The Bitcoin worth has been experiencing a part of stagnation over the previous days, leaving buyers and analysts looking for the underlying causes. Three key elements will be seen as central to explaining Bitcoin’s present sideways buying and selling pattern:

#1 ETF Inflows Are Offset By GBTC Promoting, However For How A lot Longer?

The spot Bitcoin ETFs proceed to be the dominant theme in the marketplace, and Grayscale specifically, with its GBTC, stays the main focus of analysts. Whereas the ETF inflows proceed to be record-breaking, the Bitcoin worth stays flat. One of many major causes for that is presumably the outflows on GBTC, which is considered as overpriced with its charge of 1.5% per 12 months (in comparison with 0.25%) by different issuers.

Thomas Fahrer of Apollo identified the numerous circulate discrepancies out there: “In three days of buying and selling. IBIT +16K BTC, FBTC +12K BTC, BITB +6.7K BTC, ARKB +5.3K BTC, GBTC -27K BTC. GBTC BTC is flowing however not sufficient to maintain the opposite ETFs. Provide shock inbound imo.”

Alessandro Ottaviani supplied additional insights, stating, “Bitcoin influx within the ETFs: +47k, Bitcoin outflow from Grayscale: -27k, web influx: 20k. […] Quickly or later I count on Grayscale outflow stopping or decreasing considerably. Those that have Grayscale GBTC had been already into Bitcoin and due to this fact I believe they already made the choice to promote, the execution of which ought to occur not a lot later than the launch of the ETF.

Bloomberg analysts James Seyffart and Eric Balchunas count on a portion of GBTC outflows emigrate to different Bitcoin exposures, highlighting the complexities of fund accounting and settlement delays in monitoring these actions. They famous, “GBTC has crossed $1.1 billion in outflows…We count on a significant proportion of these property to search out their means again into Bitcoin publicity, principally different ETFs.”

#2 Bitcoin Miners Promote

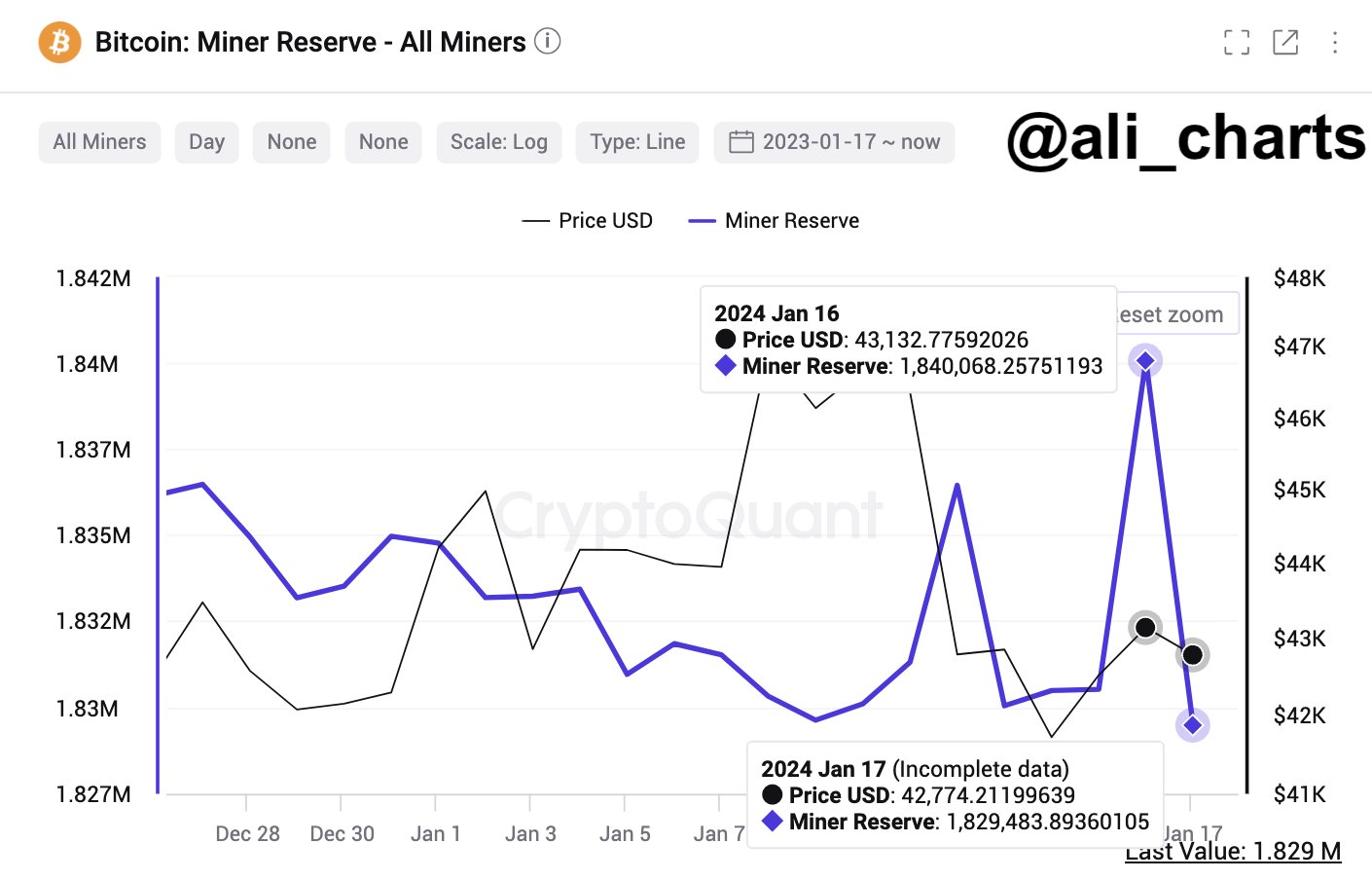

Ali Martinez has spotlighted the intensified promoting exercise by Bitcoin miners as one other issue influencing the present worth stagnation. Latest on-chain knowledge signifies that miners have considerably elevated their Bitcoin gross sales.

