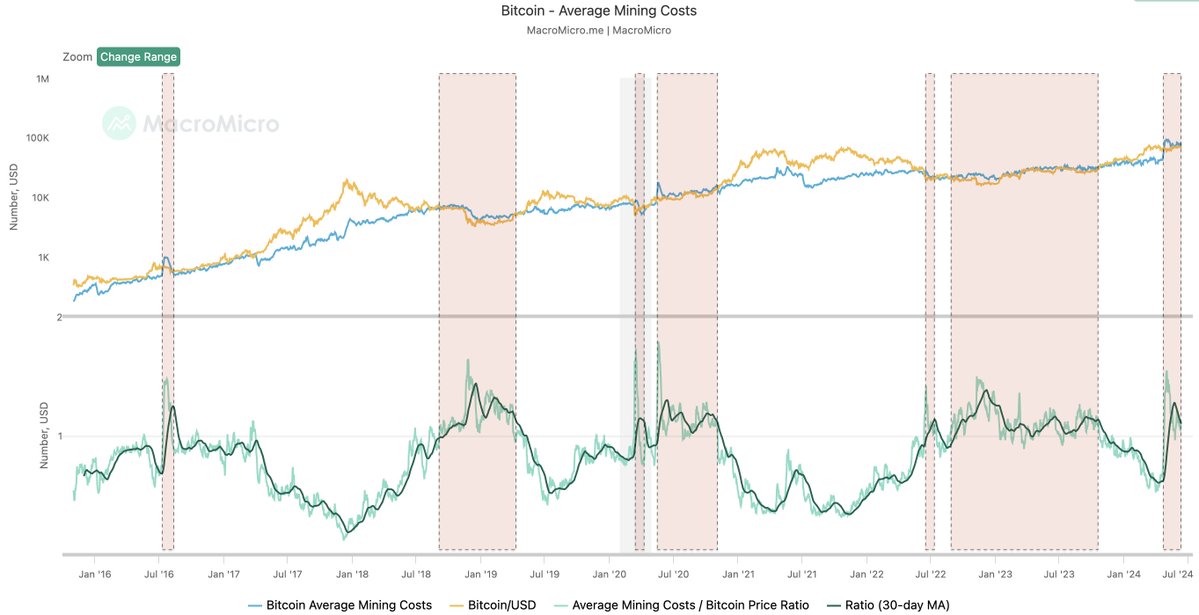

Knowledge suggests the common price of mining Bitcoin is standing round $86,700 proper now. Right here’s what historical past suggests may occur subsequent for BTC.

Bitcoin Common Mining Price Is Presently Notably Greater Than The Value

In a brand new publish on X, analyst Ali Martinez has talked about how the common mining price of BTC is wanting like proper now. The Bitcoin community runs on a consensus mechanism based mostly on the “proof-of-work” through which validators referred to as the miners compete in opposition to one another utilizing computing energy to get to hash the subsequent block on the chain.

This computing energy naturally has its operating price, with electrical energy being probably the most notable expense that the miners should pay, on condition that it’s a perpetual price. The inducement for spending capital on mining operations lies within the block rewards that these validators obtain upon efficiently including the subsequent block.

Clearly, mining bills are totally different relying on location, as electrical energy costs aren’t the identical in every single place. As such, the chart that Ali has cited from MacroMicro makes use of information supplied by the Cambridge College on BTC electrical energy consumption to seek out out a median worth.

Associated Studying

Beneath is the chart in query, which exhibits how the common mining price on the Bitcoin community has modified over the previous few years.

As is seen within the above graph, the Bitcoin common mining price (coloured in blue) had been beneath the value of the cryptocurrency earlier within the 12 months, however not too long ago, the previous’s worth has spiked and has surpassed the latter’s.

The rationale behind this sudden improve is that there’s one other variable at play when calculating the common price of mining Bitcoin: the Issuance, or the variety of tokens that the miners are minting each day.

Basically, the block rewards keep fastened each in worth and frequency, so the Issuance of the community, which is nothing else than the sum of the block rewards mined in a day, kind of stays fastened as nicely.

Particular occasions, nevertheless, don’t abide by this. They’re the Halvings. These periodic occasions that happen roughly each 4 years completely slash the block rewards in half.

The most recent such occasion, the fourth ever within the cryptocurrency’s historical past, occurred again in April. Naturally, the Halvings imply that the price of mining 1 BTC drastically goes up, as miners solely get half as many rewards as earlier than after doing the identical quantity of labor.

Thus, it’s not stunning that the price of manufacturing for the coin noticed a pointy improve coinciding with the newest Halving. At current, this metric stands at $86,700, which means that in line with MacroMicro’s mannequin, the common miner could be underwater.

Associated Studying

Primarily based on the previous development of the indicator, Ali has recognized a sample that Bitcoin has all the time adopted. “Traditionally, BTC all the time surges above its common mining price!” notes the analyst.

As such, if this sample continues to carry for the present cycle as nicely, then it might solely be a matter of time earlier than Bitcoin surges previous the $86,700 mark.

BTC Value

Bitcoin has gone by way of a drawdown of greater than 5% not too long ago, which has introduced its worth below the $66,000 stage.

Featured picture from Dall-E, MacroMicro.me, chart from TradingView.com