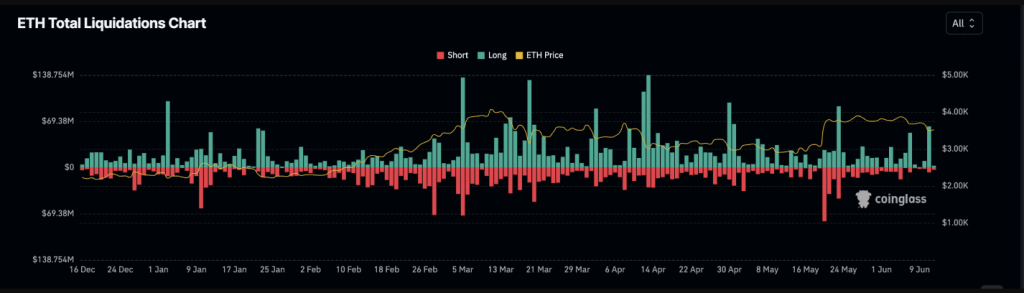

Ethereum (ETH) bulls bought a style of fireside on June eleventh because the altcoin’s derivatives market witnessed a dramatic surge in lengthy liquidations. In response to information from Coinglass, this occasion marked the very best stage of lengthy liquidations since Might twenty third, signifying a major correction for merchants who wager on rising costs.

Associated Studying

Crimson Chart: Lengthy Positions Liquidated

Overconfident buyers piled into lengthy positions, basically inserting a wager that Ethereum’s worth would climb. Nevertheless, the market had different plans. An sudden worth drop despatched shivers down the spines of those bulls, triggering a wave of liquidations.

As the value dipped under a sure threshold set by the alternate (generally known as the margin requirement), these positions had been forcefully closed to forestall additional losses for the unlucky merchants. The outcome? A collective sigh of aid for some exchanges, however a hefty invoice for liquidated bulls, totaling over $60 million on that fateful day.

Constructive Funding Fee Presents A Glimmer Of Hope

Whereas the market correction despatched shockwaves by way of the Ethereum derivatives panorama, a silver lining emerged within the type of a constructive Funding Fee. This metric basically displays the charges paid by merchants holding quick positions (betting on a worth decline) to these holding lengthy positions.

In less complicated phrases, a constructive Funding Fee signifies a stronger demand for lengthy positions, suggesting that even amidst the carnage, some buyers stay optimistic about Ethereum’s long-term prospects. This positivity is additional bolstered by the truth that ETH’s Funding Fee hasn’t dipped into unfavorable territory since Might third.

A Non permanent Hiccup?

The jury’s nonetheless out on whether or not this occasion represents a fleeting blip or a extra regarding development. Whereas the constructive Funding Fee provides a glimmer of hope, the numerous drop in derivatives exercise paints a unique image.

The previous 24 hours have seen a worrying decline in each choices buying and selling quantity (down 50%) and Open Curiosity (whole excellent contracts, down 2%). This means a possible flight from the market, with fewer members actively buying and selling choices contracts or holding open positions.

Ether Worth Forecast

Featured picture from SignatureCare Emergency Heart, chart from TradingView