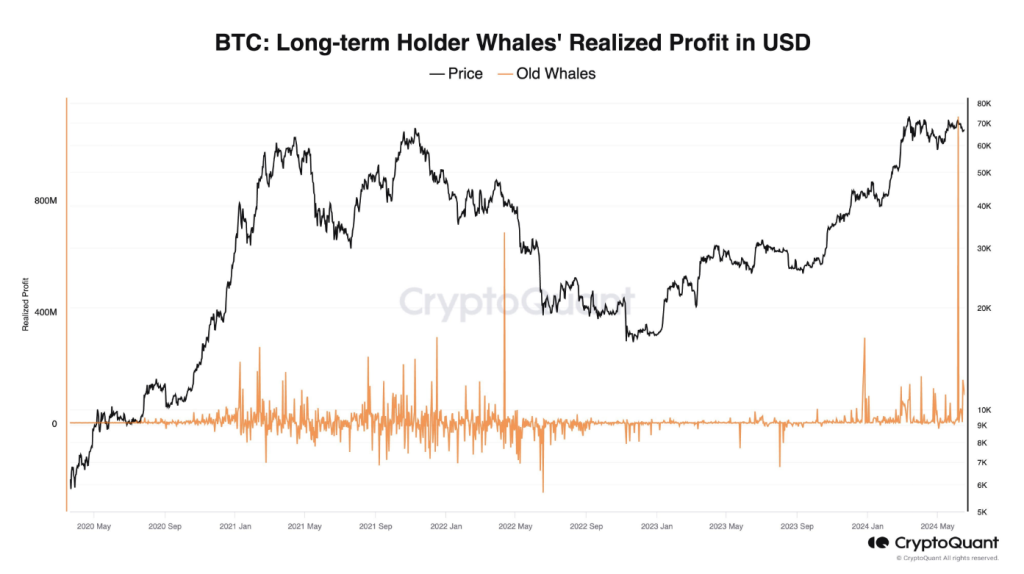

Bitcoin appears to be hitting an air pocket. Over the previous two weeks, whales have been shedding their digital property in massive quantities. This exodus, totaling over $1.2 billion in line with CryptoQuant, has been a trigger for concern for a lot of landlocked investor.

Associated Studying

The place The Whales Go, The Market Might Observe

The explanations for this sudden sell-off stay murky, however analysts level to a confluence of things. One concept suggests a shift in priorities for miners, the brawny machines that safe the Bitcoin community and earn rewards within the type of new cash.

#Bitcoin long-term holder whales bought $1.2B up to now 2 weeks, possible by brokers.

ETF netflows are destructive with $460M outflows in the identical interval.

If this ~$1.6B in sell-side liquidity isn’t purchased OTC, brokers could deposit $BTC to exchanges, impacting the market. pic.twitter.com/oYeKsRqKeF

— Ki Younger Ju (@ki_young_ju) June 18, 2024

With the booming synthetic intelligence (AI) sector providing a probably extra profitable goldmine, miners could be cashing out their crypto rewards to spend money on the way forward for computing.

The attract of AI is plain, shared Lucy Hu, a senior analyst at crypto fund Metalpha. The sheer processing energy wanted for AI improvement aligns completely with the capabilities of mining rigs. It appears miners are strategically diversifying their income streams.

This potential exodus of miners from the Bitcoin ecosystem may have a domino impact. As miners promote their rewards, it will increase the general provide of BTC in circulation, probably driving the value down.

This aligns with the noticed decline in “UTXO age” – a metric used to trace shopping for and promoting patterns. A drop in UTXO age signifies elevated promoting exercise, and that’s not a comforting signal for buyers hoping to experience the Bitcoin wave.

Conventional Markets Beckon, Leaving Bitcoin On The Seashore

Including gasoline to the hearth is the broader market sentiment. The latest energy of the US greenback and a common flight in direction of “safer” property like conventional shares have put a damper on riskier investments like Bitcoin.

This threat aversion is additional mirrored within the internet outflows of over $600 million from US-listed Bitcoin ETFs – the worst efficiency since late April.

Associated Studying

Is This A Bitcoin Bust, Or A Non permanent Hiccup?

The mixed impact of those components has been a gradual decline in BTC’s value. From a lofty perch of $71,000 just some weeks in the past, Bitcoin has dipped to slightly over $65,000. Some analysts warn of a possible freefall to as little as $60,000 if the tide of destructive sentiment continues to movement.

Whales are unloading a ton of Bitcoin. Is that this a hearth sale, a giant low cost to purchase Bitcoin, or a warning signal that issues are about to get tough for Bitcoin? Traders are ready to see if this can be a good time to purchase or if they need to get out earlier than the value drops much more.

Featured picture from Getty Pictures, chart from TradingView