Uniswap Value Prediction 2023-2032

For anybody contemplating the swap from centralized finance (CeFi) to decentralized finance (DeFi), right here’s a thought: Why can we always replace the Uniswap Value Prediction? The struggle is on for the survival of the fittest crypto venture, and we have to preserve you knowledgeable regardless of social media maneuvers by sure quarters!

How a lot is UNI value right now?

The present Uniswap value stands at $7.39, having seen a buying and selling quantity of $103,852,766 prior to now 24 hours. With a market capitalization of $4,415,691,591 and a market rank of 27, it demonstrates an lower of 1.23% over the past 24 hours.

Uniswap Value Evaluation: UNI worth collapses beneath $7.350 amidst bearish dive

TL;DR Breakdown

- Uniswap value evaluation confirms a downtrend.

- Coin worth has dropped all the way down to $7.350.

- Sturdy help is on the market on $5.385.

The most recent one-day and four-hour Uniswap value evaluation for 31 December 2023 confirms indicators of a lowering pattern for the day. The value has been following a bearish swing for the reason that previous few days. At this time, an extra rise in promoting momentum was noticed because the coin worth has sunk to $7.350 low. It’s anticipated that the continued downtrend will intensify within the close to future.

Uniswap value evaluation on a day by day time-frame: Bearish wave continues ahead as UNI declines to $7.350

The most recent one-day Uniswap value evaluation provides out a good prediction for the cryptocurrency sellers. The value has been masking a descending motion for the reason that previous 24-hours, because the promoting exercise remained marginally excessive. Because the bears have been regaining momentum, the coin worth has slumped to $7.350 edge. On the alternative hand, its Shifting Common (MA) worth has improved as much as $7.208 due to the earlier upward spike.

The volatility appears to be on the growing facet which is an extra unfavorable trace relating to the approaching market occasions. Because the volatility is altering, the higher finish of the Bollinger bands indicator now occupies $7.847 excessive. Whereby, the decrease finish of the Bollinger bands indicator is current at $5.385 low. The Relative Energy Index (RSI) indicator confirms the continued draw back as its general worth has declined to 63.02.

value evaluation on the 4-hour chart: Bears takeover as main loss beneath $7.349 noticed

The latest four-hour Uniswap value evaluation signifies a robust bearish win relating to the present market state of affairs. The Crimson candlesticks remained dominating on the four-hour value chart, because the coin worth has skilled a significant drop. Due to the rise in bearish exercise, UNI/USD worth has depreciated beneath $7.349. Furthermore, its Shifting Common worth has stepped all the way down to $7.444 due to the descent.

The four-hour value chart dictates an growing volatility which is a bearish trace relating to the approaching market occasions. Because the volatility is on the rise, the higher fringe of the Bollinger bands indicator has moved to $7.979. Whereby, the decrease fringe of the Bollinger bands indicator now occupies $7.180. The RSI graph shows a steep bearish slope and its general worth has sunk to 47.51.

What to anticipate from Uniswap value evaluation subsequent?

The most recent one-day and four-hour Unswap value evaluation confirms a bearish swing for the day. The bears remained on the main finish this week, and right now the coin worth has additional deteriorated beneath $7.350. Aspect by facet, the four-hour value evaluation depicts a bearish situation relating to the present market state of affairs as properly.

Latest Information/Opinions on the Uniswap Community

Crypto Highlights: UNI, FIL, and SPCT Surge Amid Developments. Latest weeks have seen vital developments within the crypto market, notably for Uniswap (UNI), Filecoin (FIL), and VC Spectra (SPCT). Uniswap’s NFT market launch led to a brief surge in UNI’s value, with analysts predicting continued progress. Filecoin’s integration with SushiSwap initially boosted FIL’s value, regardless of a subsequent correction; nevertheless, analysts foresee an upward pattern resulting from an expanded consumer base. In the meantime, VC Spectra has gained consideration for its AI-powered venture choice, experiencing a gentle ascent in value and projecting a complete 900% surge to $0.080 by December. These developments spotlight the dynamic nature of the cryptocurrency market and the varied elements influencing token costs.

