As Bitcoin (BTC) continues its outstanding ascent, reaching a brand new all-time excessive (ATH) of $72,300, buyers surprise when the present bull market will peak. Contemplating historic information and the upcoming halving occasion scheduled for April 2024, crypto analyst Rekt Capital has offered insights into potential timing.

Bitcoin Peak Anticipated Sooner Than Anticipated?

By inspecting earlier halving cycles and the “acceleration” noticed within the present cycle, Rekt Capital suggests that Bitcoin’s bull market could peak inside 266-315 days from breaking its outdated all-time excessive, probably occurring in December 2024 or February 2025.

Rekt Capital’s evaluation reveals that Bitcoin has traditionally peaked in its bull market roughly 518-546 days after a halving occasion. Nonetheless, the present cycle demonstrates accelerated development, lowering roughly 260 days.

In accordance with the analyst, this acceleration has the potential to halve the standard cycle size, indicating that Bitcoin’s peak within the present bull market could happen a lot prior to anticipated.

Rekt Capital’s perspective, measuring the bull market peak from when an outdated all-time excessive is breached, supplies worthwhile insights. On this cycle, Bitcoin lately broke to new all-time highs, indicating a possible milestone available in the market.

If the accelerated perspective holds, the subsequent bull market peak is estimated to happen inside 266-315 days from this breakout, touchdown someplace between December 2024 and February 2025, in keeping with the evaluation offered by Rekt.

Roughly each 4 years, Bitcoin’s halving occasions have traditionally performed a vital position in shaping market cycles. These occasions scale back the block reward miners obtain, thereby lowering the speed of recent Bitcoin provide, however this time could also be completely different, in keeping with Rekt, one other analyst.

From 4-Yr Cycle To New Horizons

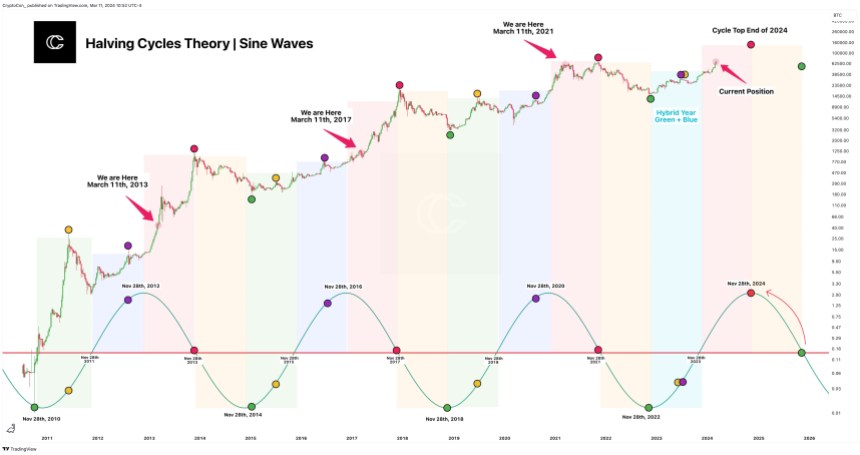

Much like Rekt’s evaluation, market knowledgeable Crypto Con means that the “typical four-year cycle” could not maintain, as Bitcoin is reaching new all-time highs prior to anticipated, and as such, Crypto Con believes that the “boundaries of the normal cycle” are being pushed, probably signaling a paradigm shift in Bitcoin’s market dynamics.

Traditionally, Bitcoin’s worth cycles have adhered to a four-year sample, characterised by market peaks round 4 years after every halving occasion. Nonetheless, Crypto Con challenges this notion, arguing that the present cycle deviates from the “conventional timeline.”

Bitcoin’s current entry into “worth discovery mode” and the achievement of recent ATHs roughly a yr sooner than anticipated counsel that the four-year cycle could not maintain its predictive energy.

Crypto Con’s evaluation signifies that the present market trajectory aligns extra intently with the 2017 bull run than with earlier cycles. Evaluating the primary tops of cycles 1 and three (2013 and 2021) to the current, each cases have been on the verge of forming their preliminary peaks round April, mirroring the present market situations.

This remark helps the potential of Bitcoin’s subsequent bull market peak occurring in late 2024 moderately than the beforehand anticipated late 2025.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal danger.