Martinez commented on X (previously Twitter), “Bitcoin Miners in Promoting Mode: Latest on-chain knowledge from Cryptoquant signifies a considerable enhance in promoting exercise by BTC miners.”

Notably, the shift in miner conduct is in line with historic developments, the place miners promote their holdings to handle money circulate or capitalize on worth will increase throughout market rallies.

#3 Consolidation Part Following ETF Mania

The market is at the moment present process a consolidation part after the euphoria surrounding Bitcoin ETFs, which led to an 82% rally. Such a part is taken into account pure and mirrors historic patterns seen in different markets, just like the first gold ETF.

Though gold initially recorded a rise of round 6%, it then took a full 9 months to start out the precise rally, which just about quintupled the value. The identical goes for the Bitcoin ETFs. It’s going to take a while earlier than the advertising and marketing machine of the asset managers begins up and new institutional buyers will be satisfied of the brand new asset class.

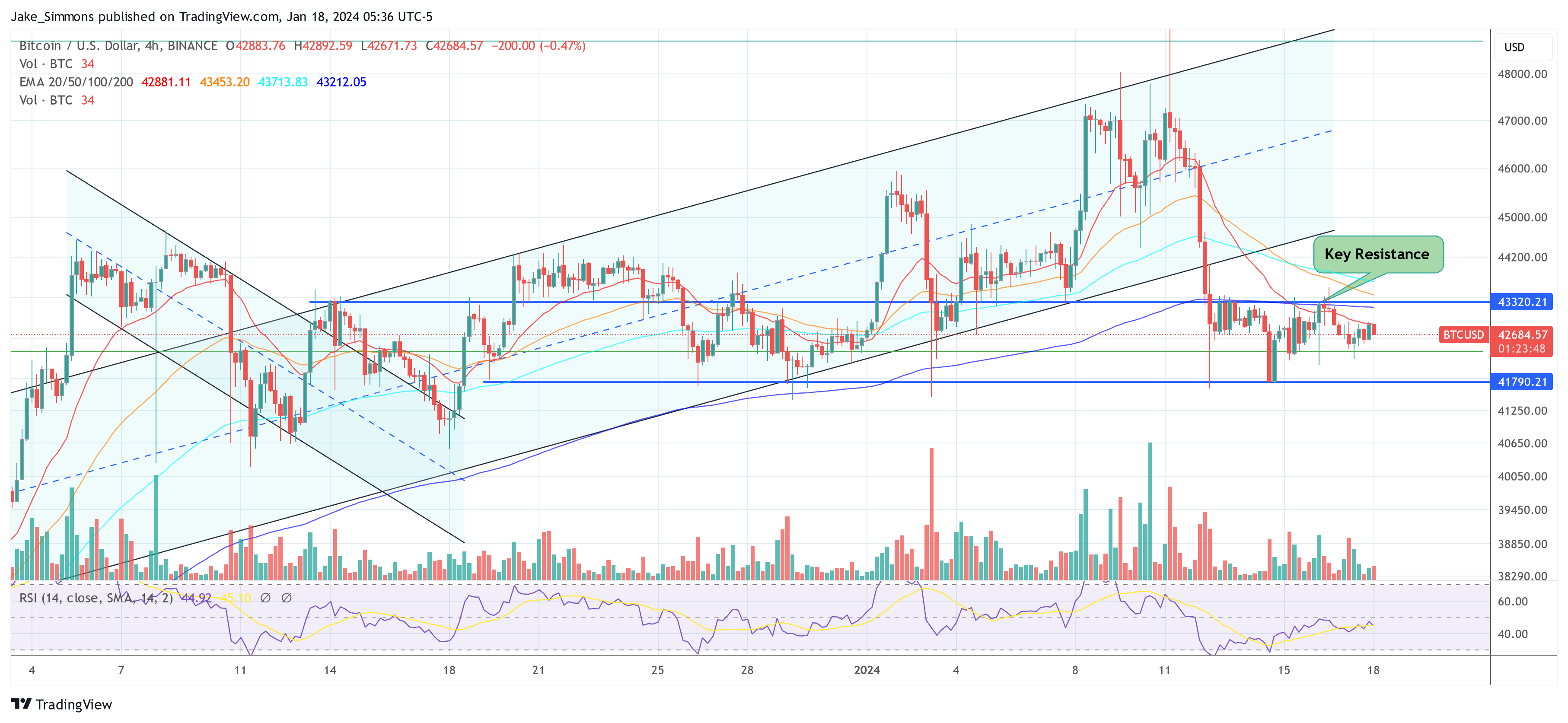

Analyst Skew supplied a technical perspective, stating, “BTC 4H: Remaining versatile until pattern confirmations, nevertheless not wanting good for the bulls with out 4H 200EMA reclaim & RSI under 50. Yearly open [is] nonetheless crucial for total risk-reward. Above is nice with bullish confirmations. Beneath is unhealthy for threat & with bearish confirmations results in downtrend (hedge mode). Pivotal space for 1H – 4H pattern ~ $42.5K”

At press time, BTC traded at $42,684.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal threat.