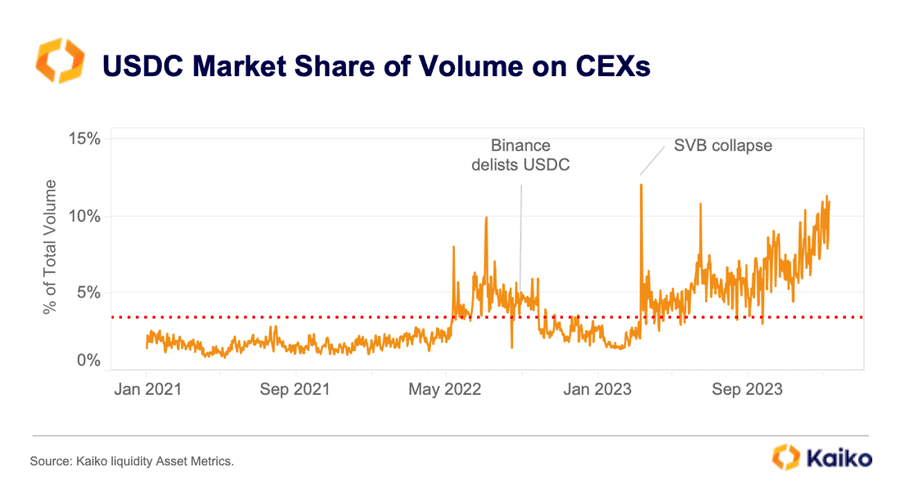

USD Coin (USDC), the second-largest stablecoin by market capitalization, has seen its market share on centralized crypto buying and selling platforms develop considerably through the previous months.

Knowledge from Paris-based crypto intelligence platform Kaiko confirmed that USDC’s market share doubled to over 10% from round 5% in September 2023, primarily because of the rising volumes recorded on Bybit.

Why USDC’s market share is rising

Bybit has emerged as the biggest marketplace for USDC, doubtless as a consequence of its introduction of a zero-fee buying and selling incentive for its USDC buying and selling pairs in February final yr.

Binance’s relisting of the USDC stablecoin, following the authorized troubles that emerged with Binance USD (BUSD), additionally doubtlessly performed a job in serving to to enhance USDC’s market share through the interval.

Coinbase, the biggest crypto buying and selling platform within the U.S., additionally progressively elevated the rates of interest on USDC, ranging from 2% and incrementally transferring it to six% all through final yr. This drastically incentivized customers of the platform to carry the stablecoin.

Additionally, Circle, the stablecoin issuer, has notable partnerships with main monetary establishments like Japanese monetary big SBI Holdings and licensing in main jurisdictions like Singapore, which additional helps to spice up USDC’s circulation and presence.

USDC’s provide

Regardless of these improved numbers, USDC’s present circulating provide stays drastically under its all-time excessive of $45 billion.

Circle attributed this decline to a number of components, together with “rising rates of interest, regulatory crackdowns, bankruptcies, and outright fraud.”

As well as, USDC confronted vital headwinds final yr after considered one of its banking companions, Silicon Valley Financial institution, collapsed. This resulted in USDC briefly dropping its peg and an enormous outflow from the digital asset.

In the meantime, Circle lately revealed its intention to go public once more by means of an preliminary public providing (IPO) filed with the U.S. Securities and Trade Fee.