The current Bitcoin halving occasion, which reduce the block reward for miners in half on April 20, 2024, has sparked a wave of optimism within the cryptocurrency market. Whereas a quick dip in a key futures metric hinted at potential short-term bearishness, total market indicators recommend a bullish pattern taking maintain.

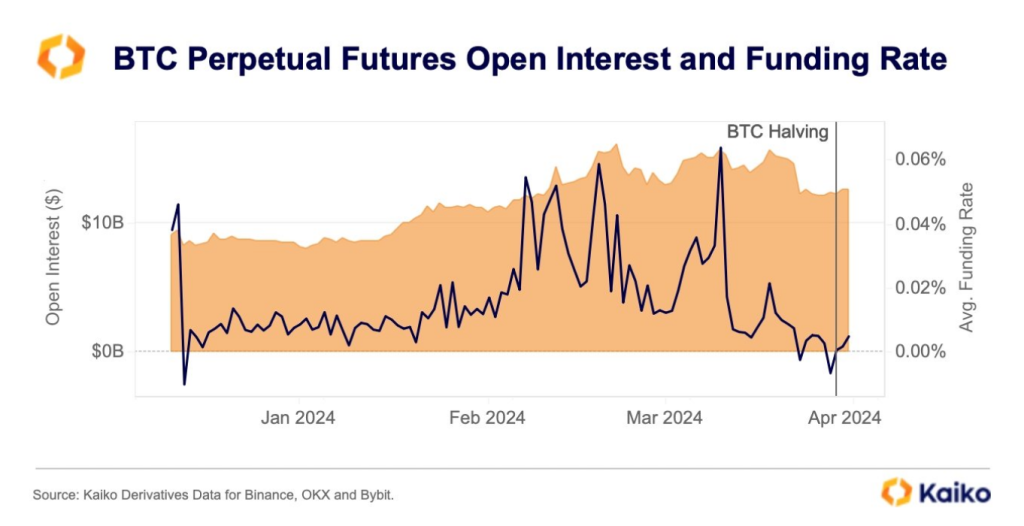

Analysts at Kaiko, a market information supplier specializing in crypto derivatives and futures, reported a shift in Bitcoin’s funding fee main as much as the halving. The funding fee is a price paid between lengthy and quick place holders in futures contracts.

A unfavourable fee signifies that quick positions are compensating lengthy positions, doubtlessly indicating a bearish outlook. Notably, Bitcoin’s funding fee dipped into unfavourable territory for the primary time this yr on April 18th, simply two days earlier than the halving.

Bitcoin Bounces Again With Renewed Bullishness

Nevertheless, this short-lived bearishness appears to have been overshadowed by a broader sense of optimism. Following the halving, Bitcoin’s funding fee swiftly recovered and presently sits at a constructive 0.0051. This implies a return to the established order the place lengthy positions are incentivized, reflecting a extra bullish market sentiment.

Funding charges for $BTC perps turned unfavourable for the primary time since late 2023 within the lead as much as the halving. pic.twitter.com/MjiU4C1L5m

— Kaiko (@KaikoData) April 24, 2024

Additional bolstering this constructive outlook is the uptick in Bitcoin’s Open Curiosity (OI), a metric that represents the entire quantity of excellent futures contracts. Regardless of a dip final week, OI has since rebounded to over $17 billion, indicating continued investor engagement within the Bitcoin market.

Bitcoin is now buying and selling at 64.250. Chart: TradingView

Halving Influence Exceeds Historic Developments

Maybe essentially the most intriguing discovering from Kaiko’s evaluation is the suggestion that this halving occasion is perhaps having a extra constructive affect on Bitcoin’s value in comparison with earlier halvings.

On the time of the report, Bitcoin was up 2.8% because the halving, exceeding the value will increase noticed instantly after the 2012, 2016, and 2020 halving occasions. Regardless of a slight value correction within the following days, Bitcoin stays practically 3% up because the halving.

Nevertheless, analysts warning towards drawing definitive conclusions from this preliminary information. The cryptocurrency market is inherently risky, and short-term fluctuations are to be anticipated.

Some consultants level to historic tendencies the place value will increase following a halving occasion have been usually adopted by intervals of consolidation or correction. The true affect of the halving on Bitcoin’s long-term value trajectory won’t be absolutely evident for a number of months.

Bullish Sentiment Fueled By Macroeconomic Elements

Past technical indicators, some analysts imagine that broader macroeconomic elements are additionally contributing to the present bullish sentiment surrounding Bitcoin.

The continuing international inflationary pressures and geopolitical uncertainties have pushed traders in the direction of property perceived as hedges towards inflation. Bitcoin, with its finite provide as a result of halving mechanism, suits this profile for some traders.

Moreover, the growing institutional adoption of cryptocurrency is seen as a constructive signal for Bitcoin’s long-term prospects. Main monetary establishments are actively exploring methods to supply Bitcoin publicity to their shoppers, suggesting a rising degree of confidence within the asset class.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site fully at your individual threat.