UNI, the native token of Uniswap, one of many high decentralized exchanges (DEXes), is beneath immense promoting stress. From the day by day chart of the UNIUSDT, the token is down 62% from March highs, although costs have stabilized previously few buying and selling weeks.

To place within the numbers, chart information exhibits that it’s up almost 35% from August lows, absorbing promoting stress.

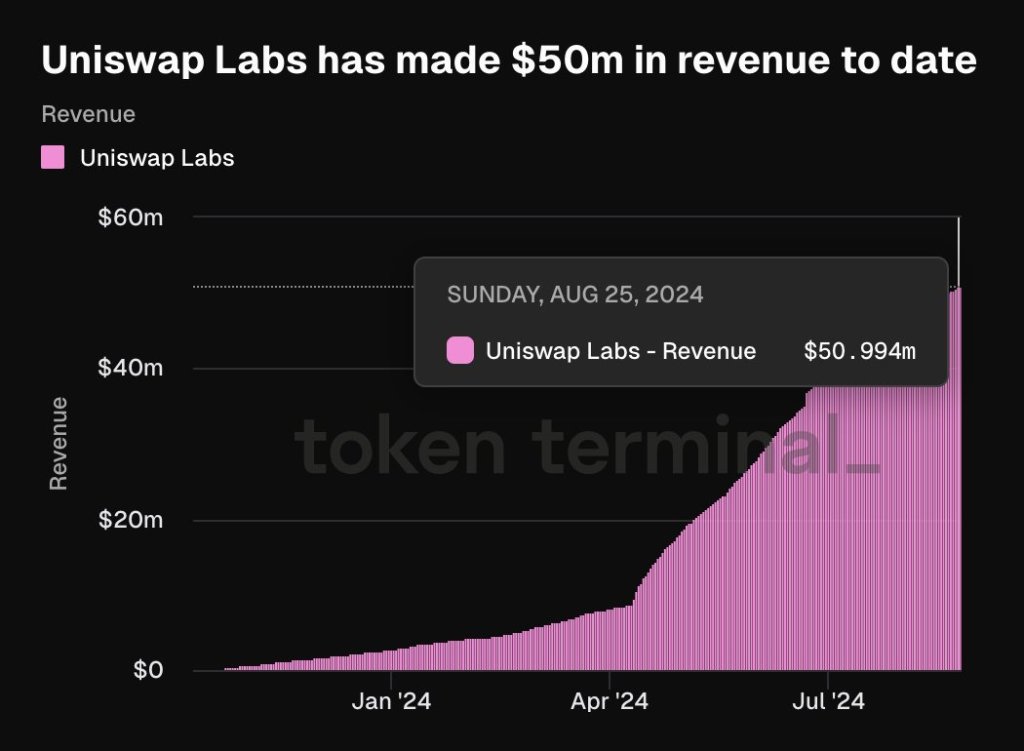

UNI Is Down However Uniswap Generates $50 Million In Income So Far

Although UNI is much off from all-time highs, shaving almost 85% from 2021 peaks, different thrilling developments may assist costs in the long run. Token Terminal information on August 25 exhibits that the DEX has generated $50 million in income to date.

Uniswap permits merchants to trustless swap tokens on a number of platforms and blockchains. Initially, it launched on Ethereum in November 2018 earlier than being deployed on the BNB Chain and varied layer-2 platforms for Ethereum, together with Arbitrum and Optimism.

In contrast to Binance, which is custodial, Uniswap customers solely want a non-custodial pockets to attach and swap. All trades are good contracts-led and with out an middleman. On the identical time, there’s a broader pool of tokens, a few of that are unavailable on high centralized exchanges like Binance.

The benefits supplied by Uniswap have seen the protocol increase the property beneath administration to over $4.73 billion, in response to DeFiLlama. As of August 26, Uniswap is accessible on over ten platforms, however the protocol manages over $3.8 billion on Ethereum.

Cumulatively, DeFiLlama information has generated over $2.3 billion in charges. All these charges are from swaps on Ethereum and all different platforms. Within the final 24 hours, Uniswap has generated over $854,000 in charges.

Is The Future Shiny, Builders Put together For V4

As crypto costs increase, it is usually extremely seemingly that DeFi exercise will rise. Because the restoration from mid-October 2023 to the March 2024 excessive, DeFi whole worth locked (TVL) greater than doubled. This enlargement displays rising curiosity and confidence from the group. In line with DeFiLlama, DeFi TVL throughout all networks stood at round $40 billion in October however rose to over $106 billion by March 2024.

As DeFi TVL rises, Uniswap will allow extra swaps, growing its charges. Furthermore, the DEX shall be a go-to platform because it enhances its protocol.

Earlier this month, Uniswap Labs, which is growing the protocol, introduced a $2.35 million prize pool for builders. The fund goals to reward builders who select flaws on Uniswap v4 earlier than rollout. As soon as reside, the brand new model of the DEX will supply new options, together with customized oracles and Hooks for much more flexibility.