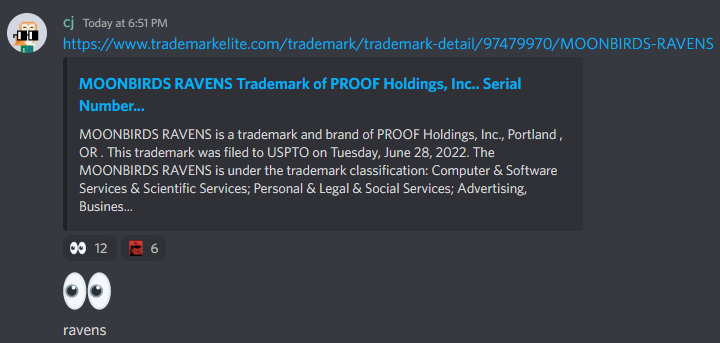

Proof simply registered a brand new trademark for Moonbirds Ravens, inflicting the collections flooring to hit ~30ETH. Many are starting to invest that this might be a brand new PFP assortment.

However don’t fear – Ryan Carson wasn’t entrance operating it.

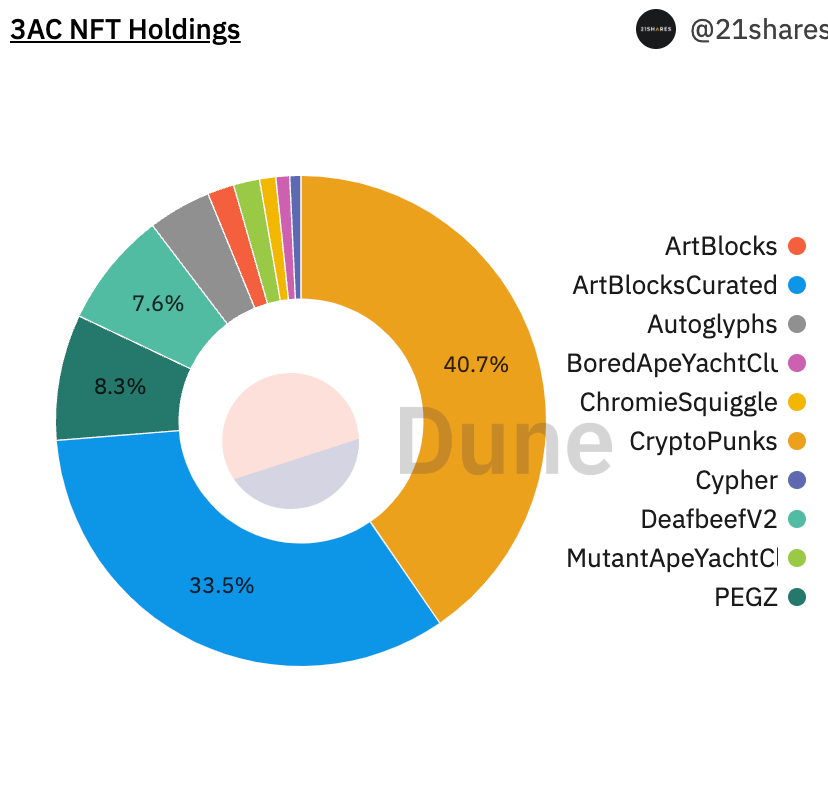

Researchers at 21 Shares put collectively a Dune analytics dashboard monitoring public pockets addresses belonging to the now bancrupt Three Arrows Capital. The analysis reveals that the agency holds a variety of blue-chip NFTs totaling $7.5M.

Holdings:

-

$3,012,393 – 11 CryptoPunks

-

$2,482,934- 330 ArtBlocksCurated

-

$613,273 – 8 PEGZ

-

$564,018 – 4 DeafbeefV2

-

$304,025 – 3 Autoglyphs

-

$125,241 – 7 ArtBlocks

-

$122,517 – 2 MutantApeYachtClub

-

$73,784 – 7 ChromieSquiggle

-

$61,909 – 1 BoredApeYachtClub

Doodles simply wrapped up its public public sale for its Genesis Field Assortment. The public sale went properly and generated 11,975.42 ETH in gross sales however that’s not the story.

