Bitcoin (BTC), the most important cryptocurrency out there, has seen its value hover between $42,000 and $43,000, halting its restoration from the dip under $38,500.

With the upcoming halving occasion scheduled for April, market consultants and crypto analysts similar to Rekt Capital are observing historic patterns that counsel an attention-grabbing value motion state of affairs, probably igniting one other vital value surge for Bitcoin.

Pre-Halving Rally For Bitcoin Imminent?

Rekt Capital, identified for its experience in analyzing market tendencies, highlights the importance of historic patterns about earlier halving occasions. These patterns reveal a constant development of considerable rallies main as much as the halving, adopted by a brief interval of correction and consolidation earlier than a serious bull run and peak.

In accordance to Rekt Capital, Bitcoin ought to start its Pre-Halving Rally as early as subsequent week if historical past signifies.

This rally, pushed by buyers “shopping for the hype” in anticipation of the halving, goals to capitalize on the value surge and understand income by “promoting the information.” Quick-term merchants and speculators typically exploit this hype-driven rally and promote their positions.

The next promoting stress contributes to a phenomenon generally known as the pre-halving retrace. This retrace usually happens a few weeks earlier than the precise halving occasion.

In earlier halving cycles, the pre-halving retrace reached depths of -38% in 2016 and -20% in 2020. It’s price noting that this part can final for a number of weeks, introducing uncertainty amongst buyers relating to whether or not the halving will act as a bullish catalyst for Bitcoin’s value.

Total, the historic patterns noticed by Rekt Capital level to the opportunity of a pre-halving rally within the coming weeks, adopted by a correction interval generally known as the pre-halving retrace.

Whereas previous efficiency is not any assure of future outcomes, these historic tendencies present useful steering on how the value of Bitcoin could carry out within the coming weeks and days earlier than the halving.

Lengthy-Time period Holder Assist And ETF Shopping for Stress

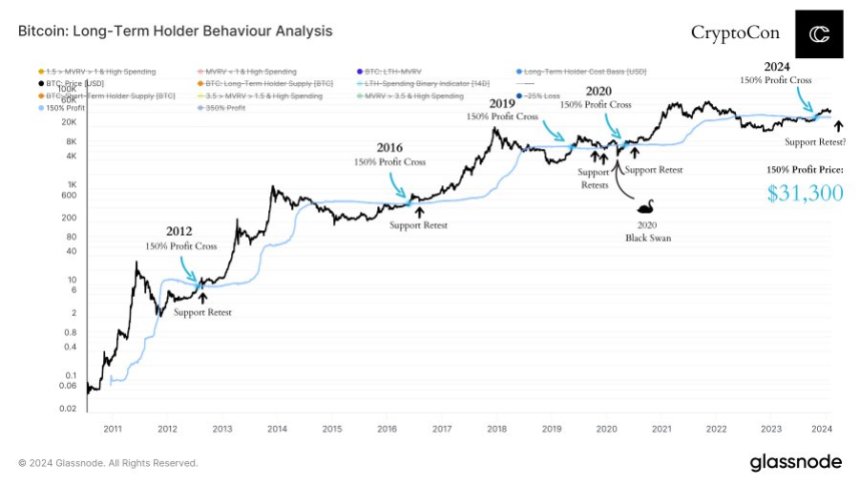

Regardless of anticipated short-term beneficial properties for BTC, Crypto Con has not too long ago drawn consideration to a historic development within the Bitcoin market. In keeping with Crypto Con, no Bitcoin cycle has ever escaped a retest of the 150% long-term holder assist line.

In accordance to the analyst, this line has acted as a vital stage of assist throughout numerous market cycles. Even in the course of the unprecedented black swan occasion and subsequent restoration in 2020, the value retested this line as assist.

By analyzing this metric, Crypto Con means that based mostly on historic patterns, Bitcoin’s value might have roughly $31,300 to retest the long-term holder assist line.

The anticipated impression of ETF shopping for stress on Bitcoin’s value is counterbalancing the argument for additional corrections. Introducing ETFs (Trade-Traded Funds) into the cryptocurrency market is a comparatively new improvement. As such, the results of ETF inflows on Bitcoin’s value stay to be seen and are a topic of ongoing remark.

Whereas the potential retest of the long-term holder assist line could create non permanent value fluctuations, proponents of Bitcoin as an funding alternative view such a state of affairs as a shopping for alternative.

In the end, Crypto Con believes that those that consider within the long-term prospects of Bitcoin could select to benefit from any value dips ensuing from a retest of assist.

BTC trades at $42,800, up a slight 0.4% previously 24 hours as of this writing.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site solely at your personal threat.