In a latest evaluation, Andrew Kang, co-founder and associate of Mechanism Capital, supplied a complete evaluation of the cryptocurrency market, specializing in the comparative strengths of Solana (SOL) over Ethereum (ETH) within the present bull cycle. Kang shared his insights through X, the platform previously generally known as Twitter.

Central to Kang’s argument is the concept within the present market, Solana presents a extra favorable buying and selling choice than Ethereum. He states, “The definition of madness is repeatedly making an attempt to lengthy ETHBTC when longing SOLBTC (or SOLETH) is the significantly better commerce in a bullish atmosphere.” This succinctly captures his perspective on the shifting dynamics between these main cryptocurrencies.

Why Solana Is The Superior Commerce Than Ethereum

Kang gives a retrospective view of Ethereum’s journey, noting, “Over the primary 6-7 years of ETH’s life, there was a number of uncertainty and lack of training round ETH. There have been a number of Bitcoin holders to be transformed to Ethereum holders.” He acknowledges Ethereum’s early volatility and its eventual emergence as a secure buying and selling asset.

Nonetheless, he means that this relative stability has now grow to be a double-edged sword: “ETH additionally grew to become a ‘protected’ risk-on asset that merchants may get into in measurement. That’s what made it an ideal cross to commerce. However over time, individuals’s allocation to eth vs btc began to harden and the quantity of individuals left to transform whittled away.”

Addressing Ethereum’s developments in expertise, Kang factors out a paradox. He states, “Whereas these [Layer 2 solutions and Modular technology] would possibly appear to be good issues, it’s these traits/improvements that weighs heavy on ETH throughout threat on durations the place ETH beforehand outperformed.” He means that these developments, although revolutionary, have launched new complexities that impression Ethereum’s efficiency in bull markets.

“Sure, you might have some conversion from BTC to ETH throughout threat on durations (a lot much less so nowadays), however on this period ETH faces way more rotational stress from these going from ETH as their base asset to those very L2s, modularity cash, SOL, these capitulating ETHBTC longs, and different shitcoins that it’s supposed to learn from,” Kang claimed.

In distinction, the crypto skilled highlights Solana’s benefits, asserting, “Not solely does SOL not face these identical points but it surely additionally has crossed the chasm in turning into a blue-chip Layer 1.” He emphasizes Solana’s resilience and its attraction to conservative traders who beforehand centered primarily on Bitcoin and Ethereum.

Kang additional elucidates, “Conservative giants that beforehand have been snug with BTC and ETH have SOL as a straightforward, protected subsequent step. It’s this transition section of turning into a brand new main or base asset that you just wish to journey. A younger quick horse, not a horse encumbered by the troubles of age, baggage and Jared Grey.”

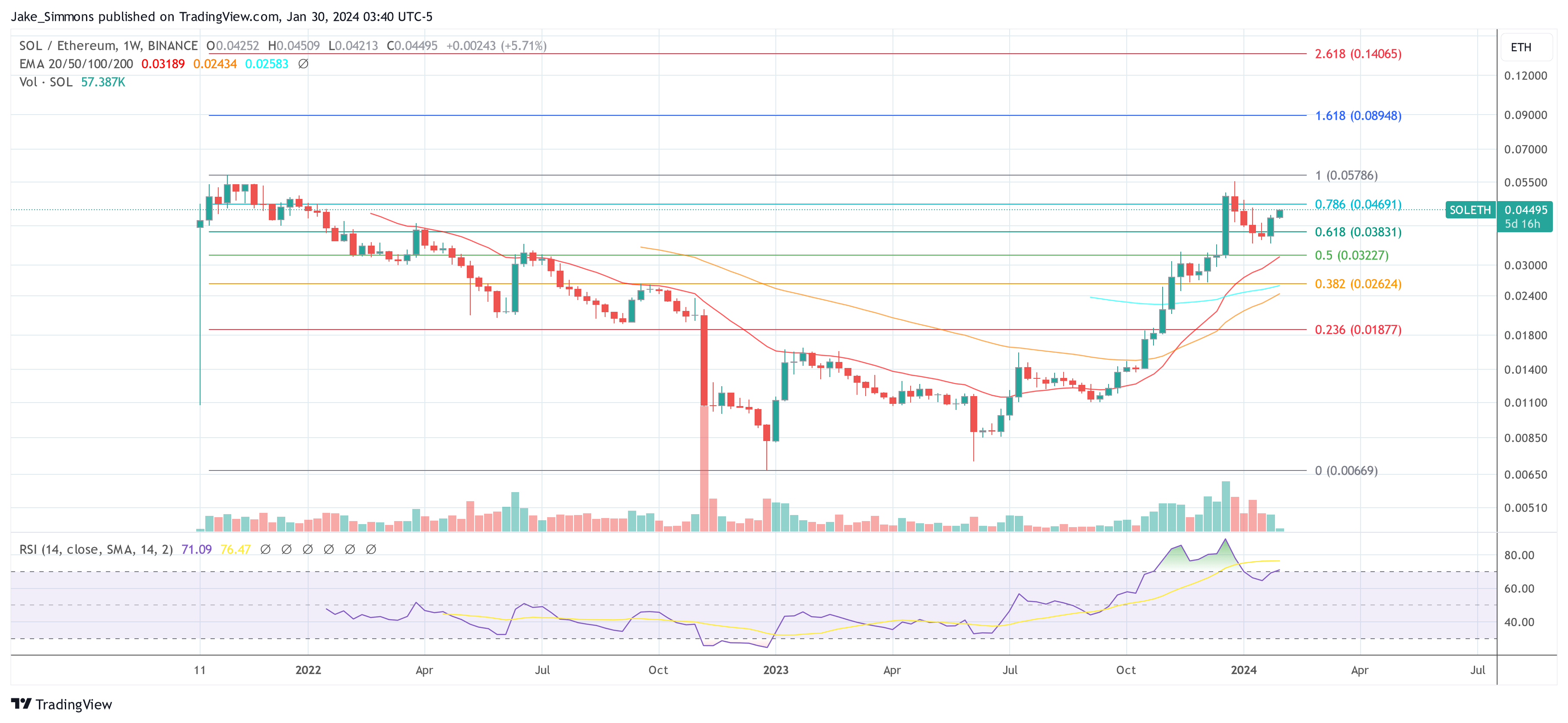

Considerably, Kang notes a significant shift in market dynamics, stating, “There was a secular shift within the collapse of ETHBTC volatility in 2023.” He posits that this shift has redefined the comparative benefit in favor of Solana. Concluding his evaluation, Kang confidently asserts, “Even when that ever adjustments, SOLBTC would be the superior commerce.”

At press time, SOL was simply 30% in need of a brand new all-time excessive in opposition to ETH.

Featured picture from securities.io, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site completely at your individual threat.