Particular because of Vlad Zamfir for introducing the concept of by-block consensus and convincing me of its deserves, alongside most of the different core concepts of Casper, and to Vlad Zamfir and Greg Meredith for his or her continued work on the protocol

Within the final submit on this sequence, we mentioned one of many two flagship characteristic units of Serenity: a heightened diploma of abstraction that significantly will increase the pliability of the platform and takes a big step in shifting Ethereum from “Bitcoin plus Turing-complete” to “general-purpose decentralized computation”. Now, allow us to flip our consideration to the opposite flagship characteristic, and the one for which the Serenity milestone was initially created: the Casper proof of stake algorithm.

Consensus By Guess

The keystone mechanism of Casper is the introduction of a basically new philosophy within the area of public financial consensus: the idea of consensus-by-bet. The core concept of consensus-by-bet is easy: the protocol provides alternatives for validators to guess in opposition to the protocol on which blocks are going to be finalized. A guess on some block X on this context is a transaction which, by protocol guidelines, provides the validator a reward of Y cash (that are merely printed to present to the validator out of skinny air, therefore “in opposition to the protocol”) in all universes during which block X was processed however which supplies the validator a penalty of Z cash (that are destroyed) in all universes during which block X was not processed.

The validator will want to make such a guess provided that they imagine block X is probably going sufficient to be processed in the universe that folks care about that the tradeoff is value it. After which, this is the economically recursive enjoyable half: the universe that folks care about, ie. the state that customers’ purchasers present when customers wish to know their account stability, the standing of their contracts, and many others, is itself derived by which blocks individuals guess on essentially the most. Therefore, every validator’s incentive is to guess in the best way that they anticipate others to guess sooner or later, driving the method towards convergence.

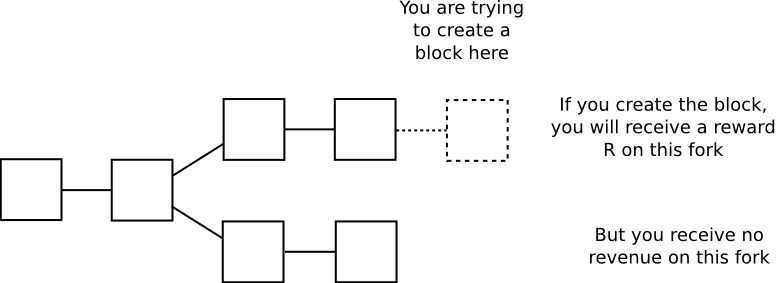

A useful analogy right here is to take a look at proof of labor consensus – a protocol which appears extremely distinctive when seen by itself, however which may in truth be completely modeled as a really particular subset of consensus-by-bet. The argument is as follows. When you’re mining on high of a block, you’re expending electrical energy prices E per second in change for receiving an opportunity p per second of producing a block and receiving R cash in all forks containing your block, and nil rewards in all different chains:

Therefore, each second, you obtain an anticipated achieve of p*R-E on the chain you’re mining on, and take a lack of E on all different chains; this may be interpreted as taking a guess at E:p*R-E odds that the chain you’re mining on will “win”; for instance, if p is 1 in 1 million, R is 25 BTC ~= $10000 USD and E is $0.007, then your beneficial properties per second on the profitable chain are 0.000001 * 10000 – 0.007 = 0.003, your losses on the shedding chain are the electrical energy price of 0.007, and so you’re betting at 7:3 odds (or 70% likelihood) that the chain you’re mining on will win. Be aware that proof of labor satisfies the requirement of being economically “recursive” in the best way described above: customers’ purchasers will calculate their balances by processing the chain that has essentially the most proof of labor (ie. bets) behind it.

Consensus-by-bet could be seen as a framework that encompasses this manner of proof of labor, and but additionally could be tailored to offer an financial sport to incentivize convergence for a lot of different lessons of consensus protocols. Conventional Byzantine-fault-tolerant consensus protocols, for instance, are likely to have an idea of “pre-votes” and “pre-commits” earlier than the ultimate “commit” to a selected outcome; in a consensus-by-bet mannequin, one could make every stage be a guess, in order that members within the later phases could have better assurance that members within the earlier phases “actually imply it”.