UNI Surges 50% in November, Breaking Resistance. UNI climbed 50% in November to $6.30, its highest since August 15, boosted by decentralized alternate (DEX) buying and selling quantity reaching a 5-month peak. Breaking a 480-day resistance pattern line alerts constructive sentiment, supported by the protocol’s month-to-month quantity of $14.20 billion. Analysts, together with Crypto Faibik, notice a bullish pattern and favorable Relative Energy Index (RSI). Warning is suggested if UNI fails to shut above the resistance line. Hypothesis about elevated DEX curiosity follows modifications in Binance management. Attaining a brand new yearly excessive is dependent upon sustained constructive sentiment and buying and selling momentum.

Modern Uranium Tokenization Unveiled on Uniswap. Uranium3o8 has launched $U, the world’s first digital token backed by bodily uranium, on Uniswap, introducing a decentralized spot marketplace for uranium buying and selling. The transfer addresses inefficiencies in conventional uranium markets, providing a streamlined, clear resolution for certified entities to interact in decentralized finance (DeFi) transactions. Every $U token represents one pound of uranium, sourced from Madison Metals. To take bodily supply, token holders should meet regulatory necessities and maintain a minimal of 20,000 $U tokens. Following supply, related tokens are burned. The initiative goals to carry effectivity and liquidity to the uranium market whereas fostering future developments within the business.

Uniswap DAO Invests $12 Million in Ekubo for 20% Governance Token Stake. Uniswap DAO has permitted a proposal to speculate $12 million (3 million UNI tokens) into Ekubo, a Starknet-based decentralized alternate, in alternate for a 20% stake in Ekubo’s governance tokens. This transfer signifies a pivotal step in decentralizing Uniswap’s protocol growth by integrating the Ekubo staff as core builders. The proposal, supported by 63% of voting tokens, additionally requires Ekubo to create a Starknet-native governance token with 20% allotted to Uniswap DAO. It additional mandates a Uniswap license improve granting Ekubo limitless use of Uniswap v4, whereas Uniswap introduces a 0.15% charge for swaps and doubtlessly a KYC operate in its fourth model.

Uniswap CEO Burns 99% of HayCoin Provide, Uniswap founder Hayden Adams not too long ago burned 99% of the HayCoin (HAY) provide resulting from considerations about value hypothesis. HAY was initially deployed for testing 5 years in the past, and Adams held nearly all of tokens in his pockets. The transfer completely eliminated about $650 billion value of HAY tokens from circulation, inflicting a major value improve. Some customers raised considerations in regards to the potential tax implications of this token burning.

The Uniswap Basis goals to safe $62.37 million in funding for his or her imaginative and prescient of a self-sovereign Web and a permissionless monetary various. The proposal, together with a ten% buffer to counter value fluctuations, will bear an on-chain vote on October 4th. If permitted, these funds will help operational actions and analysis grants, furthering the expansion and innovation of the decentralized alternate and aligning incentives for its stakeholders.

Academic platform Uniswap College, launched in collaboration with blockchain education-focused DoDAO, offers structured programs, simulations, and guides to assist customers get began with the Uniswap v3 alternate. You’ll be able to discover varied subjects, from greedy the basics of decentralized exchanges (DEX) to mastering superior methods like liquidity provision, gaining each theoretical information and sensible expertise. Uniswap v3 has garnered vital consideration, outpacing Bitcoin by way of charge era and amassing over $3.2 billion in complete worth locked throughout its protocols, establishing itself as a key participant within the decentralized finance (DeFi) panorama.

