The XRP worth has registered a notable drop in the course of the previous day as on-chain knowledge exhibits the whales have been making transactions to exchanges.

XRP Has Witnessed A Sharp Drop Over The Final 24 Hours

The cryptocurrency sector has been observing bearish winds not too long ago, with the drawdown deepening throughout the market in the course of the previous day. Many of the high cash, although, have managed to restrict their losses, aside from XRP, which has notably underperformed.

The under chart exhibits how the coin’s latest trajectory has seemed like.

Following the 14% drop within the final 24 hours, XRP has come all the way down to the $0.52 stage. This plunge has additionally put the asset greater than 21% down in comparison with the $0.66 high that it had seen a couple of days again.

As for why the cryptocurrency has carried out this poorly in the course of the previous day, maybe on-chain knowledge can present some hints.

Whales Have Been Energetic On The Community Lately

Based on knowledge from the cryptocurrency transaction tracker service Whale Alert, a number of giant transactions have been noticed on the XRP community within the final 24 hours.

All of those transactions occur to be of a scale that’s usually related to the whales, who’re giant entities that may carry a level of affect available in the market.

Naturally, one whale can’t transfer the market on their very own, however some variety of them collectively can, which can be precisely what has occurred right this moment. Usually, it may be arduous to say for sure what the whales’ intentions are once they make strikes, however tackle particulars can typically carry a touch or two.

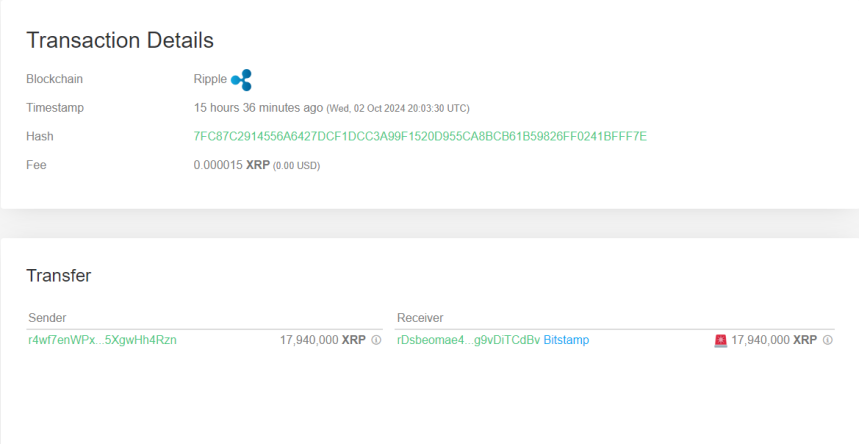

Listed below are the main points of the primary of the whale transfers from the previous day:

As is seen above, the whale moved 17,940,000 XRP, value round $10.3 million on the time the switch was executed, from an unknown pockets to an tackle related to the cryptocurrency alternate Bitstamp.

An “unknown pockets” is one which’s not affiliated to any recognized centralized platform and is prone to be an investor’s private tackle. Thus, it might seem that the whale moved cash from their self-custodial pockets to an alternate with this transaction.

Transfers of this sort are referred to as alternate inflows. Since one of many principal explanation why buyers deposit their cash to those platforms is for selling-related functions, giant alternate inflows can result in a bearish final result.

The three different XRP whale transactions from the previous day have been additionally of the identical sort, with whales shifting a mixed $37.9 million to completely different platforms. It’s doable that these transfers weren’t for promoting in any respect, however for utilizing a special service that exchanges sometimes present. Given the corresponding worth pattern, although, it’s certainly probably that these strikes offered a internet promoting stress to the cryptocurrency.