Worldcoin (WLD), a blockchain-based undertaking fueled by biometric verification, has ignited a firestorm of investor curiosity, skyrocketing 170% up to now week to succeed in a document excessive of $7.48. This meteoric rise stands out in opposition to a backdrop of sluggish efficiency in lots of different altcoins, prompting questions in regards to the driving forces behind this surge and its potential for longevity.

WLD notching a formidable 170% rally within the final week. Supply: Coingecko

Worldcoin: Bullish Metrics And AI Hype Gasoline The Flames

A number of components look like stoking the flames of Worldcoin’s present momentum. Buying and selling quantity has soared a formidable 44% to just about $840 million, propelling the token into the highest 10 by quantity regardless of languishing at 91st place in market capitalization. This hyperactive buying and selling suggests sturdy investor curiosity and hints at additional progress potential.

Including to the joy, Worldcoin boasts over 1 million day by day lively customers on its World App, signifying vital adoption. Furthermore, the undertaking basks within the mirrored glory of its affiliation with OpenAI, the famend synthetic intelligence (AI) analysis lab co-founded by Worldcoin’s creator, Sam Altman.

The current launch of OpenAI’s cutting-edge text-to-video generator, dubbed Sora, has generated a wave of constructive sentiment in the direction of Worldcoin, doubtlessly spilling over to spice up its token worth.

Worldcoin at present buying and selling at $6.9826 on the day by day chart: TradingView.com

Privateness Issues Cloud The Horizon

Nonetheless, Worldcoin’s path to success just isn’t paved in gold. Regulatory scrutiny looms massive, casting a shadow over its iris-scanning verification technique and potential privateness violations. European nations, Argentina, Kenya, and Hong Kong have expressed issues about this expertise, elevating the specter of regulatory roadblocks that would hinder future adoption and derail the undertaking’s long-term objectives.

Alameda’s Shadow Provides A Layer Of Uncertainty

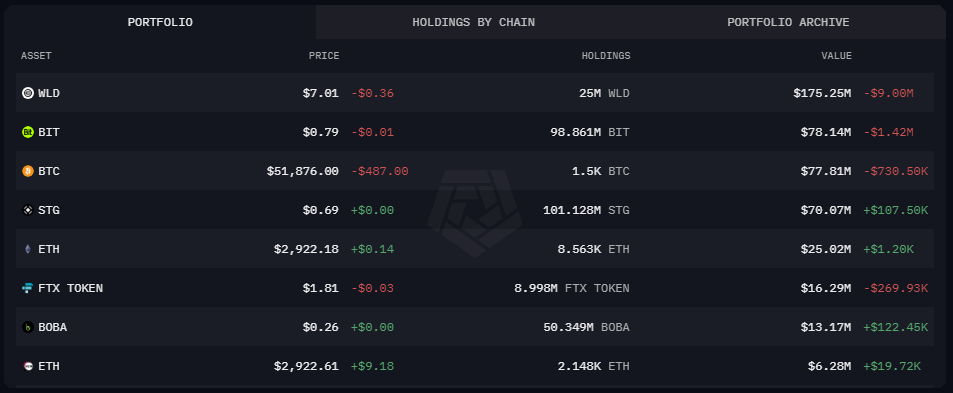

One other layer of uncertainty comes from Alameda Analysis, a significant cryptocurrency funding agency. Alameda at present holds a good portion of WLD tokens, valued at a staggering $186 million, representing a whopping 33% of its portfolio.

Whereas this funding signifies potential confidence in Worldcoin, Alameda’s current historical past of liquidating holdings in different cryptocurrencies casts doubt on their future plans with WLD. Their intentions stay shrouded in secrecy, including a layer of hypothesis to the present worth rally.

Can Worldcoin Overcome The Hurdles?

Solely time will inform whether or not Worldcoin can overcome these challenges and navigate the treacherous waters of the crypto market. Whereas the undertaking boasts spectacular consumer numbers and an thrilling affiliation with OpenAI, regulatory issues and questions on Alameda’s motives pose vital dangers.

Buyers ought to fastidiously think about these components and conduct their very own analysis earlier than putting bets on Worldcoin’s future. The approaching months will probably be essential for the undertaking, because it navigates regulatory scrutiny, addresses privateness issues, and clarifies the intentions of its main traders. Whether or not Worldcoin will emerge as a real innovator or fade into obscurity stays to be seen.

Featured picture from iStock, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site solely at your individual danger.