Uniswap ruling shapes DeFi regulation: A latest courtroom ruling in a category motion lawsuit in opposition to Uniswap separates DeFi from centralized exchanges like Coinbase, suggesting that decentralized exchanges might face completely different regulatory remedy. The choose discovered that Uniswap’s traders and builders weren’t liable underneath federal securities legal guidelines for rip-off tokens, highlighting the permissionless nature of DeFi tasks as a key issue. This ruling presents a regulatory divide between platforms like Coinbase and Uniswap and will make it tougher for the SEC to implement rules on actually decentralized exchanges, though the authorized panorama for DeFi stays evolving.

Uniswap good points standing of the highest DeFi alternate. In 2023, Uniswap overtook Coinbase’s buying and selling quantity in February and maintained its lead regardless of quantity lower. Uniswap’s day by day quantity exceeded $1.4 billion, whereas Coinbase constantly stayed above $1 billion. By Q1 2023, Uniswap’s $150 billion quantity surpassed Coinbase’s $145 billion, making it the highest DeFi alternate.

Uniswap proprietor poses a proper apology for trying to take down Caversaccios’s v4 fork accessible on GitHub. Hayden Adams has admitted that this try was futile, as fork was only one step away from DMCA motion. In accordance with the founder, this step was essential and useful for customers to commit with out restrictions.

Bots cowl as much as 90% of Uniswap buying and selling worth in keeping with the most recent evaluation as accomplished by Glassnode. The human merchants investing in Uniswap have receded to a minute percentile of seven% and 28%. Virtually 90% of UNI/USD buying and selling worth is being supported by bots from the previous help of 80%.

Uniswap Founder Hayden Adams’ Twitter account was hacked in a latest crypto business pattern of scams concentrating on business figures. The rip-off concerned a faux message about Uniswap being exploited, with malicious hyperlinks. Though the primary rip-off tweet was rapidly taken down, a number of related ones remained seen, and Adams additionally confronted points along with his MetaMask and Coinbase Pockets accounts.

UniswapX leverages the Dutch public sale approach for Optimum Pricing and Liquidity. Dutch auctions begin with a excessive asking value, progressively decreasing it till a bidder accepts it. UniswapX makes use of this idea to supply customers with the very best costs by means of competing fillers. The method can be utilized in NFT gross sales, akin to @artblocks_io, the place costs lower till all items are offered. Uniswap Labs has additionally revealed a white paper and developer paperwork in regards to the filler facet of UniswapX.

Uniswap Labs launched UniswapX— an progressive decentralized protocol enabling permissionless buying and selling throughout Automated Market Makers (AMMs) and varied liquidity sources, designed with an open-source license (GPL). Anticipate enhanced liquidity, improved pricing, safety in opposition to Miner Extractable Worth (MEV), and gas-free swapping for customers because the platform evolves.

Uniswap, has efficiently launched on the Avalanche C-Chain, increasing the attain of DeFi on the Avalanche blockchain. This transfer follows the footsteps of different outstanding DeFi platforms, together with Curve and Aave, solidifying Avalanche’s place within the DeFi house. The enlargement was made doable by means of a governance proposal initiated by Michigan Blockchain, gaining widespread help with a exceptional 95% majority in favor of the deployment.

On June 13, Uniswap Labs introduced the discharge of a draft for Uniswap v4 in a weblog submit by the founder, Hayden Adams. The up to date code introduces a function generally known as “hooks,” that are basically plugins that allow builders to ascertain customized liquidity swimming pools. The weblog submit means that these “hooks” will pave the way in which for future builders to implement on-chain restrict orders, automated deposits to lending protocols, auto-compounded liquidity supplier (LP) charges, and a bunch of different developments to the alternate as soon as it’s in place.

Uniswap Labs introduces hooks, which operate as highly effective plugins permitting builders to inject code at crucial levels in a pool’s lifecycle, akin to pre or submit swaps. This groundbreaking function empowers builders to leverage Uniswap’s liquidity and safety infrastructure, enabling them to design swimming pools with distinctive functionalities. By exposing tradeoffs in Uniswap v3, hooks present builders with the autonomy to make knowledgeable choices and combine customized options into the core pool contract, fostering additional innovation within the ecosystem.

