Bitcoin went on a downward spiral within the first week of July to strike a backside under $54,000 amidst an exacerbated selloff by some massive holders. Numerous experiences utilizing on-chain knowledge have blamed the selloffs on the German state of Saxony promoting the bitcoins it seized earlier within the 12 months.

Associated Studying

Regardless of this appreciable selloff, Bitcoin has primarily held its floor, and bulls have been profitable in stopping further value drops. In line with on-chain knowledge, Bitcoin’s standoff might be attributed to some whales, as lots of them jumped on the value lower to prime up their holdings. Notably, Bitcoin whales added 71,000 BTC to their wallets this week.

Bitcoin Whales Purchase 71,000 BTC This Week

This week, Bitcoin whales went on an absolute feeding frenzy by accumulating a whopping 71,000 BTC from crypto exchanges. Whereas the German state of Saxony was busy offloading its crypto stash, these huge gamers had been very happy so as to add to their already large holdings.

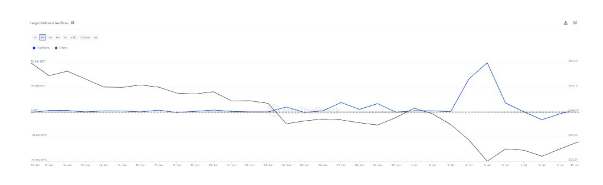

This fascinating exercise from the whales was first famous on social media platform X by IntoTheBlock. A take a look at the chart under reveals that the buildup was at its peak throughout Bitcoin’s 15% drop from $63,600 on July 1 to $53,905 on July 5.

Along with the whale accumulation, Spot Bitcoin ETFs witnessed regular inflows through the week regardless of the decline within the spot value. The funds recorded constructive internet flows each day through the week, with the most important internet circulate of $310 million on July 12.

Bitcoin Holding Up

The German state of Saxony offered over $2 billion value of Bitcoin final week and flooded the market with many BTC. When this selloff initially began, many merchants and market individuals had been skeptical about whether or not an already bearish Bitcoin might survive the promoting strain. Many analysts had been even anticipating a value decline in the direction of $47,000. Alternatively, different analysts believed that the selloff was exaggerated.

Regardless of this back-and-forth scene, Bitcoin managed to scale by means of the selloff and take up the impression of the selloff higher than many would anticipate. This confirmed that the cryptocurrency has now achieved stability, stopping additional value declines.

It additionally highlights the rising maturity of the crypto market, which has been characterised by a excessive stage of volatility over time. A $2 billion selloff could be very small in comparison with Bitcoin’s market cap of $1.18 trillion. To interrupt it down, that $2 billion represents lower than 0.2% of Bitcoin’s complete market cap.

Associated Studying

On the time of writing, Bitcoin is buying and selling at $59,960. The bulls are actually setting their eyes on breaking above $60,000 once more. Breaking and holding above $60,000 would set the stage for an additional value improve within the coming week.

Featured picture from Getty Photographs, chart from TradingView