The worldwide crypto funding market has witnessed a major inflow of capital, with current studies indicating a continued constructive development in inflows. In accordance with the most recent knowledge from CoinShares, digital asset funding merchandise have seen a further $1.35 billion in internet inflows final week.

This current injection of funds has introduced the whole for the present constructive streak to $3.2 billion. The truth that cash has been flowing to this extent is a testomony to the quantity of steam behind current market sentiment and confidence amongst traders concerning cryptocurrencies.

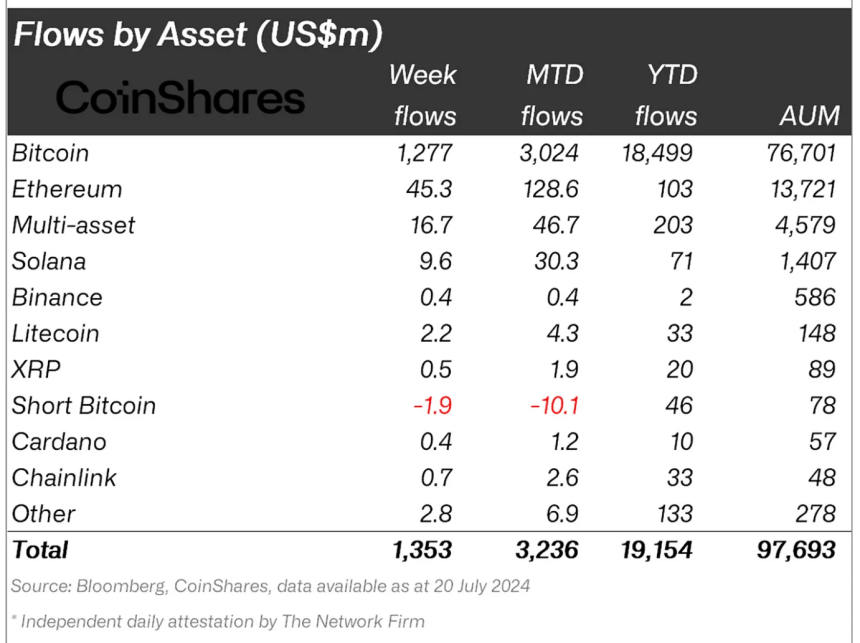

In accordance with Coinshares, this influx development just isn’t remoted to at least one explicit cryptocurrency however is moderately widespread throughout numerous digital property.

The report reveals that main asset managers akin to Ark Make investments, Bitwise, BlackRock, Constancy, Grayscale, ProShares, and 21Shares have all reported substantial inflows.

Associated Studying

Which Crypto Asset Led The Cost?

Unsurprisingly, most investments nonetheless move into Bitcoin, with respectable contributions from Ethereum and different altcoins.

In accordance with the report, Bitcoin registered roughly $1.27 billion of inflows final week, with short-Bitcoin exchange-traded merchandise (ETPs) seeing additional outflows of $1.9 million, bringing outflows since March to US$44 million.

Notably, the transaction quantity spurred thus far has contributed to a forty five% week-over-week enhance in ETP buying and selling volumes, representing 22% of the broader crypto market’s whole buying and selling volumes.

Apart from Bitcoin’s steady dominance, Ethereum’s current efficiency relative to different altcoins has additionally been noteworthy.

James Butterfill, Head of Analysis at CoinShares, famous a turning level in investor portfolio allocation, with Ethereum overtaking Solana for internet inflows year-to-date. Butterfill famous:

The outlook for Ethereum appears to have turned a nook, seeing an extra US$45m of inflows final week, overtaking Solana for the altcoin with probably the most inflows year-to-date (YTD) at US$103m. Solana additionally noticed inflows final week totalling US$9.6m, however now lags Ethereum with US$71m inflows YTD.

This transformation may be seen as vital because it suggests a bigger market rotation the place traders could also be re-aligning their portfolios with Ethereum because it continues to see potential sturdy long-term development prospects, such because the upcoming launch of its spot exchange-traded funds (ETFs).

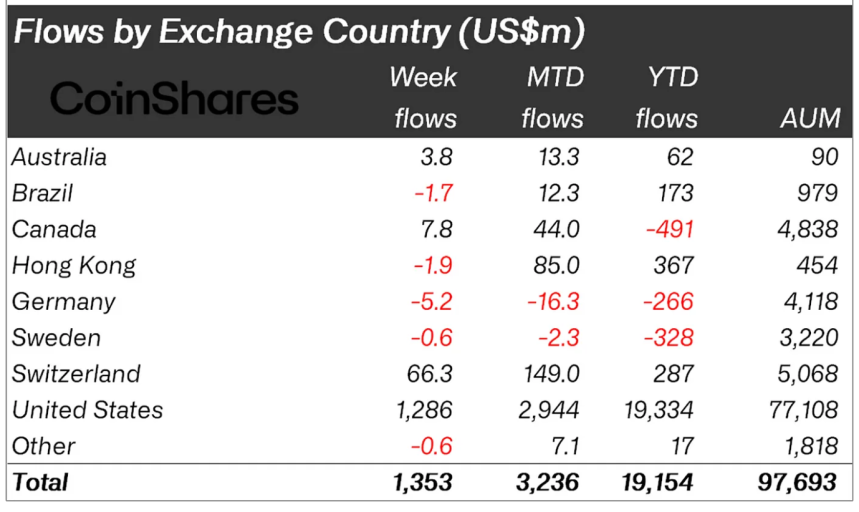

Moreover, funding flows have additionally diversified considerably throughout areas. Whereas the US and Switzerland prime the desk by a margin, there have been solely small internet outflows from Brazil and Hong Kong.

Market Efficiency Over The Previous Week

Whereas the crypto market fund flows have been constructive prior to now week, the worldwide value efficiency additionally seems to have mirrored this positiveness. Over the previous week, the worldwide crypto market valuation has surged from $2.4 trillion to $2.6 trillion.

This enhance comes in opposition to the backdrop of Bitcoin seeing a notable restoration that introduced its value to commerce as excessive as above $68,000 earlier at present earlier than now buying and selling under $67,000 on the time of writing.

Ethereum and Solana, then again, have additionally managed to see a restoration in value, similar to Bitcoin. Curiously, though Ethereum appears to be overtaking Solana in fund flows, SOL refuses to simply accept defeat concerning value efficiency.

Associated Studying

Notably, based on knowledge, between these two property, SOL has been the highest gainer over the previous week, up by 16.8%, a major distinction in comparison with ETH’s mere 2.6% surge over the identical interval.

Featured picture created with DALL-E, Chart from TradingView