Hayden Adams, the creator of Uniswap, expressed shock on Twitter a few subtle rip-off involving a faux Uniswap web site. The scammers integrated Chinese language neighborhood content material and offered hyperlinks to the legit Uniswap app, including credibility. They even organized a Zoom recording with faux high-ranking Uniswap executives, however Adams clarified that Uniswap and the Uniswap Basis weren’t concerned within the video or related to the people concerned.

A staff of builders has launched Uniswap’s good contracts on the Bitcoin community to leverage the surge in BRC-20 tokens and foster the expansion of the decentralized finance (DeFi) ecosystem. This protocol, generally known as Trustless Market, has already achieved day by day transaction volumes of $500,000, drawn in over 2,000 customers, and permits liquidity suppliers to earn a 2% fee on all swaps made throughout the community.

In April, for the fourth month in a row, decentralized alternate Uniswap outperformed Coinbase (COIN), a centralized alternate by way of buying and selling quantity, as reported by CCData. Uniswap first exceeded Coinbase’s buying and selling quantity in February.

Ethereum has undergone a collection of upgrades towards its subsequent model, Ethereum 2.0. Sadly for Uniswap, the upgrades are taking a very long time and have an effect on Uniswap by way of lengthy processing time and excessive fuel charges. Nevertheless, there are means by which the worth influence might be lowered, however earlier than we get into these strategies, let’s have a backgrounder on Uniswap and its token UNI. With this Uniswap value prediction, let’s decide if those that put money into the UNI V3 will get 3x revenue.

The introduction of the v3 elements might assist propel Uniswap cryptocurrency costs skywards, particularly contemplating the accessible knowledge reveals that the replace has already helped Uniswap turn out to be the most important DEX on the Ethereum community. Decrease transaction charges have additionally made Uniswap extra accessible to new customers.

Uniswap Value Predictions for 2023-2032

Value Predictions By Cryptopolitan

| 12 months | Minimal ($) | Common ($) | Most ($) |

| 2023 | 7.69 | 7.96 | 8.44 |

| 2024 | 11.13 | 11.45 | 13.22 |

| 2025 | 15.58 | 16.16 | 19.64 |

| 2026 | 23.52 | 24.17 | 27.34 |

| 2027 | 32.81 | 33.78 | 40.08 |

| 2028 | 49.83 | 51.52 | 57.42 |

| 2029 | 71.35 | 73.42 | 86.78 |

| 2030 | 104.04 | 107.71 | 124.07 |

| 2031 | 152.18 | 156.49 | 181.09 |

| 2032 | 217.36 | 225.18 | 264.71 |

Uniswap Value Prediction 2023

Based mostly on the forecast and technical evaluation, the worth of Uniswap is projected to hit a minimal of $7.69 in 2023. The UNI value would possibly obtain a peak of $8.44 with a imply worth of round $7.96.

Uniswap Value Prediction 2024

The anticipated value of Uniswap would possibly contact a backside of $11.13 in 2024. In accordance with our evaluation, the UNI value has the potential to succeed in as much as $13.22, with a mean estimated value of $11.45.

UNI Value Forecast for 2025

Uniswap’s value is anticipated to settle at a minimal of $15.58 in 2025. It might doubtlessly hit a peak of $19.64, averaging round $16.16 for the 12 months.

Uniswap (UNI) Value Prediction 2026

The value projection for Uniswap suggests it’d backside out at $23.52 in 2026. Our evaluation signifies the UNI value has the potential to climb to $27.34 with a mean of $24.17.

Uniswap Value Prediction 2027

In 2027, the Uniswap value would possibly start at a minimal of $32.81. Over the 12 months, it has the potential to succeed in a excessive of $40.08, with a mean determine hovering round $33.78.

Uniswap Value Prediction 2028

Our thorough technical evaluation signifies that Uniswap might begin at a minimal of $49.83 in 2028. The UNI value would possibly see a excessive of $57.42, with a median value round $51.52.

