In a chart evaluation shared through X, the crypto analyst Darkish Defender supplied perception into the potential worth actions of XRP forward of this week’s Ripple-SEC case replace. The evaluation, performed on a month-to-month time-frame, reveals that XRP has been holding above a vital assist development marked in blue. With the crypto neighborhood’s eyes set on the brand new Ripple filings anticipated subsequent week, there’s a mixture of anticipation and warning.

XRP Worth Enters Doubtlessly Essential Week

Darkish Defender notes that though market information doesn’t sometimes have a direct correlation with worth actions, the “final puzzle piece” pertaining to the Ripple case could add a layer of enthusiasm to the market sentiment surrounding XRP. The query posed is: What may occur if XRP fails to keep up its place above the blue assist line?

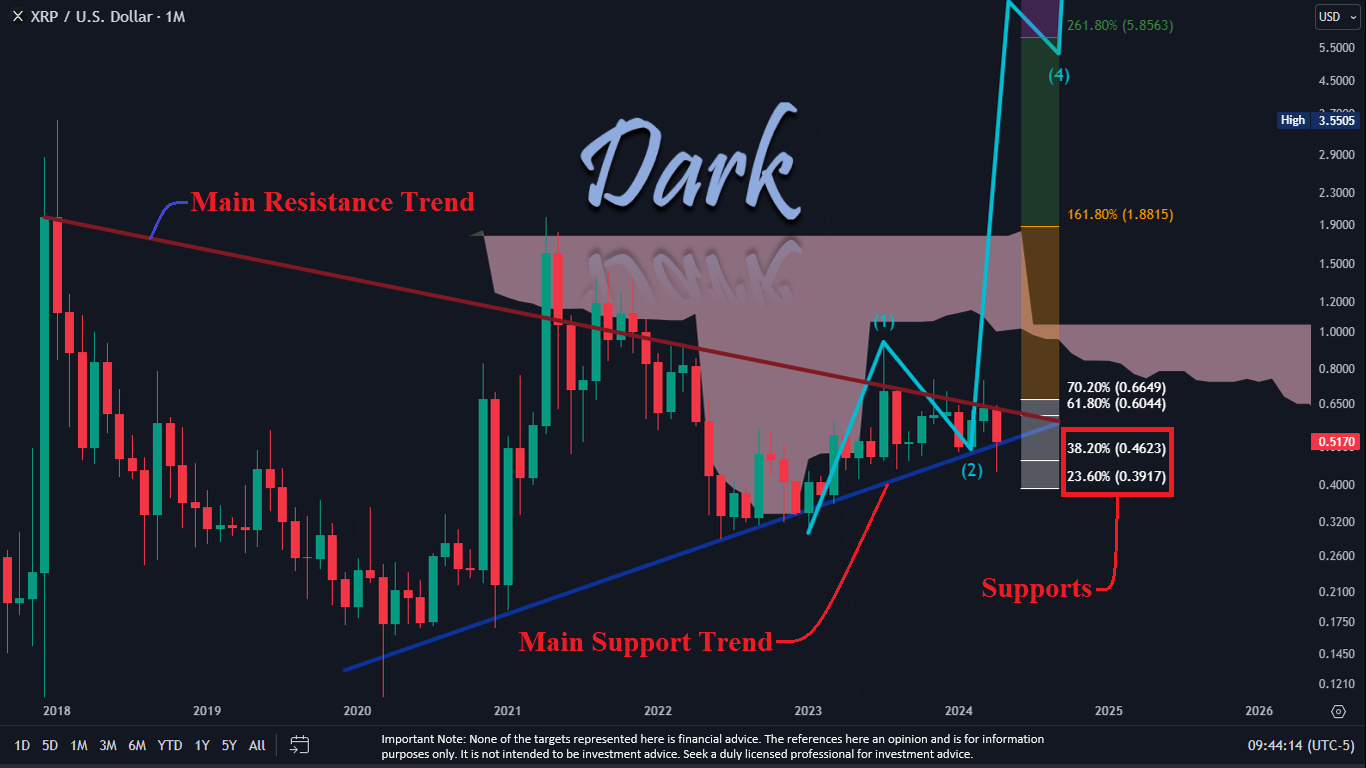

In line with the evaluation, if XRP breaks under this blue assist line, it’s going to seemingly method the 2 vital Fibonacci retracement ranges at $0.4623 (38.2% retracement stage) and $0.3917 (23.6% retracement stage). These figures are derived from the swing excessive and low factors on the chart, historically thought-about potential assist ranges the place the value may stabilize or bounce again.

Within the context of the present chart, a drop under these ranges, significantly if the value closes below $0.3917 for 2 to a few days consecutively, would invalidate the bullish five-wave construction that Darkish Defender suggests may propel XRP to a excessive of $5.85. On the flip aspect, ought to XRP reclaim the 61.8% Fibonacci stage at $0.6044, it may signify a primary step in the direction of a powerful upward transfer.

Between the value vary of $0.6649 and $0.3917, any worth motion is taken into account a sideways development. A breakout above the 70.2% stage at $0.6649 would seemingly verify a bullish development, with the analyst highlighting this as a major threshold for a constructive worth trajectory. Above this stage, XRP would then eye the subsequent Fibonacci extension ranges of $1.8815 (161.8% extension) and probably $5.8563 (261.8% extension), that are ambitiously projected targets.

The chart additionally highlights a “Essential Resistance Pattern” line that has capped the value for the reason that peak of early 2018, and the present worth motion is pinched between this descending resistance and the ascending assist development strains, forming a converging sample that merchants typically interpret as a possible breakout sign.

A breakout could possibly be the primary bullish indication of a bigger rally, with no less than one month-to-month shut above the road required. Prior to now, a number of makes an attempt at a breakout have failed, and even one month-to-month shut was adopted by a fall again under the trendline the next month.

Ripple Vs. SEC: What To Count on This Week

Ripple Labs is gearing as much as file its response to the US Securities and Change Fee’s (SEC) cures briefing on April 22, a pivotal second of their protracted authorized battle. This response from Ripple is in response to the SEC’s briefing that put forth potential cures together with disgorgement of earnings derived from XRP gross sales and civil penalties. The monetary stakes are excessive, with the SEC calculating fines that would attain round $2 billion, claiming that Ripple engaged in an unregistered securities providing with its XRP gross sales.

The authorized and monetary communities count on Ripple to mount a formidable protection in opposition to the SEC’s claims. Key to this counter-argument shall be undermining the SEC’s assertion of the need for disgorgement, given the alleged lack of demonstrable monetary hurt to XRP purchasers. Moreover, Ripple is prone to leverage favorable latest authorized selections and regulatory developments, aiming to weaken the SEC’s place.

In line with the schedule, Ripple is anticipated to submit a public redacted model of its opposition transient together with related declarations and displays right this moment, if these supplies are devoid of any SEC-designated confidential info. If confidentiality is a priority, Ripple will file the paperwork below seal and submit a redacted public model by April 24. Following this, the SEC can have the chance to answer, with their response anticipated to be filed below seal by Could 6.

At press time, XRP traded at $0.53.

Featured picture from NameCoinNews, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site completely at your personal threat.