Because the crypto market struggles to shake off the weak point of final week, the newest sentiment information from Santiment reveals that token holders and merchants are bearish on a number of the high altcoins. Based on their latest evaluation, token holders are bearish essentially the most on Chainlink–a middleware answer that powers DeFi and NFTs, Ethereum, Solana, and Bitcoin.

Out of their evaluation, it’s fascinating to notice that these cash on focus are these within the high 10, apart from Chainlink that’s nonetheless perched outdoors the highest 20. Whereas Chainlink tops the record, others, primarily Ethereum, Solana, and Bitcoin, are within the high 5.

Chainlink Struggling Regardless of CCIP Success, Ethereum Disappoints

Though Santiment didn’t present a motive to elucidate why the neighborhood is bearish on these tokens, there are elementary components that prop up this outlook. Regardless of being a frontrunner in DeFi by their Oracle answer and Cross-Chain Interoperability Protocol (CCIP), Chainlink nonetheless struggles for momentum.

LINK, the native token, rose to as excessive as $22, which is beneath the 2021 highs and is at the moment down 53% from the 2024 highs. Contemplating its function in DeFi and NFTs, holders anticipated the token to drift increased, outperforming the market. This was particularly so after the launch of the CCIP answer, which has discovered adoption amongst a number of the high DeFi and TradFi platforms.

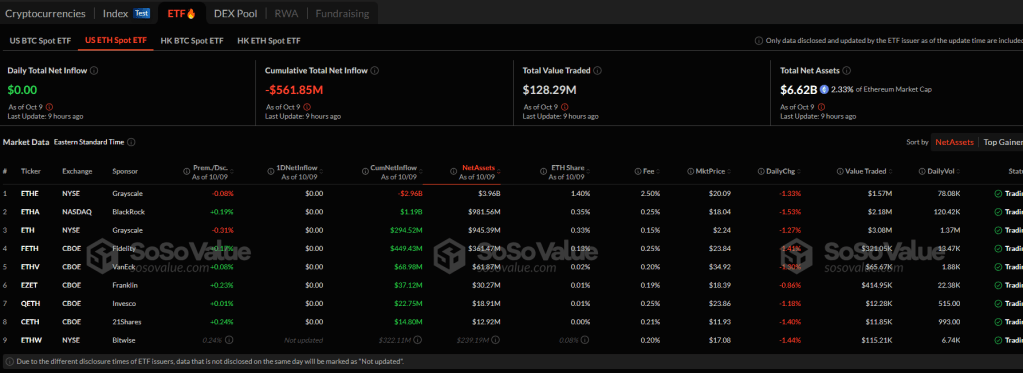

Pessimism about Ethereum’s outlook may additionally stem from disappointment following the approval of the primary batch of spot Ethereum ETFs. Not like Bitcoin, whose costs ripped increased, breaking above $70,000 to as excessive as $74,000, spot Ethereum ETFs haven’t been as profitable.

As of October 10, Soso Worth reveals that each one issuers in america managed simply over $6.6 billion. Even so, there are huge outflows from Grayscale’s ETHE, heaping huge strain on ETH costs. The second Most worthy coin remains to be buying and selling beneath $2,800 and is shifting sideways in a potential distribution.

Solana Suffers As Meme Coin Momentum Fades, Influence Of FTX Asset Distribution

Solana, alternatively, can be below strain. The success of Pump.enjoyable, which noticed a whole lot of hundreds of meme cash deployed, supported costs. Nonetheless, as Tron positive factors market share, the momentum is fading, negatively impacting costs.

Furthermore, within the coming few months, FTX trustees will distribute almost $16 billion of belongings to victims. Regardless that some would possibly proceed to HODL, others will select to liquidate–a detrimental for the coin.