Uniswap (UNI) Value Prediction 2029

The projection for 2029 means that Uniswap would possibly obtain a minimal of $71.35. There’s potential for the UNI value to peak at $86.78, averaging out at about $73.42.

Uniswap Value Forecast 2030

Uniswap’s value in 2030 is predicted to hover round a minimal of $104.04. With potential peaks as much as $124.07, the common buying and selling value is more likely to be round $107.71.

Uniswap (UNI) Value Prediction 2031

Deep evaluation of previous UNI knowledge forecasts a 2031 beginning value of about $152.18. The height would possibly contact $181.09 with a mean buying and selling worth of $156.49.

Uniswap Value Prediction 2032

By 2032, Uniswap’s value might doubtlessly begin at a minimal value of $217.36. Over the 12 months, it might peak at $264.71, with a imply worth of roughly $225.18.

Uniswap Value Prediction By Coincodex

In accordance with a value prediction from Coincodex, the worth of Uniswap is predicted to lower by -7.29%, reaching $6.27 by December 31, 2023. Technical indicators counsel a Bullish present sentiment, and the Worry & Greed Index signifies a rating of 71, signifying Greed. Previously 30 days, Uniswap has skilled 17/30 (57%) inexperienced days and exhibited 3.89% value volatility.

The forecast from Coincodex suggests it may be an opportune time to buy Uniswap. Contemplating the historic value tendencies of Uniswap and BTC halving cycles, the bottom projected value for Uniswap in 2024 is round $5.88. Conversely, within the subsequent 12 months, its value would possibly soar to a excessive of $15.57.

Uniswap Value Prediction By DigitalCoinPrice

Digital Coin Value’s Uniswap value forecast offers a bullish potential for the token’s future value factors. In accordance with a forecast evaluation by Digital Coin Value, the worth of UNI (Uniswap) is anticipated to surpass $18.20 in 2024. It’s anticipated that by the top of that 12 months, the minimal value of Uniswap might be round $16.10, with the potential to succeed in a most of $18.77. Wanting additional forward, the evaluation predicts that by 2032, the worth of UNI might exceed $141.85. The minimal value by the top of 2032 is projected to be roughly $141.35, with a chance of reaching a most stage of $143.78.

Uniswap Value Predictions By CryptoPredictions.com

In accordance with CryptoPredictions.com’s UNI value prediction, the forecast for Uniswap in January 2024 suggests that it’s going to begin the month at a value of $7.046 and conclude at $4.94. All through the month, the UNI value is predicted to peak at $7.264, whereas the bottom anticipated value is $4.94.

Uniswap Value Prediction By Market Sentiment

As Bitcoin continues to claim its dominance, the panorama for altcoins undergoes a change, exemplified by the challenges confronted by Uniswap. The elevated regulatory scrutiny imposed by the SEC has solid a shadow on these various digital property, inflicting traders to retreat cautiously. Whereas the Uniswap community has made notable strides, the UNI token finds itself struggling to take care of its worth, hinting at a possible substantial decline within the imminent weeks.

However, the bullish camp stays steadfast, propelled by the sturdy developments throughout the community. The prevailing market sentiment stays unsettled, prompting quite a few analysts to advise in opposition to investing in Uniswap at this juncture. Amongst them, Alt Sherpa, a famend crypto analyst, tasks a major correction of roughly 25% for the UNI token throughout this quarter.

UNI Overview

To make clear the assorted aspects of Uniswap, particularly for these new to the platform, it’s vital to know its key parts. Uniswap Labs is the corporate accountable for creating each the Uniswap protocol and its internet interface. The protocol itself is a set of persistent, non-upgradable good contracts on the Ethereum blockchain that collectively kind an automatic market maker. This permits for peer-to-peer market making and the swapping of ERC-20 tokens.

To work together with this protocol, customers can make the most of the Uniswap Interface, a user-friendly internet interface designed for this function. Nevertheless, it’s value noting that this interface is only one of some ways to interact with the Uniswap protocol. Moreover, the platform has a governance system, generally known as Uniswap Governance, which is enabled by the UNI token and oversees the principles and future growth of the Uniswap Protocol.

