The ten spot Bitcoin ETFs skilled their greatest three-day outflow since their debut in January, as reported by Bloomberg. This shift in investor sentiment comes after heightened curiosity that propelled the biggest cryptocurrency out there to a file excessive of $73,700.

Bitcoin ETFs See File Outflows

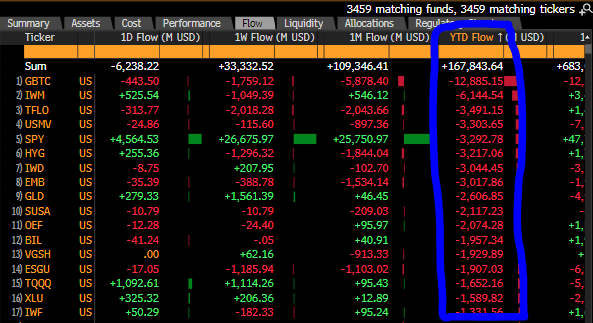

Between Monday and Wednesday, a internet complete of $742 million exited the Bitcoin ETFs, reflecting outflows from the Grayscale Bitcoin Belief (GBTC) and a moderation in subscriptions for comparable choices from distinguished corporations like BlackRock (IBIT) and Constancy Investments (FBTC).

In accordance to Bloomberg ETF knowledgeable Eric Balchunas, the Grayscale Bitcoin Belief has skilled a notable outflow surge. This latest growth signifies a “second wind” of investor withdrawals, with a considerable $1.4 billion leaving the belief simply this week.

Notably, these withdrawals have surpassed all different ETFs in year-to-date outflows and set a brand new file for cumulative outflows in ETF historical past, as proven within the chart above.

Nonetheless, GBTC continues to carry a distinguished place when it comes to income technology. It at present ranks third out of the three,400 ETFs obtainable, demonstrating its continued monetary success.

Regardless of the latest outflows, the general efficiency of those funds stays noteworthy, with internet inflows of $11.4 billion recorded since their launch, based on knowledge compiled by Bloomberg. This signifies probably the most profitable debuts for an ETF class.

Crypto Analyst Predicts “Huge Bounce” For BTC

Bitcoin skilled a major surge of over 5% in the US on Wednesday, propelled by indicators from the Federal Reserve (Fed) hinting at potential interest-rate cuts.

Nonetheless, the Asian market painted a special image on Thursday, with Bitcoin shedding momentum in comparison with continued features in international shares and gold. In response to Bloomberg, the information of outflows from Bitcoin ETFs permeated markets, contributing to the contrasting efficiency.

Nonetheless, famend crypto analyst Michael van de Poppe shared a daring prediction on social media platform X (previously Twitter). In his submit, he expressed optimism a few “huge bounce” for Bitcoin, suggesting the potential for a continuation of its upward trajectory.

Van de Poppe additionally predicted that Bitcoin may consolidate within the close to time period earlier than embarking on one other rally in the direction of the all-time excessive it reached earlier than the halving occasion, which is anticipated to start someday in April.

Presently, BTC is buying and selling at $66,200, reflecting a 4% enhance up to now 24 hours regardless of ongoing outflows within the ETF market. Over longer time frames, Bitcoin has proven constant features, with a 27% enhance over the previous thirty days and a formidable 136% acquire year-to-date.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual danger.