Bitcoin costs are risky, not too long ago dropping from the height of over $73,000 in March to the present spot ranges. Analysts are turning to historic knowledge for insights with mounting promoting stress and a few buyers worrying about potential short-term losses. This historic evaluation is essential in figuring out whether or not we’ve reached a market high or if that is only a short-term pause earlier than the pattern resumes.

Will The Depth Of This Correction Rely On This?

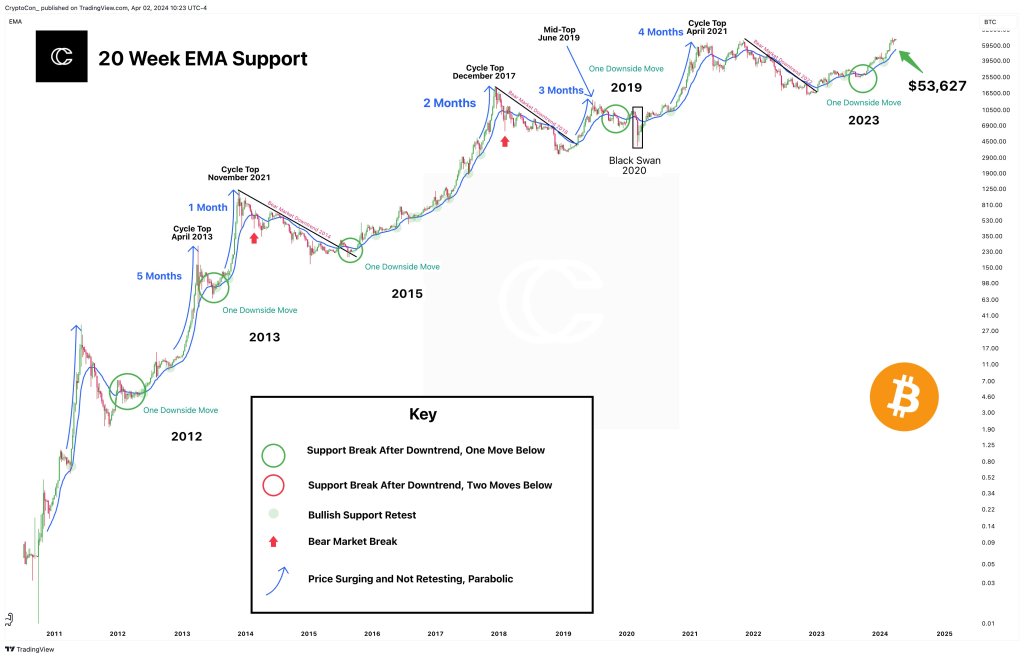

In a publish on X, one analyst mentioned the depth of the present correction will largely depend upon whether or not Bitcoin is “parabolic” or not. At any time when an asset registers “parabolic” costs, it means valuation has elevated sharply, and, at some degree, analysts suppose it’s unsustainable.

In that case, costs have a tendency to chill off later, however after key resistance ranges and even all-time highs have been damaged. If so, then the present cool-off might counsel the formation of a possible “first cycle high” on the March 2024 all-time excessive of $73,800.

This formation will probably be much like these seen in April 2013 and 2021.

Nevertheless, in one other state of affairs, merchants ought to anticipate a unique association, assuming the current value development wasn’t unsustainable or parabolic. Assuming that is the case, Bitcoin will doubtless proceed bleeding and revisit established assist ranges.

The analyst predicts a attainable correction to as little as the $53,600 assist within the coming classes. This retracement, the analyst continues, will enable the formation of a “smoother curve like 2016 – 2017.”

The Affect Of Bitcoin Halving

Apart from this evaluation, one other analyst is roping within the idea of the Bitcoin pre-halving cycle. Often, and historic formations, costs are inclined to collapse main as much as the halving occasion, which is ready for the third week of April.

In a publish on X, the analyst mentioned the present rejection and the failure of bulls to push costs greater counsel that the coin would possibly consolidate between $60,000 and $70,000 within the coming weeks.

Bitcoin continues underneath stress and can doubtless register much more losses within the days forward. Primarily based on the day by day chart formation, BTC costs are trending beneath the center BB. Notably, it’s discovering sturdy rejection from the $71,700 zone.

Although the uptrend stays, consumers will solely be in management ought to costs rise, reversing present losses, ideally with growing participation ranges.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal threat.