In per week marked by consolidation throughout the cryptocurrency market, the native token of Uniswap, UNI, has defied the development, surging over 15%, and surpassing the $10 mark. This bullish run comes amid constructive developments inside the Ethereum ecosystem and Uniswap’s ongoing authorized battle with the US Securities and Change Fee (SEC).

Associated Studying

Driving The Ethereum Wave

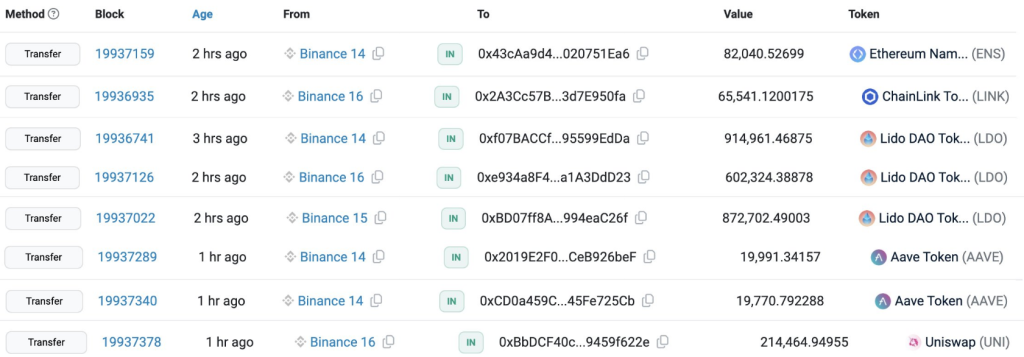

Past the authorized battle, the present momentum inside the Ethereum ecosystem can be propelling UNI’s value upwards. On-chain knowledge reveals important whale withdrawals from crypto exchanges following information of a possible spot Ethereum ETF.

One other recent pockets withdrew 213,166 UNI($1.96M) from #Binance simply now.https://t.co/u15CE864hm pic.twitter.com/kyOBv0TB5G

— Lookonchain (@lookonchain) Might 24, 2024

This flight to security, coupled with the general bullish sentiment surrounding Ethereum, is making a ripple impact that advantages UNI, a key participant inside the Ethereum DeFi panorama.

From a technical standpoint, UNI’s breakout from a month-to-month consolidation section paints a promising image. Each technical indicators and on-chain knowledge recommend a possible 25% value enhance for UNI.

The token’s latest surge signifies a possible bull run, with analysts eyeing a value goal of $12.80 if the present momentum continues.

Including gasoline to the fireplace is Santiment’s Age Consumed index, which measures the motion of dormant tokens. Spikes on this index typically precede value rallies, and the most recent uptick by the latter a part of April appears to have foreshadowed UNI’s present uptrend.

This on-chain metric reinforces the bullish outlook for UNI, suggesting that traders are awakening to its potential.

Quick Sellers Get Burned As Bulls Take Cost

The latest value rally has additionally been accompanied by a big rise in buying and selling exercise. Knowledge from Coinalyze reveals over $1 million in Uniswap liquidations within the final day.

Nearly all of these liquidations (over $750,000) had been quick positions, indicating that merchants betting towards UNI are feeling the warmth. This surge in open curiosity, with extra merchants going lengthy on UNI, additional strengthens the bullish management over the token’s value.

Uniswap Takes A Stand Towards The SEC

This show of defiance has instilled confidence amongst traders, who view it as a constructive signal for Uniswap’s future. The favored decentralized alternate (DEX) just lately obtained a Wells discover from the regulatory physique, alleging that UNI is a safety. Nonetheless, Uniswap has vowed to problem this declare, asserting that the SEC’s case is weak.

Associated Studying

The SEC case towards Uniswap stays unresolved, and a unfavourable final result may dampen investor sentiment. A broader market correction may nonetheless impression UNI’s value.

Featured picture from Wallpapers, chart from TradingView