Bitcoin merchants are upbeat, assured that bulls have extra legs to push costs above $72,000 and all-time highs. Whereas the thrill about what lies forward is primarily because of the mass influx into spot Bitcoin exchange-traded funds (ETFs), Charles Edwards, the founding father of Capriole Investments, has picked out a number of elements capping the present uptrend to $100,000.

Right here’s Why Bitcoin Is Nonetheless Buying and selling Under $100,000

In a publish on X, Edwards mentioned a number of elements mix to suppress beneficial properties. Nevertheless, most relate to a tussle between new institutional cash and a wave of long-term holder promoting.

Roughly six months after the primary batch of spot Bitcoin ETFs have been authorized by the USA Securities and Alternate Fee (SEC), billions proceed to move to those spinoff merchandise.

Associated Studying

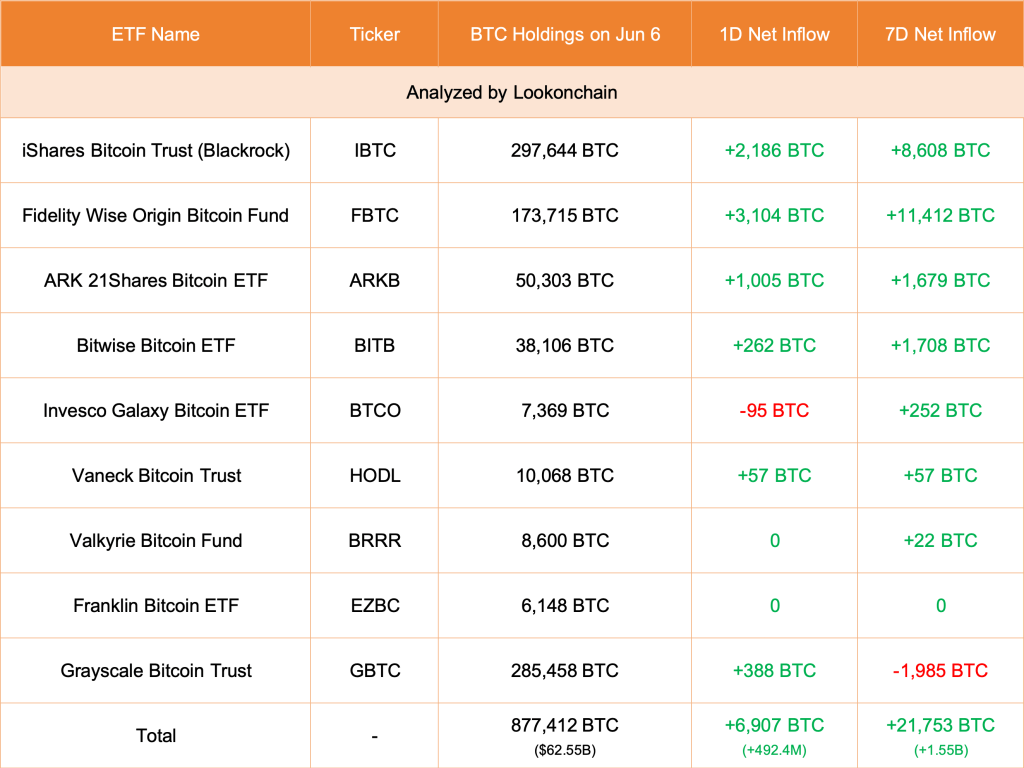

In response to Lookonchain, all 9 spot BTC ETF issuers in the USA added 6,907 BTC price over $492 million on June 6. Constancy added 3,104 BTC, whereas BlackRock purchased 2,186 BTC.

Encouragingly, following sharp beneficial properties on Might 20, establishments have been more and more shopping for extra BTC, gaining publicity by way of spot ETFs.

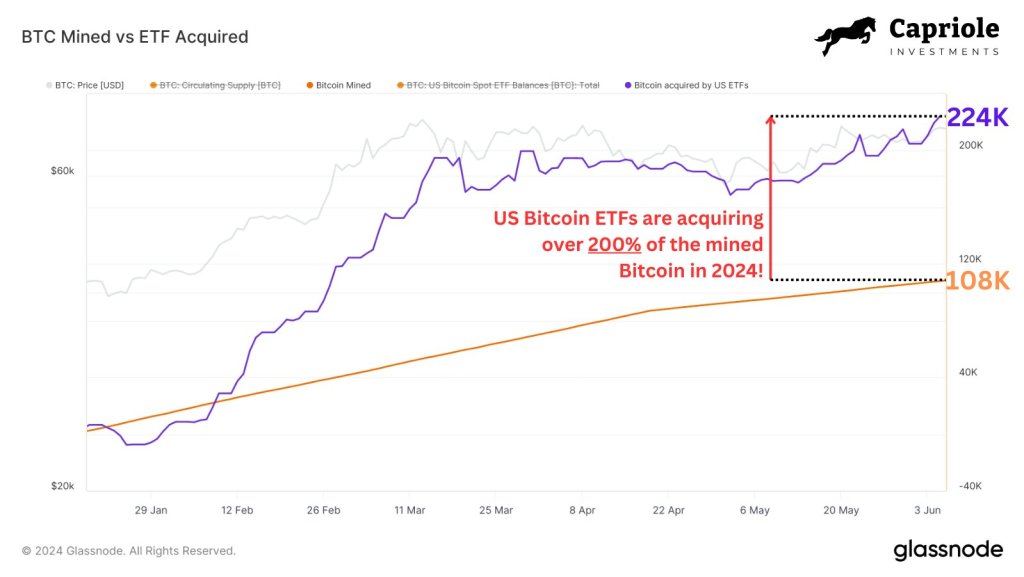

Over the previous half yr or so, Edwards notes that spot Bitcoin ETF issuers in the USA have been aggressively accumulating. To date, they’ve purchased 200% of all BTC mined since their debut in January.

What this implies is that there’s a regular and spectacular stream of institutional funding flowing to Bitcoin. BTC costs have been trending larger in response to this growth, breaking above 2021 highs and printing contemporary all-time highs in March 2024.

Associated Studying

Although the uptrend is obvious, the tempo of growth is discouraging. Edwards notes that increasingly more long-term holders are actively promoting. Their share of the overall provide has been shrinking for the reason that December 2023 peak of 57%, falling to 54%, lowering 630,000 BTC within the course of. This determine dwarfs the overall holdings of all BTC gathered by spot Bitcoin ETF issuers in the USA.

Spot Bitcoin ETF Inflows, USD Liquidity, And Lengthy-term Holder Habits Are Key

Amid this wait, the founder thinks Bitcoin might nonetheless exceed native resistance and rally to $100,000. For this stage to be examined, there have to be a spike in institutional urge for food for BTC, even pushing day by day purchases to over $1 billion.

Moreover, long-term holders should decelerate their liquidation, lowering provide. If this prints out because the M2 cash provide in the USA will increase, the coin might surpass expectations, breaking out from the present vary.

Function picture from DALLE, chart from TradingView