What’s essential to notice is that solely 23 ETH was spent on fuel charges. For reference, the Yuga Labs Otherside mint value customers 64,000 ETH in fuel.

Comply with Zima Purple on Twitter

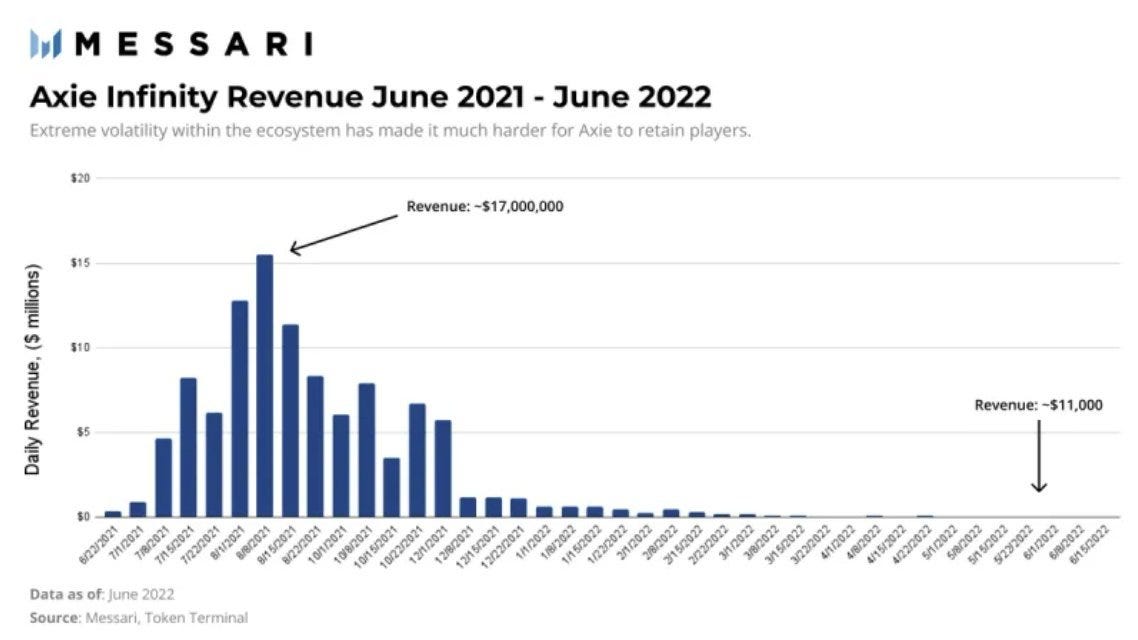

Axie Infinity was frozen after being hacked for $625M in March. Final week the crew formally reopened the sport’s deposits and withdrawals.

It has actually been a tough few months for Axie. The sport’s each day revenues have sunk to ~$11,000 from $17,000,000 again in August.

Fortunately there may be lastly some excellent news. After 3 audits the Ronin Bridge is again open so hopefully, they’ll get issues again on observe.

Key factors:

-

They recovered all misplaced consumer funds

-

All consumer funds are absolutely backed 1:1 by the brand new bridge

-

The brand new bridge design features a circuit-breaker system to assist defend in opposition to massive suspicious withdrawals

Tim Schuermer is a co-founder of Gallop. Gallop has created a set of developer instruments that broaden the utility of NFTs. These instruments are constructed for all builders, creators and buyers, energetic within the NFT area.

On this episode we talk about:

-

The present state of NFT knowledge

-

Why aggregating knowledge for NFTs is so troublesome

-

Why a product like Gallop must exist

-

How NFT knowledge can be utilized to create superior monetary merchandise

-

The multifaceted utility of NFTs

-

How early we’re within the monetary NFT revolution

-

And a lot extra