Bitcoin, the enigmatic digital foreign money, is again within the highlight because the US banking system grapples with mounting stress. Whereas some predict a stratospheric rise to $1 million per coin, fueled by financial woes, others stay skeptical.

Associated Studying

Banking On Bitcoin’s Rise?

Bitcoin advocates see it as a beacon of stability in a storm. Not like conventional property tied to the well being of establishments, Bitcoin boasts a finite provide and decentralized nature. This, they argue, positions it completely to profit from a “flight to security” state of affairs, the place traders search refuge from a doubtlessly collapsing banking system.

The latest historical past appears to help this narrative. In March 2023, the failures of distinguished establishments like Silicon Valley Financial institution coincided with a 40% surge in Bitcoin’s worth inside every week. Business figures level to this as proof of Bitcoin’s position as an “uncorrelated asset class” – a hedge towards conventional monetary turmoil.

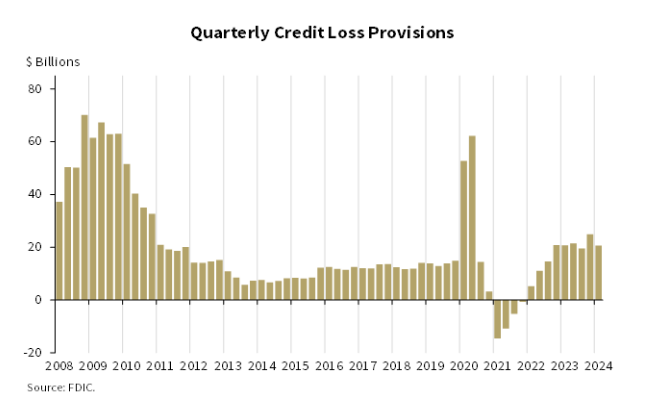

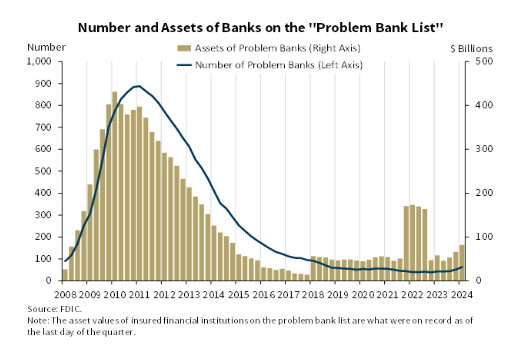

Additional bolstering this argument is the newest report by the Federal Deposit Insurance coverage Company (FDIC). The report paints a regarding image, highlighting a worrying pattern of unrealized losses on securities held by US banks.

These losses, pushed by rising rates of interest, have ballooned to over $500 billion. Moreover, the variety of banks on the FDIC’s “Drawback Financial institution Checklist” has grown from 52 to 63 in only one quarter, elevating fears in regards to the total well being of the sector.

Million-Greenback Dream Or Flight Of Fancy?

Whereas the potential for Bitcoin to achieve worth appears simple, the bold worth goal of $1 million faces sturdy headwinds. Consultants warn that such a dramatic surge may come at the price of a full-blown financial meltdown, a state of affairs that wouldn’t essentially profit Bitcoin in the long term.

Moreover, Bitcoin’s historic correlation with different property is just not static. Whereas durations of weak correlation exist, there have additionally been situations of sturdy correlation, significantly throughout broader market downturns. This casts doubt on Bitcoin’s potential to fully decouple itself from a struggling conventional monetary system.

Associated Studying

One other issue to contemplate is the latest uptick within the M2 cash provide, a metric representing the whole cash circulating within the financial system. Traditionally, durations of M2 growth have coincided with Bitcoin worth will increase. Nonetheless, the interaction between cash provide and Bitcoin in an atmosphere with a doubtlessly shaky banking system stays an open query.

The Highway Forward For Bitcoin

Bitcoin’s future is a little bit of a guessing recreation proper now. Banks within the US are having some issues, and that might make Bitcoin extra precious. But when the entire financial system goes downhill, even Bitcoin may undergo. So, all of it is dependent upon how unhealthy issues get with the banks and the financial system usually.

Featured picture from Pngtree, chart from TradingView