It may also be used to incentivize right conduct in out-of-band human consensus, if that’s wanted to beat excessive circumstances resembling a 51% assault. If somebody buys up half the cash on a proof-of-stake chains, and assaults it, then the neighborhood merely must coordinate on a patch the place purchasers ignore the attacker’s fork, and the attacker and anybody who performs together with the attacker robotically loses all of their cash. A really bold objective can be to generate these forking selections robotically by on-line nodes – if accomplished efficiently, this might additionally subsume into the consensus-by-bet framework the underappreciated however necessary outcome from conventional fault tolerance analysis that, below sturdy synchrony assumptions, even when nearly all nodes try to assault the system the remaining nodes can nonetheless come to consensus.

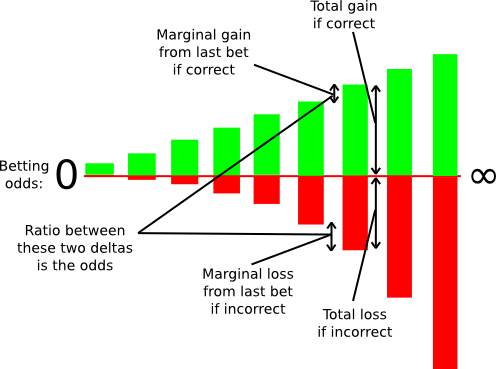

Within the context of consensus-by-bet, totally different consensus protocols differ in just one manner: who’s allowed to guess, at what odds and the way a lot? In proof of labor, there is just one type of guess supplied: the flexibility to guess on the chain containing one’s personal block at odds E:p*R-E. In generalized consensus-by-bet, we are able to use a mechanism often called a scoring rule to basically supply an infinite variety of betting alternatives: one infinitesimally small guess at 1:1, one infinitesimally small guess at 1.000001:1, one infinitesimally small guess at 1.000002:1, and so forth.

A scoring rule as an infinite variety of bets.

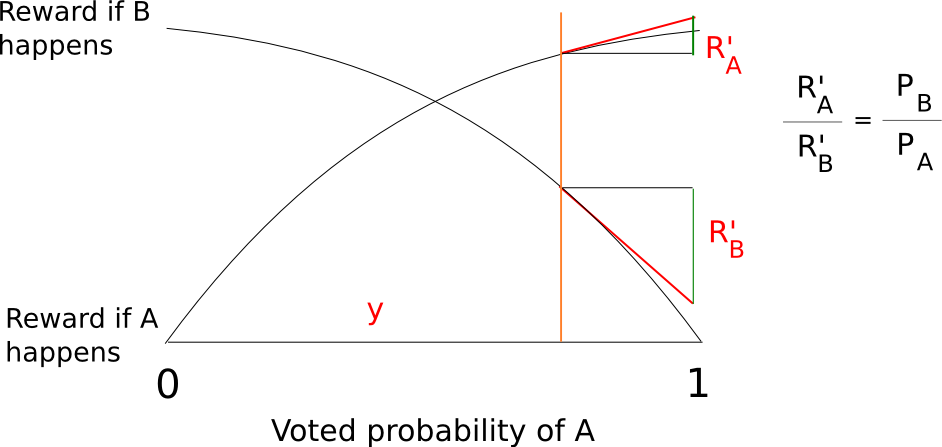

One can nonetheless determine precisely how giant these infinitesimal marginal bets are at every likelihood degree, however typically this system permits us to elicit a really exact studying of the likelihood with which some validator thinks some block is more likely to be confirmed; if a validator thinks {that a} block will likely be confirmed with likelihood 90%, then they may settle for the entire bets beneath 9:1 odds and not one of the bets above 9:1 odds, and seeing this the protocol will be capable of infer this “opinion” that the prospect the block will likely be confirmed is 90% with exactness. In actual fact, the revelation precept tells us that we could as properly ask the validators to provide a signed message containing their “opinion” on the likelihood that the block will likely be confirmed straight, and let the protocol calculate the bets on the validator’s behalf.