Uniswap Value Historical past

Though the decentralized alternate (dex) has been round since 2018, it wasn’t till 2020 that the Uniswap cryptocurrency token got here into existence. Within the first 12 months of its launch, it had an preliminary value of simply $3.00. Nevertheless, due to the ferocious hype surrounding it, Uniswap value change elevated to $7.00 by 19 September 2020, in keeping with CoinMarketCap.

After the hype and pleasure started to wind down, the worth additionally started to fall, however it didn’t expertise a drastic value change than different tokens, nor was its all-time low after the actual fact. Its all-time low was at $1.03 on 17 September 2020, earlier than its value improve, in keeping with CoinGecko.

Though, CoinMarketCap states its all-time low to be $0.4190 on that very same day. It skilled an all-time excessive of $8.44 a day after it calmed down and declined. UNI’s value continued to say no because the months rolled by, though it by no means went beneath $2 earlier than it once more started to extend slowly, because of the 2020 bull run.

UNI completed the 12 months 2020 with a value of $5.00. Since then, it has continued to extend, being on the verge of surpassing its former all-time excessive.

Uniswap operates on a decentralized P2P alternate automated market maker (AMM), away from standard cryptocurrencies. Earlier than we dig into the Uniswap value prediction, allow us to take a look at a few of the distinctive options of Uniswap.

Being linked to Ethereum enabled as two good contracts, Uniswap has a singular provision of liquidity suppliers (LPs). This distinctive function of Uniswap acts as a major catalyst in eradicating the hurdle regarding token mining. In a way, it promotes transparency by eliminating intermediaries or permission.

Therefore, digital property are linked as pairs as a substitute of particular person cryptocurrencies. As a decentralized protocol for automated liquidity provision on Ethereum, Uniswap took your complete crypto house unexpectedly throughout the pandemic; Uniswap determined to launch this token UNI on 17 September 2020.

Extra on the Uniswap Community

Is it a great time to put money into Uniswap?

The brand new 12 months 2023 has been fairly constructive for the large cryptos, with Bitcoin buying and selling above $20k for the primary time since November 2022. Uniswap has had an identical trajectory and will see extra good points within the coming weeks and months. In addition to, UniSwap is undoubtedly a reputable DEX amongst crypto traders, they usually choose UNI cash to put money into due to its market efficiency and good funding returns. This isn’t funding recommendation.

Who’s the Uniswap Founder?

Uniswap was created on 2 November 2018 by Hayden Adams, a former mechanical engineer at Siemens. He knowledgeable his followers by means of Twitter that it’s only some weeks for the reason that launch of the Uniswap v3, and it’s already the very best quantity DEX protocol on OxPolygon. He additional famous that its value is barely $45 million on TVL.

Uniswap (UNI) is among the most outstanding decentralized finance (DeFi) exchanges. The DeFi protocol was based in 2018 by former mechanical engineer Hayden Adams. The Uniswap alternate capabilities as a 100% on-chain automated protocol market maker on the Ethereum blockchain. The AMM permits DeFi customers to swap ether (ETH) for any ERC-20 token with out intermediaries, fixing many liquidity issues most exchanges face.

How does Uniswap work?

