Glassnode’s hodler web place change metric affords a granular view into the conduct of Bitcoin’s long-term buyers. The metric is calculated by monitoring the inflows and outflows from wallets categorized as holders — or those that have been “holding on for pricey life” for a really very long time.

This metric is pivotal in understanding market sentiment, significantly the arrogance ranges of the buyers recognized for his or her long-term dedication to holding Bitcoin, no matter market volatility.

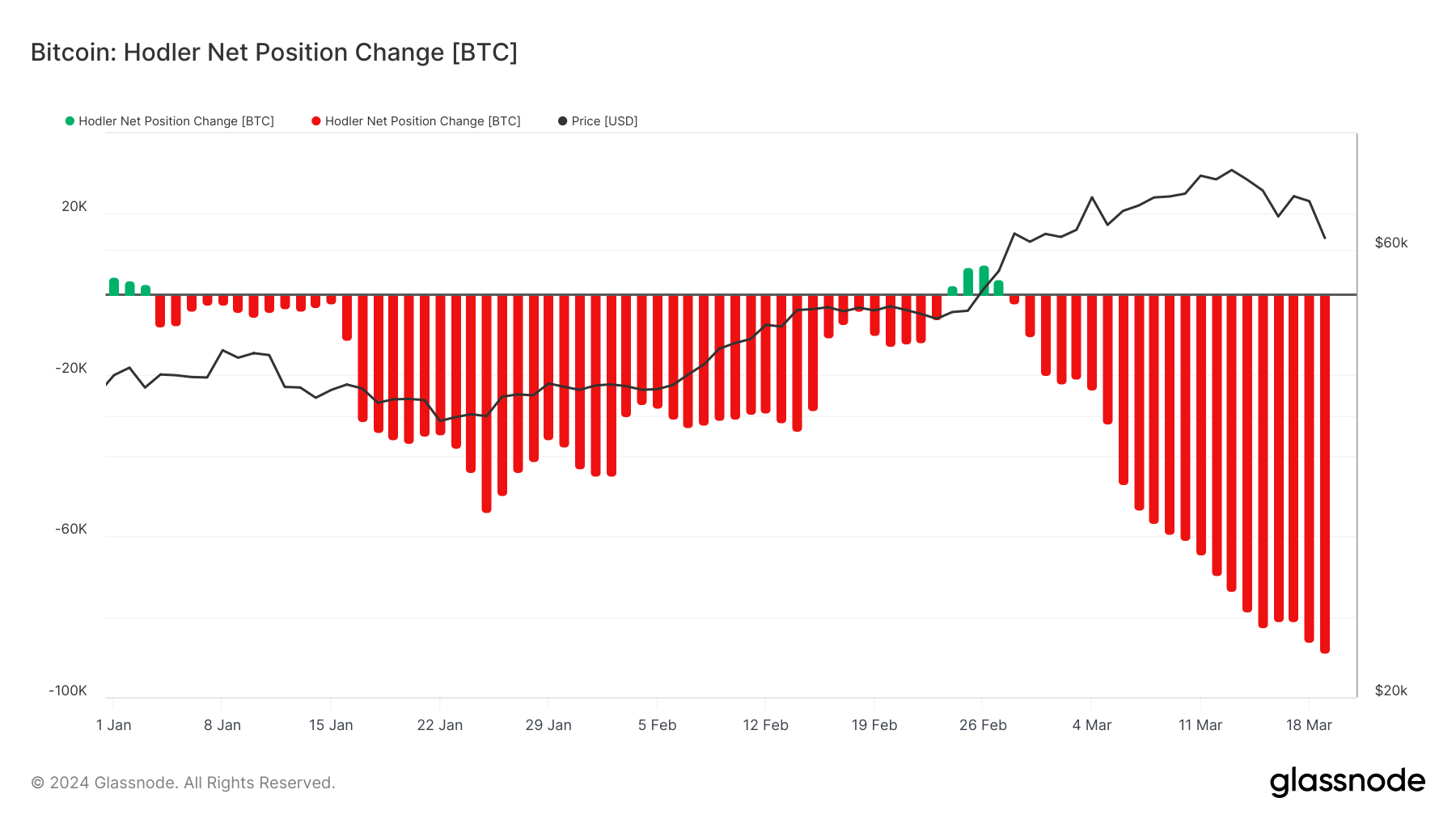

On March 19, the 30-day hodler web place change reached -88,860 BTC, marking probably the most vital detrimental shift in three years.

This downward pattern has endured since Jan. 4, damaged solely by a quick 4-day interval of constructive change on the finish of February. This appreciable lower in hodler balances comes after a pointy correction in Bitcoin’s worth — which dropped from a peak of $73,000 on Mar. 13 to simply underneath $61,000 by Mar. 20.

Such a big detrimental change in hodler steadiness usually indicators a change in long-term investor conduct and might point out lowered confidence in Bitcoin’s worth stability within the close to time period. The timing and scale of those modifications can counsel a notable shift in sentiment amongst these buyers, who’re typically recognized for his or her resilience throughout market volatility.

Nevertheless, deciphering the state of the market by means of a single metric, such because the hodler web place change, may be deceptive if different indicators aren’t thought-about.

Earlier CryptoSlate evaluation discovered that regardless of the short-term worth volatility and the rise in promoting stress on centralized exchanges, the underlying pattern of accumulation throughout the market remained unaffected.

That is seen within the divergence between the market cap and the realized cap, indicating that the lower in market worth didn’t deter the buildup of Bitcoin, with the realized cap displaying a rise within the realized worth of all cash moved on the community.

Regardless of the lower in long-term holder balances since December 2023, this ongoing accumulation means that different elements are at play. The decline in over-the-counter (OTC) desk balances and vital outflows from Grayscale’s ETF are potential contributors to this pattern.

OTC desks, serving large-volume merchants and establishments, facilitate main transactions with minimal market impression. A discount in OTC balances might point out that institutional buyers are transferring their holdings to exchanges, probably in anticipation of gross sales or to satisfy liquidity wants. This contributes to the detrimental hodler web place change with out essentially indicating a broad sell-off amongst particular person long-term holders.

Moreover, outflows from Grayscale’s GBTC, a key institutional car for Bitcoin publicity earlier than the launch of spot Bitcoin ETFs, might have considerably influenced the hodler web place. These actions may very well be pushed by buyers reallocating to ETFs with extra aggressive charges or liquidating positions attributable to market situations.

The info reveals the significance of contemplating a number of sources and on-chain metrics to achieve a complete understanding of the market. Institutional actions can have outsized impacts on market indicators and will not all the time align with the sentiment and conduct of the broader investor group.

The publish What’s pushing down Bitcoin’s hodler balances? appeared first on CryptoSlate.