Yield aggregator Yearn launched its new YFI governance token on July 17, 2020, together with a number of new liquidity swimming pools.

Excerpt from the YFI token weblog publish | Supply: Medium.com/iearn/

Greatest-known on the time for its Y Curvepool, Yearn offered (and continues to offer) customers with a number of methods to earn curiosity by contributing their capital to totally different swimming pools.

On the time, Yearn’s swimming pools provided among the highest lending charges in DeFi. Its flagship pool managed $8 million in belongings and a return of over 10% APY between its inception and the YFI token launch.

Yearn’s suite of merchandise created a complete system for lending and arbitrage, transferring liquidity throughout numerous totally different DeFi platforms to get the most effective returns.

This included all the pieces from Curve to Compound, Aave, Uniswap and several other extra.

Easy methods to Earn YFI Governance Tokens

Incomes YFI at its launch was simple: Present liquidity to one in all Yearn’s merchandise beneath and stake the liquidity provision tokens.

The merchandise included:

- yTrade: Permitting buying and selling of prime stablecoins (DAI, USDC, USDT, TUSD, and sUSD) with leverage as much as 1000x utilizing an initiation charge, or 250x with out.

- yLiquidate: An automatic system for dealing with defaults on Aave loans.

- yLeverage: Permitting customers to open a 5x leveraged Dai Vault utilizing USDC as collateral.

- ySwap: A secure Automated Market Maker (AMM) permitting for single-sided liquidity provision whereas incomes curiosity and rewards.

- *.finance: A brand new credit score delegation platform for good contract to good contract credit score delegation lending (particulars TBA).

Whereas different DeFi protocols had parts put aside for his or her groups or bought in preliminary choices, Yearn made it clear that YFI tokens have been designed to haven’t any monetary worth past their use in governance.

Burning YFI For Rewards

A brand new staking interface would allow YFI holders to burn their earnt YFI, in alternate for aDAI.

The pool of aDAI was to be generated by charges from a number of sources and mechanisms throughout the protocol together with:

- Curiosity, system, and leverage charges

- Liquidation bonuses

- Proceeds from liquidity mining on different DeFi protocols.

This offered YFI with some clear inherent worth, regardless of the workforce’s claims stating in any other case.

The place Is Yearn Now?

Yearn has steadily continued improvement, regardless of an $11 million hack in 2021 and the departure of its founder, Andre Cronje in March 2022.

The protocol at the moment has a complete worth locked (TVL) of $260.8 million, in line with DeFiLlama.com.

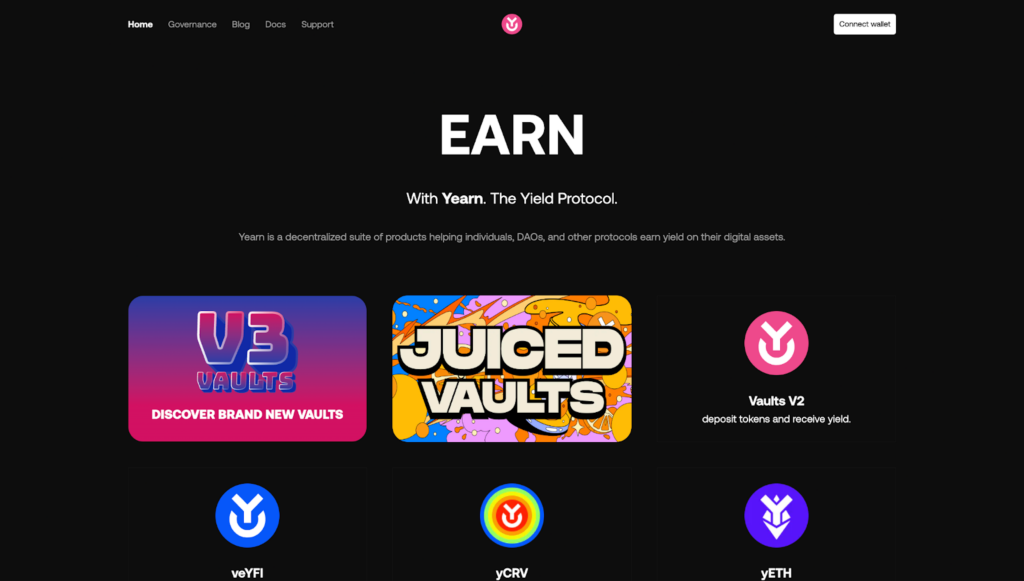

The present Yearn homepage | Supply: Yearn.fi

Yearn continues to offer a collection of assorted helpful merchandise and portals. These accessible at the moment embody:

- V3 Vaults: Select between single or a number of methods for his or her belongings, offering extra management and accommodating numerous threat appetites.

- Juiced Vaults: Put money into Ajna, a brand new protocol. These methods are new and thrilling, however have restricted liquidity.

- V2 Vaults: Earn returns from a variety of present DeFi methods. Elevated flexibility over V1, however much less customizable than V3.

- veYFI: Lock YFI tokens to obtain boosted vault rewards, take part in governance, and earn from early exit penalties and non-distributed gauge rewards.

- yCRV: Earn income from protocol charges and vote-maximized bribes, which is transformed to crvUSD stablecoin and distributed to yCRV stakers.

- yETH: Deposit liquid staking tokens (LSTs) to obtain yETH, or deposit and stake to obtain st-yETH and begin incomes liquid staking yield.

- yPrisma: Earn income from protocol charges and vote-maximized bribes, which is transformed to mkUSD stablecoin and distributed to yPRISMA stakers.

Though it’s comparatively simple to deposit right into a Yearn vault, it stays a platform for the extra DeFi-savvy customers.

With a comparatively complicated and blended mixture of yield-generating methods, customers might want to know the ins and outs of DeFi to grasp what their deposits are actually doing.