Bitcoin skilled a major surge, climbing from a low of $62,050 on Sunday to a peak of $66,500 late Monday. As of Tuesday, the BTC worth is barely correcting beneath this key resistance degree, however hovering above $65,000. A number of important components have contributed to the rally, together with a brief squeeze coinciding with the upcoming US elections, robust demand within the spot Bitcoin market, and substantial inflows into US spot Bitcoin Trade Traded Funds (ETFs).

#1 Brief Squeeze And US Election Affect

Yesterday’s worth surge may be partly attributed to the liquidation of leveraged quick positions. Singapore-based buying and selling agency QCP Capital writes of their newest investor word that almost $80 million value of Bitcoin and Ethereum leveraged shorts had been liquidated, making use of upward strain in the marketplace. Whereas some speculate that the postponement of Mt. Gox’s reimbursement deadline to October 2025 performed a job, this information was already revealed on Friday, suggesting different components had been at play throughout Monday’s rally.

Associated Studying

“Though there could possibly be many components that might clarify as we speak’s transfer, it’s fairly an attention-grabbing time if we take a look at historic worth motion. We’re in the course of October and simply three weeks away from the US elections,” QCP Capital notes. In each 2016 and 2020, Bitcoin remained in a good buying and selling vary for months earlier than initiating a major rally roughly three weeks earlier than the US Election Day. In 2016, Bitcoin doubled in worth from $600 by the primary week of January following the election. Equally, in 2020, it surged from $11,000 to a excessive of $42,000 by January.

This 12 months, October—also known as “Uptober” attributable to its traditionally robust efficiency—has been underwhelming, with Bitcoin up simply 1.2% in comparison with a median of 21%. The present rally, occurring three weeks earlier than the US elections, means that historical past is perhaps repeating itself, probably resulting in additional worth appreciation as investor optimism builds.

#2 Sturdy Demand For Bitcoin

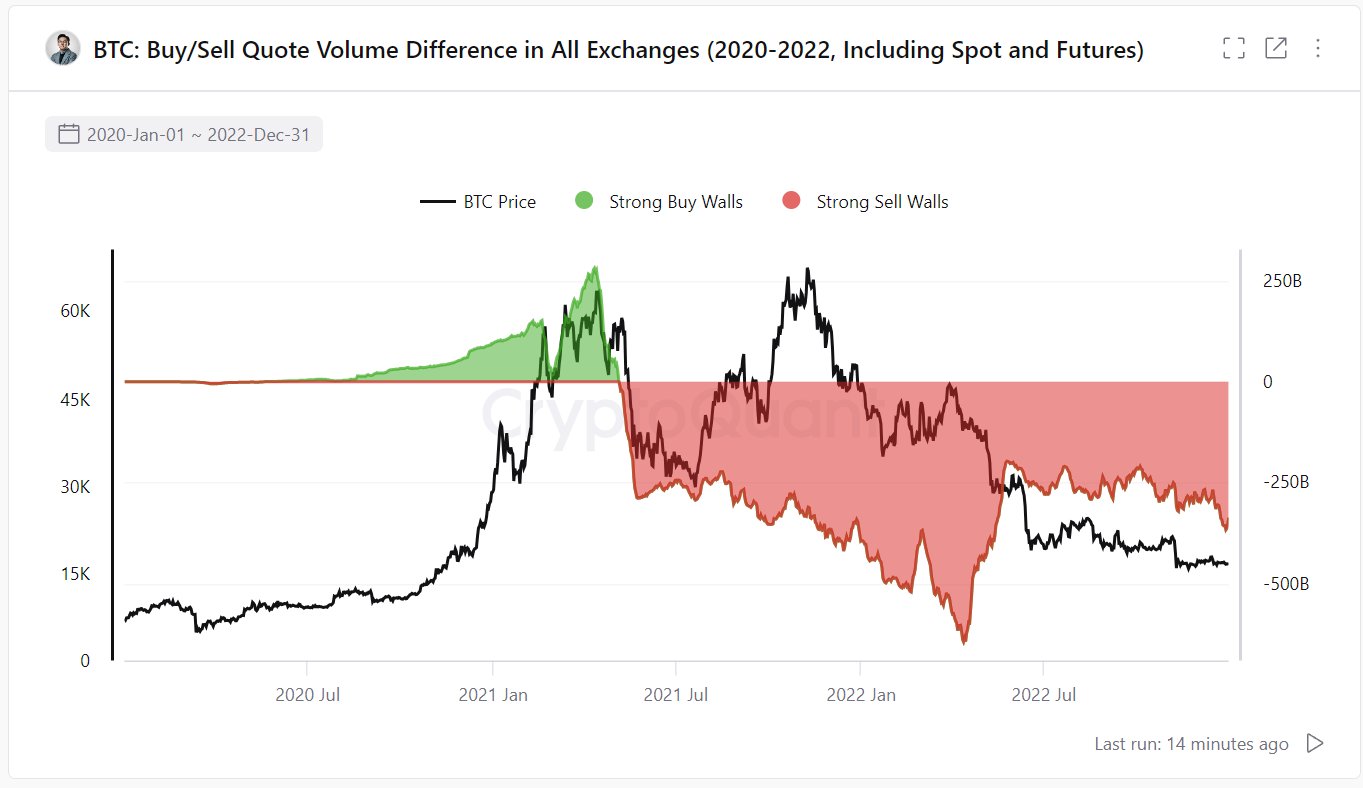

For the primary time since mid-2023, Bitcoin’s purchase orders are matching promote orders in spot market order books throughout exchanges. Ki Younger Ju, Founder and CEO of CryptoQuant, highlighted this growth by way of X: “Bitcoin purchase partitions on all exchanges at the moment are robust sufficient to neutralize promote partitions.”

This shift marks a major change from the development noticed since Might 2021. “Knowledge from the final cycle (2020-2022). It’s the gathered distinction between quoted purchase and promote volumes. Since Might 2021, promote partitions had been constantly thicker than purchase partitions till the tip of the cycle,” Younger Ju shared.

#3 Surge In Spot Bitcoin ETF Inflows

Monday witnessed one of many highest Bitcoin ETF inflows on document, totaling $555.9 million—the biggest internet influx day since June 3. This substantial capital inflow was unfold amongst a number of main asset managers. BlackRock acquired $79.5 million, Constancy attracted $239.3 million, Bitwise gathered $100.2 million, Ark Make investments noticed inflows of $69.8 million and the Grayscale Bitcoin Belief (GBTC) skilled inflows of $37.8 million.

Associated Studying

Nate Geraci, President of The ETF Retailer and host of the ETF Prime podcast, commented on these inflows by way of X: “Monster day for spot btc ETFs… $550mil inflows. Now approaching *$20bil* internet inflows in 10mos. Merely ridiculous & blows away each pre-launch demand estimate. That is NOT “degen retail” $$$ IMO. It’s advisors & institutional buyers persevering with to slowly undertake.”

At press time, BTC traded at $65,750.

Featured picture created with DALL.E, chart from TradingView.com