HodlX Visitor Put up Submit Your Put up

On the earth of DeFi (decentralized finance), oracles play a vital position in making certain the accuracy and reliability of knowledge particularly pricing knowledge used inside varied protocols and platforms.

What are worth oracles

A worth oracle is a particular kind of oracle that gives off-chain (exterior) worth info to on-chain (blockchain) sensible contracts.

Given the remoted nature of blockchains, sensible contracts can’t entry exterior info immediately, and oracles function a bridge to convey this exterior knowledge onto the blockchain.

Why worth oracles are so essential in DeFi

Worth oracles are extensively unfold in DeFi. They’re a core aspect of many crypto initiatives.

Lending protocols decide with oracles the proper collateralization ranges and provoke liquidations when mandatory. Algorithmic stablecoins preserve their peg to exterior property.

Artificial property observe costs of RWAs (real-world property) to handle artificial variations on the blockchain.

Any venture that makes use of asset costs wants some sort of worth oracle.

As oracles are extensively utilized in crypto initiatives and virtually all the time play a vital half in them, oracle assaults have grow to be probably the most fashionable varieties of assaults on crypto initiatives.

Forms of costs oracles, their benefits, disadvantages and safety points

Chainlink worth oracle

Arguably essentially the most well-known oracle supplier, the answer consists of a community of oracles (knowledge feeds) that convey knowledge into the blockchain.

Overview

A bunch of impartial operators updates every knowledge feed. Subsequently, a wise contract validates and aggregates knowledge from these operators.

Operators are rewarded for his or her data-publishing actions.

Every knowledge feed has its particular parameters, such because the minimal variety of oracles, the minimal variety of oracles required to replace the worth and the frequency of updates.

Information aggregation

Provided that the info is provided by varied operators, a vital step entails amalgamating them right into a single worth.

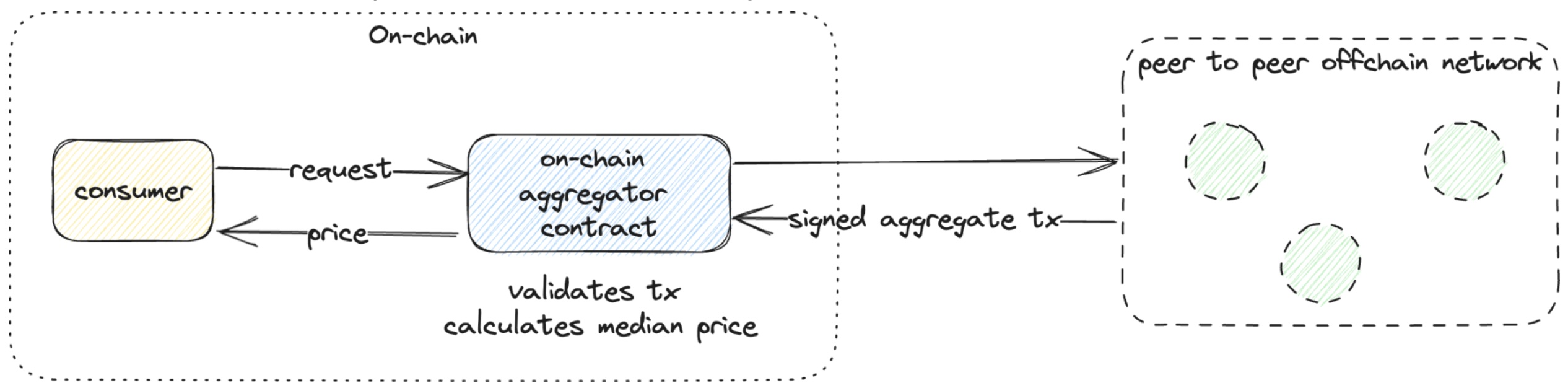

This course of unfolds in two steps initially, operators make the most of off-chain reporting, after which the info is provided to the aggregator contract.

Off-chain reporting embodies a P2P (peer-to-peer) community of operators consisting of a number of nodes.

Each node indicators and submits its worth, and by way of a consensus mechanism, an combination transaction is crafted.

This transaction consists of operators’ signatures and submitted costs and is subsequently validated on-chain.

Using a community of operators with a consensus mechanism considerably reduces the price of forming the ultimate worth all aggregation calculations are carried out off-chain, and just one last transaction is recorded whereas additionally sustaining the answer’s decentralization.

It’s value noting that Chainlink worth knowledge feeds aren’t accessible in all networks and positively not for all currencies.

The addition of extra currencies is feasible, however they need to meet particular Chainlink necessities, which may be costly.

Due to this fact, when the required foreign money for a venture is absent, different varieties of oracles should be thought-about.

Pyth worth oracles

One other fashionable worth oracle supplier operates throughout greater than 12 chains. Much like Chainlink oracles, it includes three fundamental parts, that are as follows.

