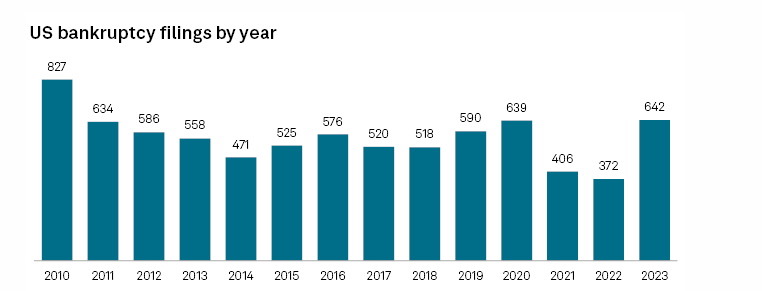

Company bankruptcies in america hit a 13-year excessive final yr as corporations struggled to remain afloat amid excessive rates of interest and rising labor prices.

New knowledge from market intelligence agency S&P International reveals 2023 noticed a complete of 642 chapter filings – the very best degree since 2010 when there have been 827 chapter filings.

Based on S&P International, California recorded probably the most filings throughout the nation with 95 corporations looking for chapter safety in 2023, adopted by Texas with 75 and Florida with 68. New York witnessed 58 filings final yr whereas New Jersey documented 31. Different states that had 15 or extra chapter filings embody Massachusetts, Georgia, Nevada, Illinois, North Carolina and Pennsylvania.

S&P International warns that enterprise situations will stay powerful in 2024 as the price to borrow capital stays excessive.

“Though buyers anticipate the Federal Reserve to chop rates of interest as early as March, corporations will nonetheless need to deal with comparatively excessive rates of interest and strong wage progress within the close to time period.”

S&P International just isn’t the one one sounding an alarm over the prospects of the US economic system within the yr forward. In a brand new episode of the Simply Markets Webcast, billionaire “Bond King” Jeffrey Gundlach predicts that 2024 shall be a bearish yr for the markets as he expects the economic system to enter a interval of contraction.

“I believe 2024 shall be a yr of excessive volatility: beginning with declining charges, then recession, then recession response. DoubleLine is prepared and loaded for bear.”

Gundlach is the founder and CEO of DoubleLine Capital LP, an funding agency with $91 billion in belongings underneath administration.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney