Fast Take

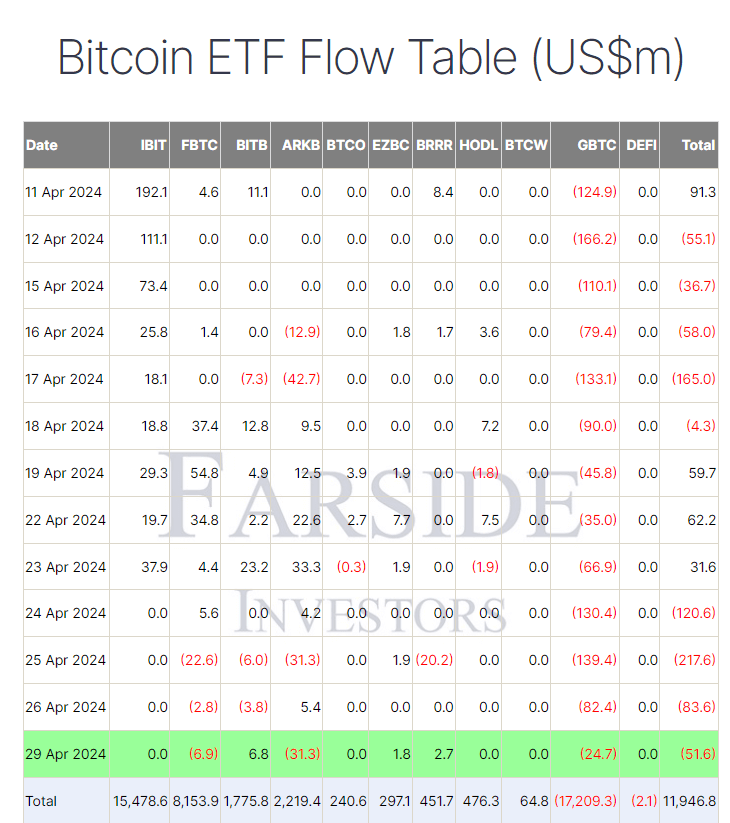

In line with the most recent information from Farside Traders, April 29 noticed an outflow of $51.6 million from US Bitcoin ETFs, marking the fourth consecutive buying and selling day of outflows. Whereas this determine doesn’t signify the bottom outflow throughout this era, it highlights the prevailing market sentiment.

Grayscale’s GBTC product witnessed an outflow of $24.7 million, the bottom since April 10, bringing its complete outflows to $17,209.3 billion. Then again, BlackRock’s IBIT noticed no influx or outflow for the fourth consecutive buying and selling day, sustaining its complete inflows at $15,478.6 billion, based on Farside information.

Farside information reviews that Constancy’s FBTC skilled one other outflow of $6.9 million, marking the third consecutive buying and selling day of outflows. This brings FBTC’s complete inflows to $8,153.9 billion. Ark’s ARB noticed a considerable outflow of $31.3 million, its second outflow previously three buying and selling days, taking its complete inflows to $2,219.4 billion.

In line with Farside information, the entire inflows throughout all ETFs have dropped beneath $12 billion, at the moment standing at $11,946.8 billion.