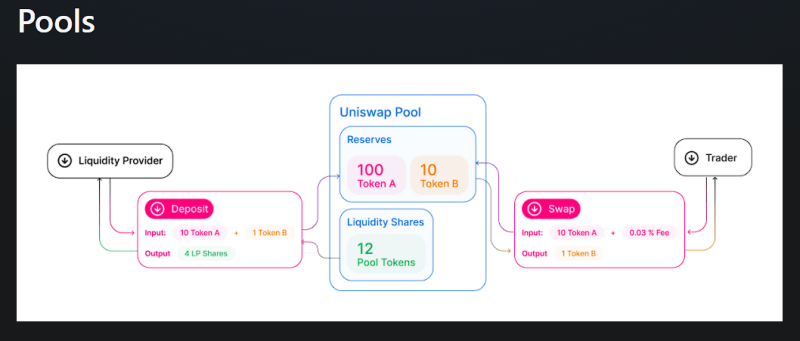

Uniswap pioneered the Automated Market Maker mannequin, wherein customers provide Ethereum tokens to Uniswap “liquidity swimming pools,” and algorithms set market costs based mostly on provide and demand (versus order books matching bids and asks from customers on a centralized alternate like Coinbase).

By supplying tokens to Uniswap liquidity swimming pools, customers can earn rewards whereas enabling peer-to-peer buying and selling. Customers provide tokens to liquidity swimming pools, commerce tokens, and even create and checklist their very own tokens (utilizing Ethereum’s ERC-20 token protocol). There are presently lots of of tokens on Uniswap, and lots of well-liked buying and selling pairs are stablecoins like USDC.

A number of the potential benefits of decentralized exchanges like Uniswap embody the next:

- Self-governing: Funds are by no means transferred to any third celebration or are usually topic to counterparty danger (i.e., trusting your property with a custodian) as a result of each events are buying and selling straight from their very own wallets.

- International and permissionless: There is no such thing as a idea of borders or restrictions on who can commerce. Anybody with a smartphone and an web connection can take part.

- Ease-of-use and pseudonymity: No account signup or private particulars are required.

Uniswap Good Contracts

Uniswap is only a bunch of good contracts that work collectively to make a decentralized alternate. Good contracts are uploaded to the blockchain, and because it’s on the blockchain, the code has the identical immutable, decentralized, and borderless capabilities as cryptocurrencies. Good contracts can switch cash autonomously based mostly on the parameters within the code, permitting for extremely environment friendly monetary companies.

Buyers ship their cryptocurrency or coin funds to a Uniswap good contract to earn curiosity on their holdings; these traders are known as liquidity suppliers. The good contracts that maintain their cryptocurrency are referred to as liquidity swimming pools.

Liquidity suppliers are needed for Uniswap to function, because it’s how they will present liquidity to commerce on the platform. As an alternative of ordering books, the good contract calculates the worth of every cryptocurrency market asset. That is how a Uniswap good contract works.

Why do individuals belief UNI?

Individuals have turn out to be conscious that one cannot flip a billionaire within the quick time period or long run when one invests properly in crypto. Therefore they purchase tokens based mostly on the coin’s long-term precise efficiency. That is all of the extra cause so that you can be in UNI for the long run, not the short-term good points.

Why is UNI protecting regular regardless of the bear market?

The credit score goes to the religion traders have reposed within the asset. On the similar time, it is a wonderful cause that UNI is listed on the alternate to point out glorious efficiency. This triggers investor response and reveals an excessive amount of motivational sentiment—no marvel the token reveals a relentless up-rise consequently. Our completely optimized content material goes right here!

Uniswap is only a bunch of good contracts that work collectively to make a decentralized alternate. Good contracts are uploaded to the blockchain, and because it’s on the blockchain, the code has the identical immutable, decentralized, and borderless capabilities as cryptocurrencies. Good contracts can switch cash autonomously based mostly on the parameters within the code, permitting for extremely environment friendly monetary companies.

Buyers ship their cryptocurrency or coin funds to a Uniswap good contract to earn curiosity on their holdings; these traders are known as liquidity suppliers. The good contracts that maintain their cryptocurrency are referred to as liquidity swimming pools.

Liquidity suppliers are needed for Uniswap to function, because it’s how they will present liquidity to commerce on the platform. As an alternative of ordering books, the good contract calculates the worth of every cryptocurrency market asset. That is how a Uniswap good contract works.

Methods to scale back value influence on UNI

- Change the Uniswap Alternate Model. Select among the many Uniswap variations, V1 (outdated model) and V2 new model V3. On the underside navigation bar, you’ll choose V1 because the model you need to use to transact the swap. You’ll verify that you just perceive the disclaimer and click on on proceed with V1 for the transaction.

