Through the business day of the annual Bitcoin convention in Nashville, Tennessee, Robert Kennedy Jr., an unbiased candidate for the US presidency, unveiled an bold monetary coverage plan that might rework america into the world’s largest holder of Bitcoin. The coverage facilities on the strategic acquisition of Bitcoin, valued at $619 billion, to match the present US gold reserves. This transfer, in keeping with Kennedy Jr., is aimed toward redefining financial coverage and enhancing fiscal self-discipline inside the federal authorities.

Kennedy Jr. Vs. Donald Trump

Throughout a roundtable dialogue with Scott Melker and Caitlyn Lengthy, CEO of Custodia Financial institution, Kennedy Jr. emphasised the philosophical alignment between his insurance policies and the Bitcoin neighborhood’s beliefs of private freedom, property rights, and governmental integrity. “That is greater than about growing the dimensions of your pile,” Kennedy Jr. stated, underlining Bitcoin’s potential to reinforce self-sovereignty and counteract what he describes as a “harmful warfare economic system” pushed by fiat foreign money.

“Bitcoin shouldn’t be solely an offramp to this inflationary freeway which is the freeway to hell, but it surely is also a means of restoring integrity to our authorities. It’s a means of restoring private freedoms, it’s a means the center class can isolate itself from inflation which is only a type of authorities theft,” the unbiased candidate acknowledged.

Associated Studying

Kennedy Jr. drew a distinction between his constant advocacy for Bitcoin and the current supportive gestures from former President Donald Trump, who will communicate on the convention on Saturday. Kennedy identified Trump’s prior skepticism and his current controversial determination to probably appoint JPMorgan CEO Jamie Dimon as Treasury Secretary, which Kennedy criticized as opposite to the ethos of draining the political “swamp.”

He added, “President Trump additionally was linked with Steve Mnuchin who tried to finish person-to-person Bitcoin transactions,” emphasizing the necessity for a cautious method in the direction of Trump’s newfound enthusiasm for Bitcoin.

Furthermore, Kennedy Jr. detailed his plan to incrementally combine Bitcoin into the US treasury. Beginning with the issuance of treasury payments anchored to a basket of exhausting currencies—together with platinum and gold—Kennedy proposed a phased method that may start with 1% of recent treasury issuances backed by these exhausting belongings, scaling as much as 100% over time.

US Would Want To Purchase $619 Billion In Bitcoin

“I’d be keen so as to add Bitcoin to the steadiness sheet. I’m going to try this. I’m gonna truly do a basket of exhausting currencies of perhaps platinum and gold and different exhausting currencies and start issuing a minimum of the category of treasury payments which are anchored to exhausting foreign money. Let’s say the primary yr by 1% after which perhaps the subsequent yr by 2% to look at how that goes as a result of that may inject self-discipline into the product and finally rise up to 100%,” Kennedy Jr. defined.

Associated Studying

Notably, his technique would contain direct purchases of Bitcoin to realize holdings equal to the US gold reserves. “I wish to have the federal authorities start to purchase Bitcoin and over the time period my time period of workplace finally have an equal quantity of Bitcoin that we’ve gold. As a result of Bitcoin is an trustworthy foreign money, it’s a foreign money that’s based mostly upon proof of labor,” he declared.

In response to knowledge by Arkham, the US authorities presently holds 213,239 BTC value $14.3 billion confiscated via regulation enforcement. Which means, even when Kennedy would switch all of those right into a strategic reserve, the US would want to purchase way more BTC at present costs.

The US presently holds the most important official gold reserves on the planet, with 8,134 tons of gold valued at roughly $619 billion. To match this worth with Bitcoin at present costs would require buying about 9.4 million BTC. This acquisition would symbolize practically 45% of the entire 21 million BTC that may ever be mined.

For perspective, MicroStrategy, the most important company holder of Bitcoin, owns 226,331 BTC, and BlackRock, the most important spot Bitcoin ETF supervisor, controls 334,000 BTC.

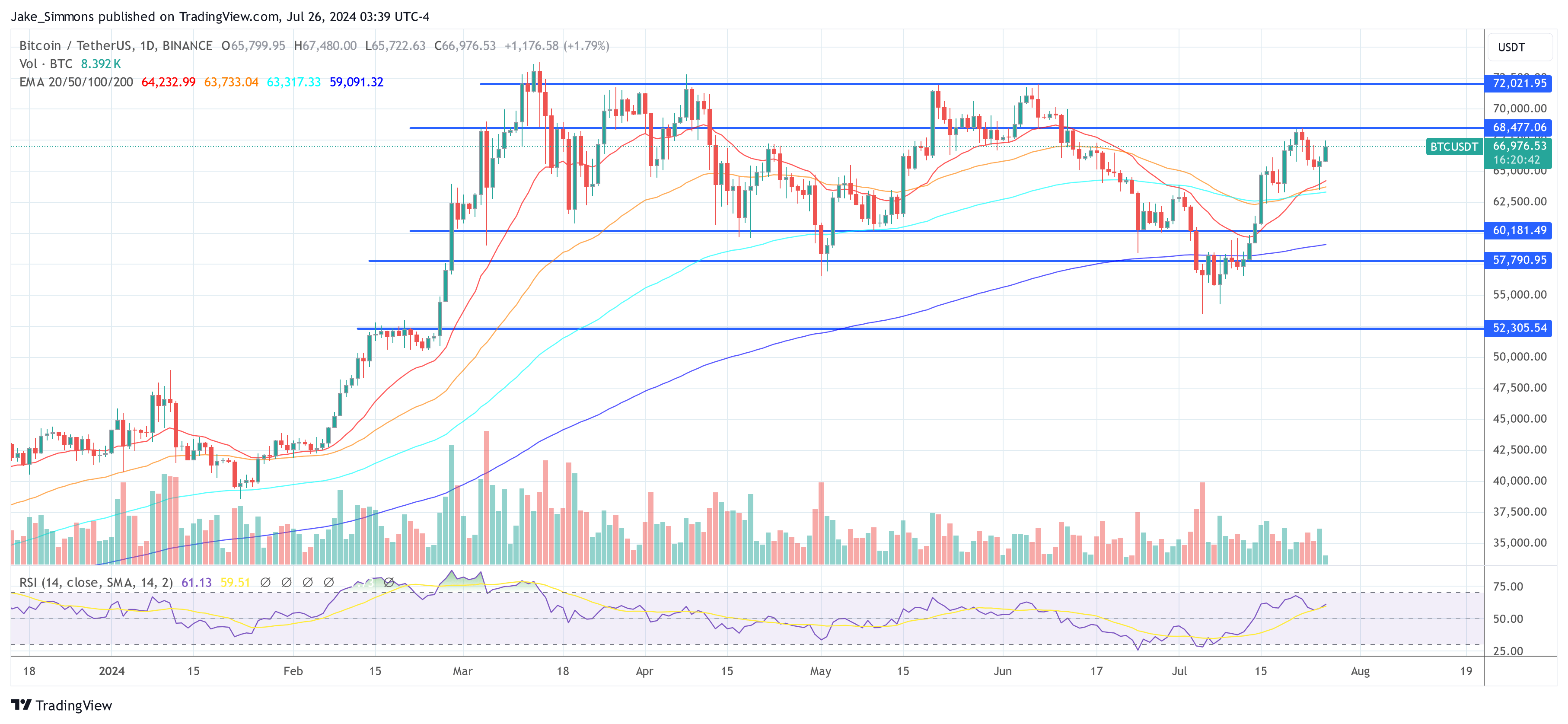

At press time, BTC traded at $66,976.

Featured picture from YouTube, chart from TradingView.com