- Publishers who present worth knowledge

- Pyth’s oracle program, a module that aggregates knowledge from publishers

- Shoppers, that are protocols that request worth knowledge

Let’s study how the Pyth structure works for almost all of the programs supported by Pyth.

For knowledge aggregation, a protocol named Pythnet is used. It’s a Solana-powered utility blockchain utilized by Pyth’s knowledge suppliers.

These suppliers provide worth quotes for every asset. Pythnet combines these costs to provide a single aggregated worth.

Subsequently, the mixed costs are transferred to focus on chains utilizing the Wormhole protocol. Lastly, the buyer contracts retrieve the costs from on-chain storage.

TWAP oracles

TWAP oracles compute the common worth of a selected asset over a particular time interval.

As implied by the identify, these on-chain oracles function based mostly on a precept that calculates the imply asset worth over a predetermined time interval.

Whereas seeming easy of their performance, deploying them securely presents notable challenges.

One of many pronounced benefits of using TWAP oracles lies in addressing the difficulty of worth manipulation inside DEX swimming pools.

In eventualities the place a venture is pegged to the instantaneous worth of an asset, malefactors might exploit this by using a flash mortgage to skew the asset’s worth and subsequently execute an assault.

By leveraging TWAPs, the manipulator is compelled to take care of the distorted worth over a selected period, permitting arbitrage mechanisms to return into play and counteract the malicious intent.

Regardless of the obvious simplicity of TWAP oracles, making certain their safe implementation is usually a complicated endeavor.

The resilience to assaults is contingent upon a number of elements, such because the effectiveness of the arbitrage mechanism, the pool’s capital quantity, the protocol’s immunity to cost manipulations, the community’s consensus mechanism and varied different parts.

Usually, it may be posited that relying solely on TWAP oracles can’t be deemed completely safe.

Nonetheless, they’ll proficiently operate as a complementary measure alongside different varieties of worth oracles.

In synthesizing, whereas TWAP oracles serve to inhibit and complicate exploitative worth manipulations in DEX swimming pools by necessitating the upkeep of manipulated costs over a specified timeframe, their deployment needs to be approached with a meticulous understanding of their complexities and potential vulnerabilities.

Contemplating them as a part of a wider, multi-faceted oracle technique is instrumental in enhancing the robustness and safety of blockchain initiatives in navigating the risky and generally adversarial landscapes of cryptocurrency markets.

Open worth feed

That is an oracle developed by the Compound protocol.

The primary concept of the oracle is to mix costs from totally different sources initially Chainlink and Uniswap markets

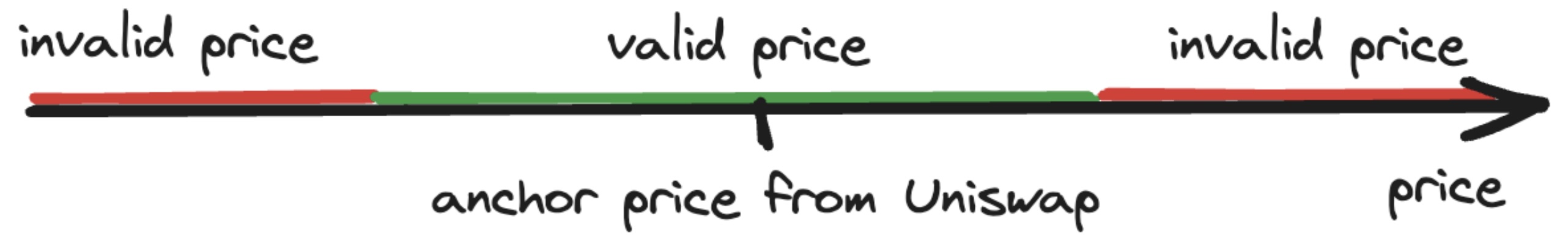

The Open worth feed oracle makes use of a particular contract that enables a trusted supply to replace costs.

As soon as the worth is up to date, it’s in comparison with an anchor worth from Uniswap pool.

If the worth deviates from the anchor worth greater than initially set boundaries, the worth replace is discarded.

The anchor worth is fetched with the TWAP mechanism described above.

Open worth feed defends from incorrect knowledge posted by an exterior worth supplier.

The draw back is when the worth fluctuates regularly, the TWAP worth could also be not up to date and the precise asset worth supplied by an exterior supply can be discarded.

Maker DAO oracles

Maker oracles are one of many oldest oracles within the EVM ecosystem.

