Willy Woo, an on-chain analyst, believes the Bitcoin upswing is much from over. Citing the event within the Bitcoin Macro Oscillator and the potential for conventional finance leaping on the bandwagon (FOMO), the chances of BTC rallying in not less than two robust legs up within the coming session couldn’t be discounted.

On-Chain Information Alerts Extra Upside For Bitcoin

In a put up on X, Woo stays assured about what lies forward for the world’s Most worthy cryptocurrency. Primarily based on on-chain improvement, there are indicators that the coin could firmly push larger, breaking above the present lull.

Bitcoin stays principally range-bound when writing, buying and selling inside a decent zone capped by $73,800 on the higher finish and $69,000 as instant assist. Even with analysts being assured of what lies forward, the coin has failed to beat robust promoting momentum from sellers to breach all-time highs in a buy-trend continuation.

From how the coin is about up, the present sideways motion could also be accumulation or distribution, relying on the breakout path. As an illustration, any upswing above $72,400 may spur demand, lifting the coin in the direction of $73,800. Conversely, losses beneath $69,000 and the center BB may see BTC droop to March 5 lows and even decrease.

Will TradFi FOMO And Quick Squeeze Raise BTC?

Even with the slowdown in upside momentum, Woo says there may be robust potential for “one other stable leg up.” The analyst additionally added that there might be two surges if TradFi traders “FOMO” into Bitcoin. Within the 2017 bull run, the rally to $20,000 was primarily as a consequence of retailers leaping in and FOMOing on the coin.

With spot Bitcoin exchange-traded funds (ETFs) out there in america, hypothesis is that extra establishments and high-net-worth people are shopping for the coin. If BTC rips larger, breaking $74,000, extra influx will probably be into the a number of spot Bitcoin ETFs, fueling demand.

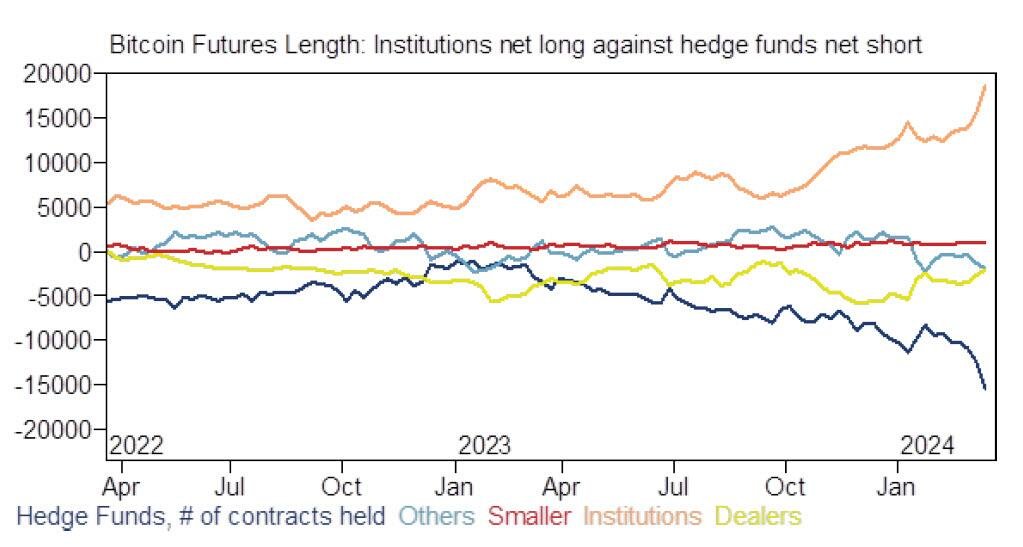

This bullish outlook comes when different analysts count on Bitcoin to surge within the classes forward. In a put up on X, one analyst says the incoming quick squeeze will probably propel the coin above March highs. Each time a brief squeeze occurs, costs rise, forcing sellers to purchase again at larger costs, accelerating the uptrend.

The evaluation is behind a record-breaking hole between institutional traders betting on worth will increase and hedge funds promoting the coin.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site completely at your individual threat.