- Break down transactions and scale back the variety of purchases. The value influence mechanism is problematic for large transactions. This drawback could be solved by lowering the variety of property for commerce and shopping for or promoting the specified quantity of transactions.

- Altering the worth slippage tolerance. Because of extreme value fluctuations and the prolonged course of of registering a purchase or promote transaction in decentralized exchanges, a rise in value slippage helps to finish the transaction.

Additionally Learn:

Conclusion

Uniswap’s Model 3 (v3) was launched on Boba Community after receiving approval from the Uniswap DAO. The proposal, which acquired help from ConsenSys and FranklinDAO, was voted on by the DAO neighborhood, with a majority voting in favor of the deployment.

As soon as the deployment is accomplished, Uniswap can have the possibility to develop its consumer base by incorporating members from the Boba Community ecosystem, thereby considerably growing the decentralized alternate’s complete worth locked and transaction quantity. Consequently, it could quickly push the Uniswap token’s value above essential resistance ranges.

The decentralized finance (DeFi) sector has been probably the most impacted by the present bearish pattern. Uniswap is among the super DeFi platforms, and its native token, UNI, has been witnessing huge volatility in tandem with the broader crypto market. Nevertheless, the worth momentum has been delivered to a stabilized zone following a number of integrations and developments to the community, protecting customers glued to the platform. Taking a look at its roadmap, Uniswap might turn out to be essentially the most dominating and used DeFi platform within the subsequent few years because the staff is bold about undertaking its venture’s objective.

The continued developments of the Uniswap platform have attracted a variety of traders and crypto analysts to supply their viewpoints on future value actions. Uniswap offers glorious hope to the crypto neighborhood because the platform provides builders superior instruments to construct progressive decentralized functions.

Forecasters present blended predictions in regards to the UNI token’s future costs because the bullish forecast suggests a worth of over $122 by 2030, whereas the bearish prediction lies close to the $20 value barrier. A well-known crypto analyst, Mr. Legend Crypto, predicts that the UNI token will surpass its earlier highs and pave its approach for a bullish transfer as much as $105!

Uniswap will start recovering in 2023 because the crypto market recovers from the crypto winter. It’s inconceivable to inform when Uniswap will hit backside, however it’s undoubtedly undervalued and might be worthwhile within the coming years. Regardless of not sustaining its pricing past a honeymoon interval, the Uniswap protocol has confirmed helpful for early adopters. Analysts, nevertheless, are a bit of extra cautious shifting ahead for the reason that Uniswap protocol’s success is essential. Contemplate the explanations for the bullish value:

- Uniswap has turn out to be the largest and most dominating decentralized alternate protocol on the Ethereum community, implementing an open-source infrastructure with an automatic liquidity protocol integration. The Uniswap DEX provides customers a free itemizing of their tokens and a fast swap between tokens with out registration.

- Uniswap Alternate is extraordinarily protected, because it operates as a decentralized alternate and liquidity pool and is constructed on Ethereum, which means it has the identical safety because the Ethereum blockchain. Since it’s decentralized, there isn’t any central server to hack and acquire entry to customers’ funds.

- Uniswap can be well-known for its dedication to progress. Not too way back, its neighborhood members voted to create a Uniswap Basis, specializing in enhancing neighborhood governance and distributing grants to a number of tasks within the Uniswap ecosystem. Additionally, WEB3 developments might be a major gas; nevertheless, unfavorable laws and market crashes would possibly derail the constructive efficiency of Uniswap.

Please be suggested that each one predictions for UNI cryptocurrency costs are extraordinarily speculative and don’t signify sound monetary recommendation. Any vital funding calls for thorough investigation and recommendation from educated professionals. All the time use warning when buying and selling, and by no means danger extra money than you possibly can afford to lose. Doing your personal analysis is extremely suggested when investing.