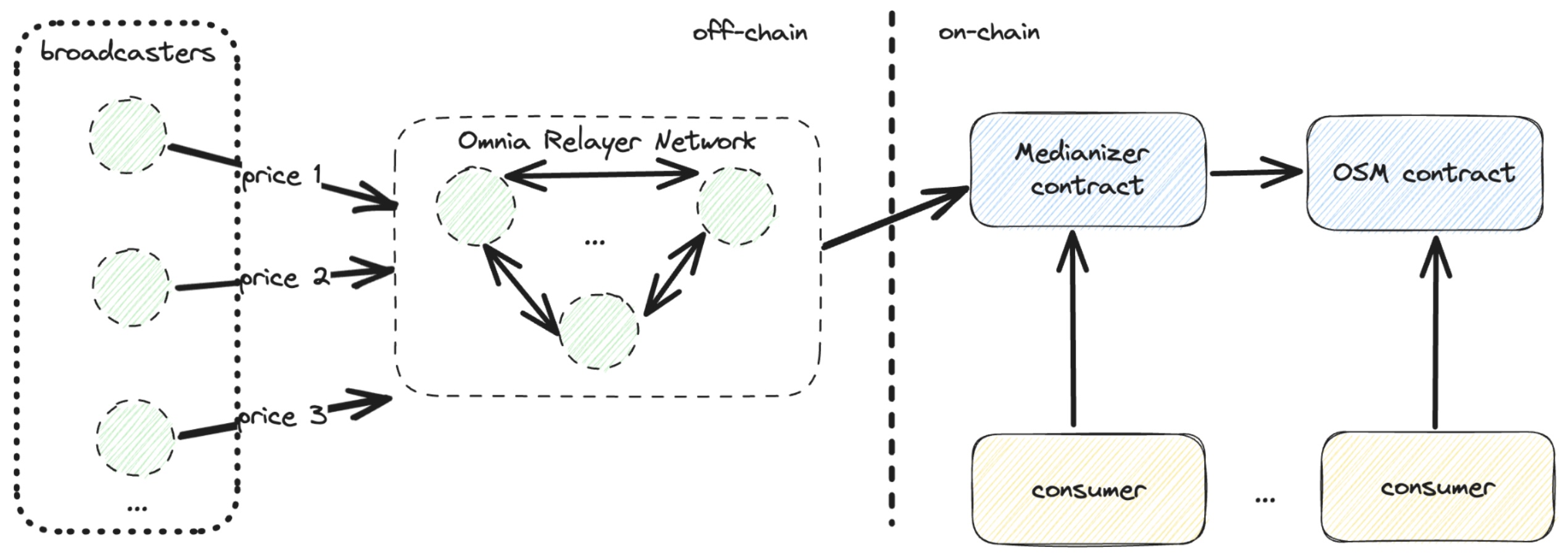

Like Chainlink and Pyth, it makes use of an off-chain community the place worth broadcasters provide asset worth evaluations.

The on-chain oracle module has two fundamental contracts edian and OSM (oracle safety module).

The ‘median’ part gives the Marker’s trusted reference worth. It computes a median of obtained costs and shops its worth.

The ‘OSM’ contract ensures that the saved worth values aren’t taken earlier than a sure delay has handed.

It needs to be famous that this worth oracle is out there just for whitelisted contracts.

Conclusion

Worth oracles are a vital a part of the DeFi ecosystem. The safety of quite a few crypto initiatives relies on oracles.

Sadly, there isn’t any greatest answer for a worth oracle every oracle has its personal limitations, benefits and downsides.

That’s why it’s essential to know what oracles can be found and to decide on the very best answer for a crypto venture.

FAQ

Through which crypto initiatives can worth oracles be used?

Worth oracles can be utilized in a mess of crypto initiatives, particularly these inside the DeFi sector.

Examples of use circumstances embody lending protocols which want to make sure right collateralization ranges, algorithmic stablecoins which require dependable worth pegs to exterior property and artificial asset platforms which want to trace RWA costs to handle their on-chain artificial counterparts.

Is there a greatest answer for oracles at the moment accessible?

No, there isn’t any one-size-fits-all greatest answer for oracles in the intervening time.

Every oracle has its personal benefits and downsides, relying on particular use circumstances, safety fashions and community compatibility.

Due to this fact, it’s pivotal to grasp the accessible oracles and select one which aligns greatest with a selected crypto venture’s necessities and objectives.

What are the hazards of utilizing TWAP oracles?

Whereas TWAP oracles provide sure deserves, akin to mitigating rapid worth manipulations by averaging the asset worth over a specified time, they aren’t impervious to threats and complexities.

Deploying TWAP oracles securely is notably difficult, and their resilience to assaults hinges on a number of variables together with the arbitrage mechanism’s effectiveness, the liquidity pool’s capital and the community’s consensus mechanism, amongst others.

They is likely to be used successfully together with different varieties of oracles to make sure enhanced safety and performance in a multi-oracle technique.

Gleb Zykov is the co-founder and CTO of HashEx Blockchain Safety. He has greater than 14 years of expertise within the IT trade and over eight years in web safety, in addition to a robust technical background in blockchain know-how Bitcoin, Ethereum and EVM-based blockchains.

Comply with Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney