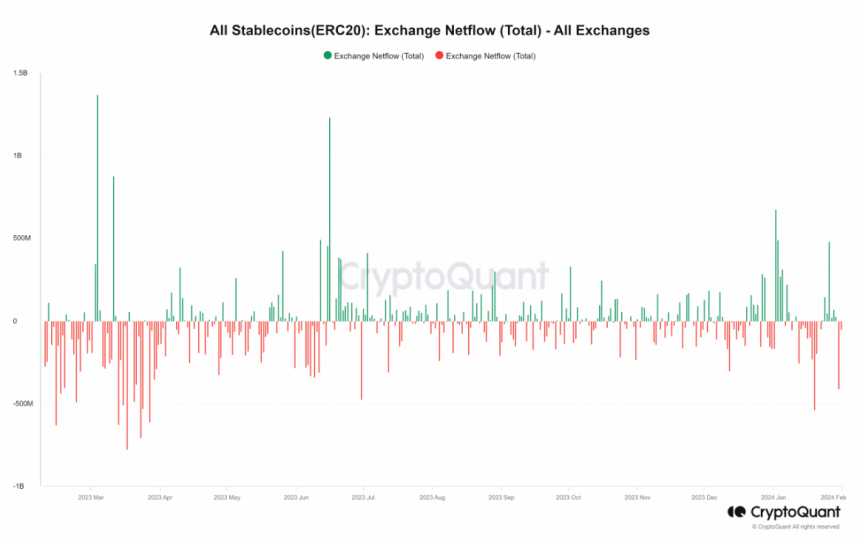

The cryptocurrency trade has witnessed a major change within the motion of stablecoins, providing worthwhile observations into the evolving dynamics of the market. Latest information from IntoTheBlock and CryptoQuant has proven a surge in stablecoin inflows into exchanges, reaching file highs in January.

Notable inflows have been noticed on January 2nd ($478 million), January third ($489 million), and January twenty sixth ($673 million). Nonetheless, this pattern has since reversed, with outflows dominating the market.

On January thirtieth, there was a considerable outflow of $412 million, marking the second-highest each day outflow recorded within the month, following the $541 million outflow on January nineteenth.

USDT Leads Stablecoin Rally, However Warning Persists In Crypto Market

An evaluation of the 24-hour buying and selling quantity of the highest stablecoins on CoinMarketCap reveals that Tether (USDT) and USD Coin (USDC) collectively accounted for roughly 90% of the full quantity. Tether, specifically, has been dominant by way of flows, with a 24-hour buying and selling quantity exceeding $42 billion, whereas USDC’s quantity stood at round $6 billion.

Taking a better have a look at the circulate of USDT by means of CryptoQuant, it was discovered that there was a considerable influx of $373 million on January twenty sixth, adopted by a prevailing pattern of outflows, with over $83.4 million noticed on the time of writing.

USDTUSD at the moment buying and selling at $0.99897 on the each day chart: TradingView.com

Consultants recommend that the rise in stablecoin inflows onto exchanges, significantly the $478 million on January 2nd, may point out merchants’ and buyers’ readiness to take part available in the market or their need to safeguard their funds throughout unsure occasions.

Conversely, the shift in direction of outflows might sign warning or preparation for potential market volatility. Moreover, the substantial influx of stablecoins, particularly USDT, may point out elevated shopping for energy and intentions to ascertain positions within the cryptocurrency house.

Stablecoins Surge, Sign Investor Preparation

The rise in stablecoin inflows onto exchanges may be interpreted in two methods. Firstly, it might point out that buyers and merchants are making ready to enter the market. By shifting their funds into stablecoins, they’ll shortly transition into different cryptocurrencies after they understand favorable alternatives. This means a readiness to take part and make the most of potential market actions.

Secondly, the rise in stablecoin inflows can also replicate a need to maintain funds in a safe method, significantly throughout unsure occasions. Stablecoins supply stability by being pegged to a selected asset, such because the US greenback, which may be interesting to buyers in search of to guard their capital in occasions of market volatility. This cautious strategy may be seen as a option to safeguard funds and mitigate dangers in an unpredictable market.

Tether Information Almost $3 Billion Revenue

In the meantime, Tether introduced a “record-breaking” $2.85 billion in quarterly earnings because the market capitalization of its foremost token, USDT, approached $100 billion.

Based on a weblog put up by Tether, the curiosity gained on the corporate’s monumental holdings in US Treasury, reverse repo, and cash market funds—which assist the USDT stablecoin—account for round $1 billion of the earnings in the newest quarterly attestation report that was launched on Wednesday. Every thing else was “primarily” because of the progress of Tether’s different property, like gold and bitcoin (BTC), the stablecoin issuer mentioned.

Featured picture from Wccftech, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site totally at your individual danger.