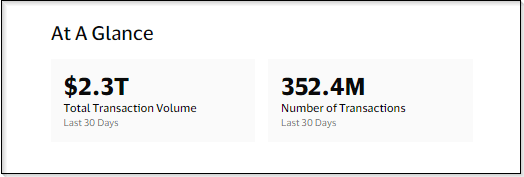

The seemingly unshakeable reign of Tether (USDT) because the king of stablecoins faces a brand new challenger. Circle’s USD Coin (USDC) has pulled off a shock victory, recording a better transaction quantity than Tether in April 2024, in response to on-chain analytics from funds large Visa.

This growth marks a big shift within the stablecoin panorama. Whereas Tether boasts a staggering market capitalization of over $110 billion, USDC, with its $33 billion valuation, has emerged because the extra actively traded coin.

Visa’s knowledge reveals USDC processed a whopping $456 billion – which is 400% extra – in transaction quantity final week, in comparison with Tether’s $89 billion.

Stablecoin transactions. Supply: Visa

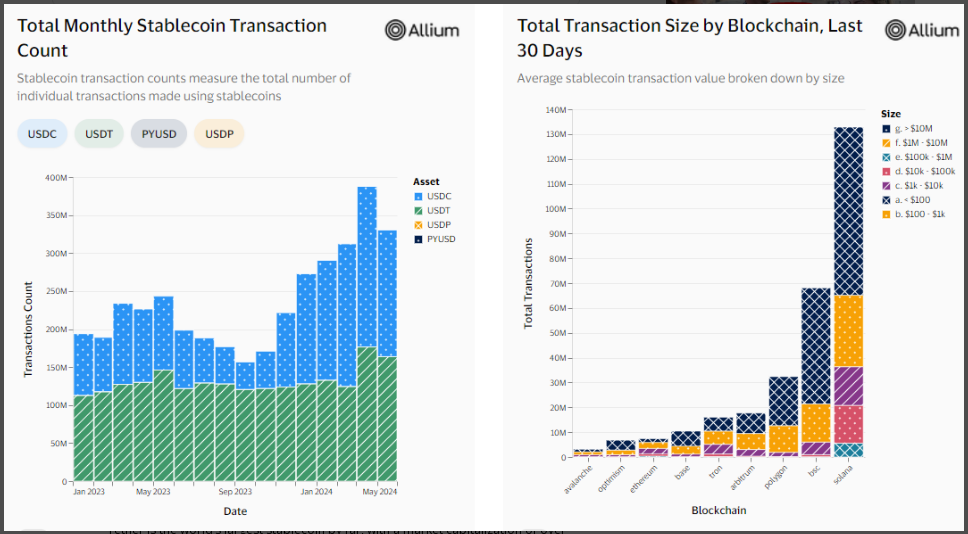

USDC: A Gradual And Regular Climb

This victory wasn’t a sudden in a single day success. USDC has been steadily chipping away at Tether’s dominance since late 2023. Visa’s knowledge reveals USDC’s month-to-month transactions surpassed Tether’s for the primary time in December 2023, with 145 million transactions in comparison with Tether’s 127 million. The April figures solidify this pattern, with USDC clocking in at over 166 million transactions in opposition to Tether’s practically 164 million.

Supply: Visa

Consultants level to a number of components behind USDC’s rise. Elevated regulatory scrutiny surrounding Tether’s reserves and ongoing issues about its transparency could also be driving customers in direction of USDC, perceived as a extra regulated and auditable stablecoin.

Moreover, USDC’s partnership with Visa itself might be enjoying a task. Visa launched a stablecoin analytics dashboard in April, prominently that includes USDC alongside different main stablecoins. This elevated visibility is perhaps attracting new customers to the platform.

As of at present, the market cap of cryptocurrencies stood at $2.2 trillion. Chart: TradingView.com

Tether Nonetheless Holds The Crown (For Now)

Regardless of USDC’s spectacular transaction quantity surge, Tether stays the undisputed king when it comes to market capitalization. Its $110 billion dwarfs USDC’s $33 billion, indicating a a lot bigger complete worth of excellent cash. This implies Tether remains to be the popular retailer of worth for a lot of crypto traders, even when they aren’t actively buying and selling it as ceaselessly.

Moreover, Tether boasts a considerably bigger consumer base. Whereas USDC processed extra transactions in April, Tether noticed exercise from over 34 million distinctive wallets in comparison with USDC’s 9.57 million. This might suggest Tether is used for bigger transactions or by a wider vary of people, whereas USDC caters to a extra lively buying and selling neighborhood.

The Future Of Stablecoins: A Two-Horse Race?

The battle between USDC and Tether is much from over. USDC’s latest success in transaction quantity demonstrates its rising affect inside the crypto ecosystem. Nonetheless, Tether’s established consumer base and market cap dominance recommend it gained’t be simply dethroned.

The evolving regulatory panorama and consumer preferences for transparency and safety will possible be key components shaping the way forward for stablecoins. Whether or not USDC can preserve its momentum and problem Tether’s market cap benefit, or if Tether can regain its transaction quantity lead, stays to be seen.

Featured picture from Faucet World, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site solely at your personal threat.