Bitcoin is consolidating, struggling for positive aspects, and value motion within the every day chart. Even with the rejection of decrease costs, the coin has but to observe via, decisively reversing losses of June 24.

Ought to Bitcoin Merchants Brace For Extra Losses?

In mild of this, one analyst on X thinks there could possibly be extra losses within the coming days. Posting on X, the on-chain analyst highlighted a worrying pattern: Even amid the Bitcoin buying and selling neighborhood’s optimism, sellers are relentlessly stacking up extra brief orders.

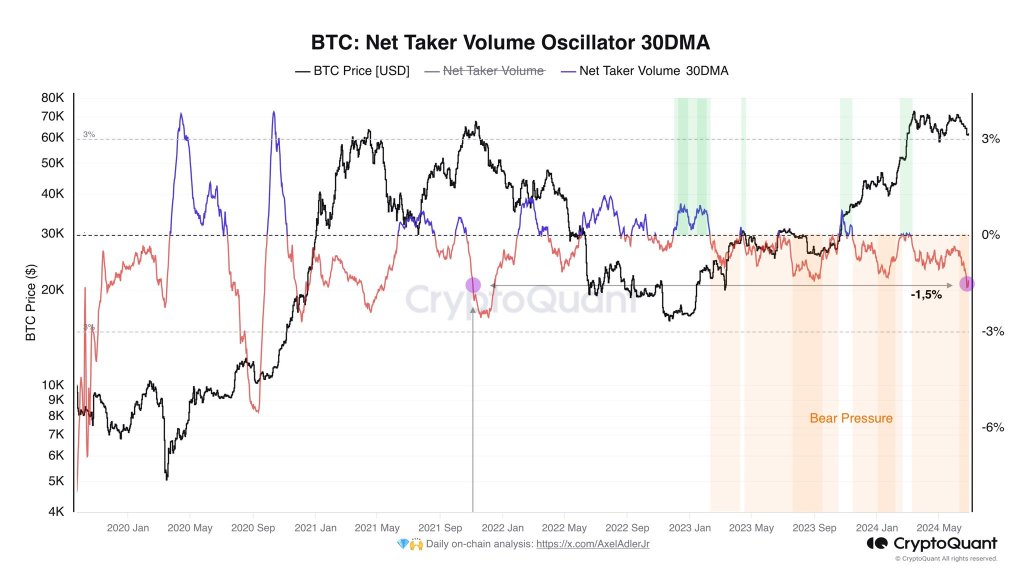

In keeping with the Bitcoin Web Taker Oscillator indicator, the studying is -1.5%. At this degree, it’s on the similar level noticed when costs rocketed to as excessive as $70,000 in November 2021 earlier than dumping sharply all through 2022.

Bitcoin is trending at a close to all-time excessive, roughly 20% from $73,800 printed in mid-March 2024. Though the uptrend of Q1 2024 defines the present formation, costs are retesting key help ranges stacked between $56,500 and $60,000.

If there are deeper losses, because the analyst tasks, BTC may crash, reaching $50,000. This improvement would mechanically disqualify the short-squeeze narrative in some quarters.

Associated Studying

Compounding the bearish strain, the analyst additionally picked out an uptick in lengthy liquidations, rising to 13% as of June 27. The upswing in lengthy liquidations implies that leveraged merchants throughout main exchanges like Binance and OKX at the moment are exiting at a loss.

The analyst added that what’s occurring relating to liquidation is just like occasions within the 2019-2020 correction. Then, extra lengthy merchants had been liquidated, and inside 5 months, BTC crashed by 46%.

If the previous guides, then it’s seemingly that the identical may unfold within the coming months. Nonetheless, the analyst notes that if whales purchase over 500,000 BTC, costs will stabilize and shoot increased.

Bearish Sentiment Constructing Up: Time To Purchase Bitcoin?

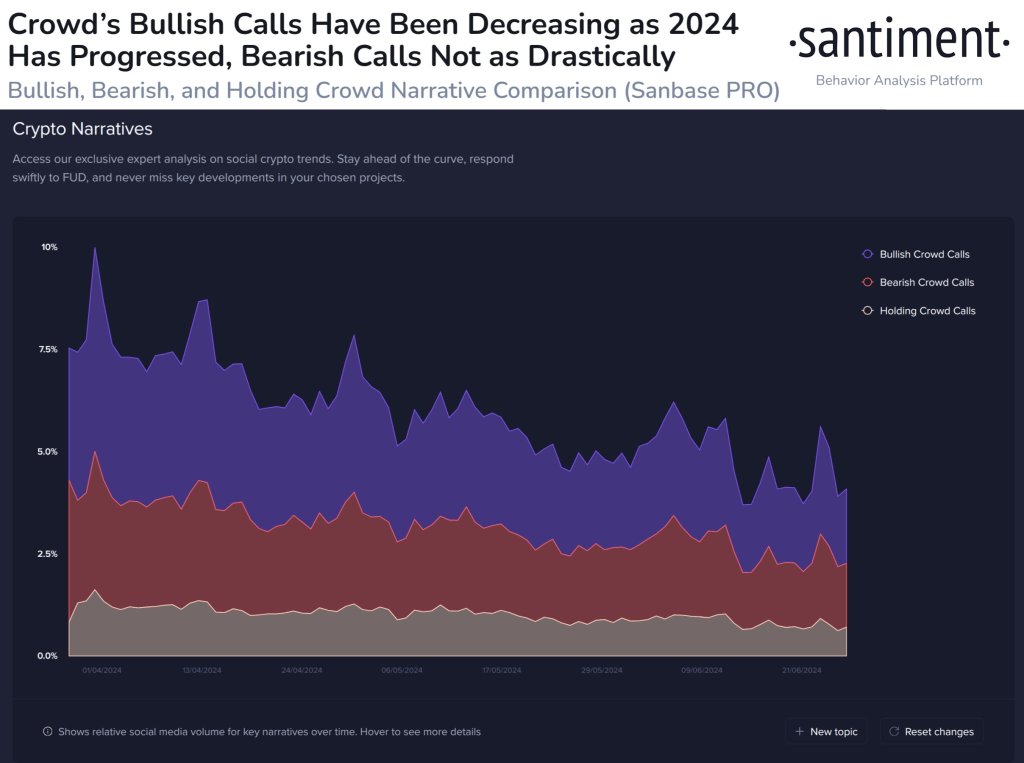

Santiment information additionally reinforces this bearish narrative. In latest weeks, the variety of customers and merchants anticipating BTC to edge increased has been plunging throughout a number of social media platforms.

Of observe, bearish sentiment has been increase because the Bitcoin halving occasion and the sideways motion of costs since April 2024. Although merchants had been optimistic forward of the Halving occasion on April 20, the failure of costs to breach $74,000 eroded confidence.

Even so, the present bearish sentiment could possibly be a contrarian indicator, particularly contemplating the overall resilience of bulls. Costs stay above $60,000, rejecting makes an attempt for decrease lows.

Associated Studying

Typically, declining dealer and investor confidence accompany bottoms, a scenario seen as of late June. Aggressive merchants would possibly view this as a loading alternative, believing BTC is undervalued at spot charges.

Function picture from DALLE, chart from TradingView