Dwindling Stockpiles: Exchanges Feeling The Squeeze

For years, cryptocurrency exchanges have served because the lifeblood of the digital asset market. They supply the platform for purchasing, promoting, and buying and selling cryptocurrencies, with a good portion of any given coin’s whole provide residing inside their digital vaults. Nonetheless, on the subject of ETH, a dramatic shift appears to be underway.

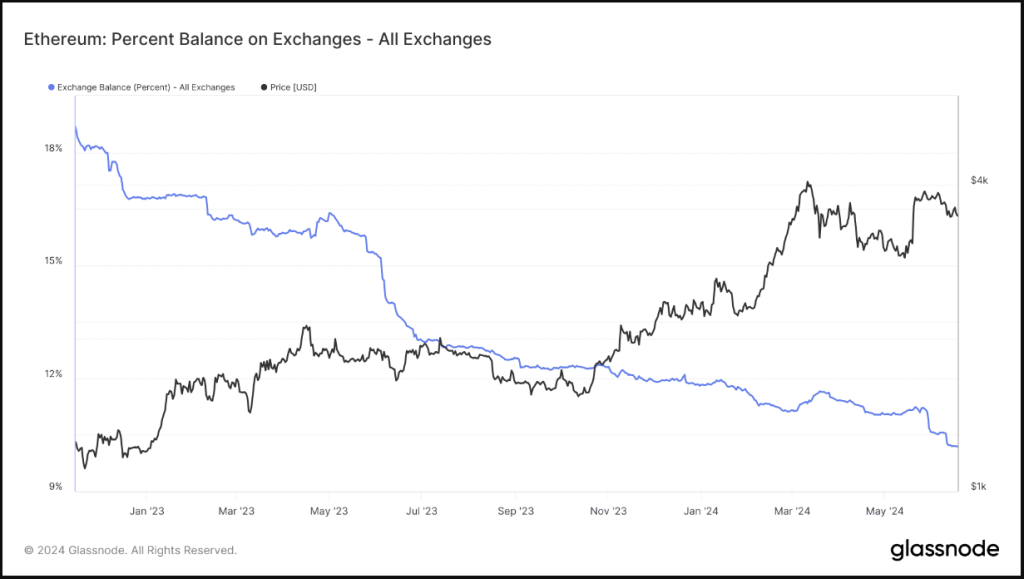

In keeping with a latest evaluation of on-chain knowledge, the steadiness of ETH on exchanges has plummeted to its lowest stage in eight years, hovering round a mere 10.20%. This interprets to a good portion of ETH holders withdrawing their cash from exchanges, successfully taking them off the marketplace for rapid sale.

The explanations behind this exodus stay open to hypothesis. Some consultants imagine it may very well be a strategic transfer in anticipation of the upcoming Ethereum Merge, a significant community improve that can transition the blockchain from proof-of-work to a extra energy-efficient proof-of-stake mannequin. This shift might doubtlessly unlock staking alternatives for ETH holders, incentivizing them to carry onto their cash for longer intervals.

Outflows Dominate: A Signal Of Accumulation Or Warning?

Additional bolstering the “accumulation principle” is the dominance of internet outflows on exchanges in latest days. This metric tracks the distinction between ETH coming into and leaving alternate wallets. A unfavorable netflow, as seen at the moment, signifies that extra ETH is flowing out than coming in. This means that traders aren’t solely withdrawing their current holdings but in addition refraining from depositing new ETH onto exchanges, doubtlessly signaling a rising sense of long-term bullishness.

Associated Studying

Nonetheless, some analysts warning towards overly optimistic interpretations. The decline in alternate provide may be attributed to a extra cautious investor sentiment within the face of latest market volatility. With the broader cryptocurrency market nonetheless recovering from a droop, some holders could be opting to maneuver their ETH to non-public wallets for safekeeping, ready for a extra opportune second to re-enter the market.

Featured picture from iStock, chart from TradingView