Like Bitcoin, Ethereum, and different prime altcoins, Solana stays below immense promoting strain. Whereas bulls wrestle for momentum, $160 is rising as a neighborhood resistance stage for merchants to be careful for.

Regardless of the upside momentum in September, Solana patrons didn’t carry costs above this line. At press time, there’s a native double prime, whilst one analyst on X notes that Solana outperformed different platforms, posting a pointy inflow in web influx.

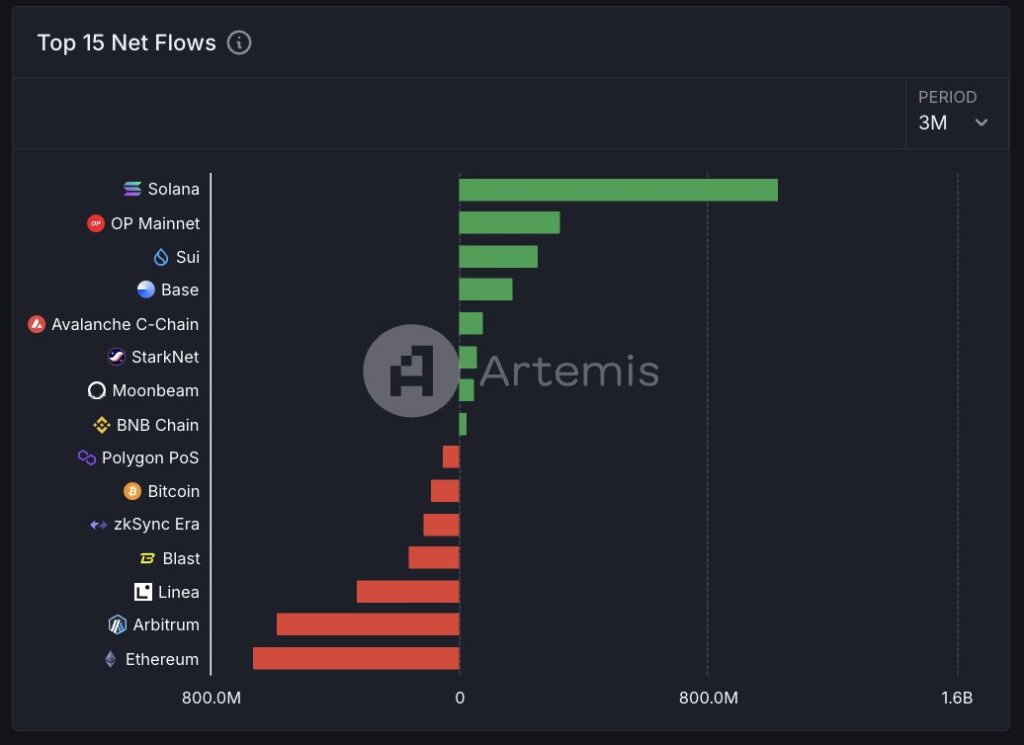

Solana Acquired Over $800 Million In Internet Flows Over Three Months

In contrast to Ethereum, Solana is a contemporary blockchain with comparatively excessive scalability. The platform can course of hundreds of transactions each second, translating to low charges, and thus, extra initiatives are selecting to launch on the community in order that consumer expertise stays unaffected. Occasions over the past three months, trying on the inflow of capital to Solana, cement this place.

Associated Studying

To place within the numbers, Solana registered over $800 million in web flows. This capital injection is greater than double what OP Mainnet, an Ethereum layer-2, acquired and far more than what Sui, one other scalable blockchain, posted within the final three months. It is usually greater than what Base and Starknet–two of Ethereum’s standard layer-2s, posted, and exceeds what Avalanche and the BNB Chain acquired.

Apparently, throughout this era, Arbitrum, an Ethereum layer-2 and the most important of all of them, Linea, Blast, and Bitcoin noticed outflows. Regardless of being the most important sensible contracts platform, Ethereum posted huge outflows of practically $800 million.

It stays to be seen what might have triggered the outflows in Ethereum whereas encouraging capital to Solana. Whereas on-chain payment variations might be an element, the continual dump of ETH in Q3 2024 might have triggered the outflow. At spot charges, ETH is down 35% from Q3 2024 highs, whereas Solana is simply 25% from July highs when it rose to round $192 earlier than pulling again.

Will SOL Break $160?

At the same time as Solana attracts capital, the coin stays below intense promoting strain. The native line at $160 must be convincingly damaged for the uptrend seen within the second half of 2023 to proceed. Additional beneficial properties will see Solana float to as excessive as $190 and probably escape from the present vary.

Associated Studying

Nonetheless, there might be headwinds. If Bitcoin fails to get better, it might drag the altcoin markets, together with Solana, with it. On the identical time, there are considerations that the upcoming FTX token distribution would negatively affect SOL costs.

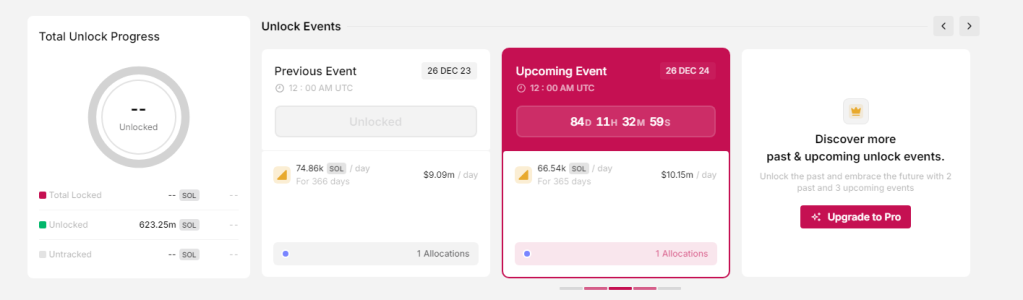

Furthermore, in keeping with Token Unlocks, the crew plans to launch tokens on December 26, 2024. Over 66,000 SOL will exit every single day for a yr.

Characteristic picture from DALLE, chart from TradingView