In line with knowledge from Lookonchain, an on-chain analytics platform, Ethereum (ETH), whales have withdrawn roughly $64.2 million value of ETH from main exchanges.

This vital motion of funds coincides with a notable uptick within the value of ETH, indicating an growing curiosity within the asset.

Ethereum Whales Motion Indicators Confidence

In line with Lookonchain’s findings, a lot of the ETH provide has been shifted from alternate wallets to custodial wallets. The on-chain analytics platform reported that an Ethereum tackle labeled 0x8B94 had withdrawn an quantity of 14,632 ETH, valued at roughly $45.5 million, from Binance.

Lookonchain states these funds have been actively staked inside six days, indicating a deliberate transfer in the direction of adopting long-term funding methods.

The evaluation from the platform additionally factors out that one other two contemporary whale wallets have transferred 6,000 ETH, amounting to $18.7 million, from Kraken to undisclosed pockets addresses during the last two days.

Whales are accumulating $ETH!

0x8B94 withdrew 14,632 $ETH($45.5M) from #Binance and staked it up to now 6 days.https://t.co/bywnrZ2glt

2 contemporary whale wallets withdrew 6K $ETH($18.7M) from #Kraken up to now 2 days.https://t.co/0kEvOmiv3hhttps://t.co/90fqjJXsSu pic.twitter.com/J0ewl8S3OX

— Lookonchain (@lookonchain) February 26, 2024

This pattern suggests a rise in main buyers to safe substantial quantities of Ethereum away from alternate platforms, doubtlessly as a method of positioning for long-term asset appreciation.

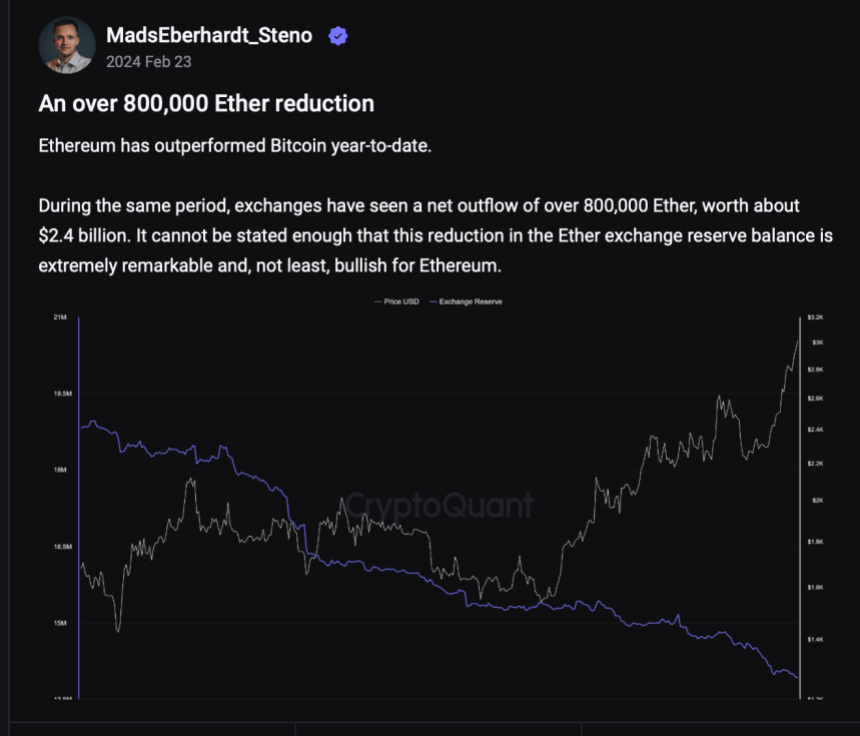

Additional echoing it is a latest evaluation from CryptoQuant’s Quicktake, which underscores a notable pattern relating to Ethereum withdrawals from exchanges over the previous few weeks. This commentary depends on the “Change Reserve” metric, which screens the amount of ETH tokens held within the wallets of all centralized exchanges.

When the worth of this metric will increase, it signifies that buyers are depositing extra belongings than withdrawing them from centralized exchanges, indicating a buildup of Ethereum reserves. Conversely, a decline within the metric suggests a internet outflow of belongings from these platforms.

In line with knowledge from CryptoQuant, over 800,000 ETH, equal to roughly $2.4 billion, has exited cryptocurrency exchanges because the starting of the 12 months. Such substantial outflows from these platforms usually point out a surge in investor confidence within the Ethereum community and its native token.

Ethereum’s Value Momentum And Potential For A Important Breakout

In the meantime, Ethereum’s value has displayed bullish momentum, witnessing a 5.5% improve up to now week and reclaiming the essential $3,000 mark.

Monetary guru Raoul Pal has drawn consideration to Ethereum’s potential for a serious breakout, pointing to a “dual-chart sample” noticed on the ETH/BTC chart.

The ETH/BTC chart is an absolute stunner…and prepared for the subsequent large transfer the break of the mega wedge…lets see how is pans out… pic.twitter.com/5x4tJLjtJy

— Raoul Pal (@RaoulGMI) February 25, 2024

Pal highlights a “mega wedge” sample alongside an inside descending channel, indicating a consolidation part with bullish potential.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site totally at your individual danger.