Due to the wonders of calculus, we are able to truly give you pretty easy capabilities to compute a complete reward and penalty at every likelihood degree which are mathematically equal to summing an infinite set of bets in any respect likelihood ranges beneath the validator’s acknowledged confidence. A reasonably easy instance is s(p) = p/(1-p) and f(p) = (p/(1-p))^2/2 the place s computes your reward if the occasion you’re betting on takes place and f computes your penalty if it doesn’t.

A key benefit of the generalized strategy to consensus-by-bet is that this. In proof of labor, the quantity of “financial weight” behind a given block will increase solely linearly with time: if a block has six confirmations, then reverting it solely prices miners (in equilibrium) roughly six instances the block reward, and if a block has 600 confirmations then reverting it prices 600 instances the block reward. In generalized consensus-by-bet, the quantity of financial weight that validators throw behind a block may enhance exponentially: if a lot of the different validators are keen to guess at 10:1, you is likely to be snug sticking your neck out at 20:1, and as soon as nearly everybody bets 20:1 you may go for 40:1 and even larger. Therefore, a block could properly attain a degree of “de-facto full finality”, the place validators’ complete deposits are at stake backing that block, in as little as a couple of minutes, relying on how courageous the validators are (and the way a lot the protocol incentivizes them to be).

Blocks, Chains and Consensus as Tug of Battle

One other distinctive element of the best way that Casper does issues is that somewhat than consensus being by-chain as is the case with present proof of labor protocols, consensus is by-block: the consensus course of involves a call on the standing of the block at every top independently of each different top. This mechanism does introduce some inefficiencies – significantly, a guess should register the validator’s opinion on the block at each top somewhat than simply the top of the chain – but it surely proves to be a lot easier to implement methods for consensus-by-bet on this mannequin, and it additionally has the benefit that it’s way more pleasant to excessive blockchain pace: theoretically, one can actually have a block time that’s quicker than community propagation with this mannequin, as blocks could be produced independently of one another, although with the apparent proviso that block finalization will nonetheless take some time longer.

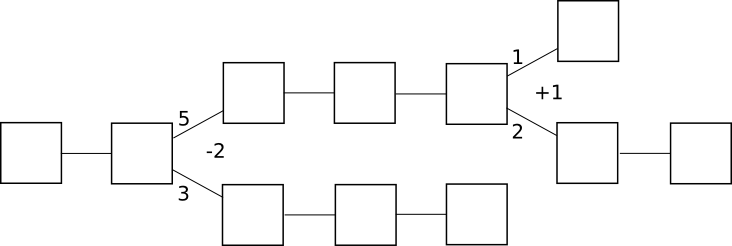

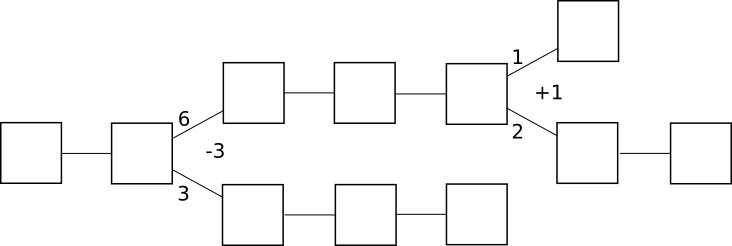

In by-chain consensus, one can view the consensus course of as being a type of tug-of-war between detrimental infinity and optimistic infinity at every fork, the place the “standing” on the fork represents the variety of blocks within the longest chain on the best facet minus the variety of blocks on the left facet:

Purchasers attempting to find out the “right chain” merely transfer ahead ranging from the genesis block, and at every fork go left if the standing is detrimental and proper if the standing is optimistic. The financial incentives listed here are additionally clear: as soon as the standing goes optimistic, there’s a sturdy financial strain for it to converge to optimistic infinity, albeit very slowly. If the standing goes detrimental, there’s a sturdy financial strain for it to converge to detrimental infinity.

By the way, word that below this framework the core concept behind the GHOST scoring rule turns into a pure generalization – as an alternative of simply counting the size of the longest chain towards the standing, rely each block on either side of the fork:

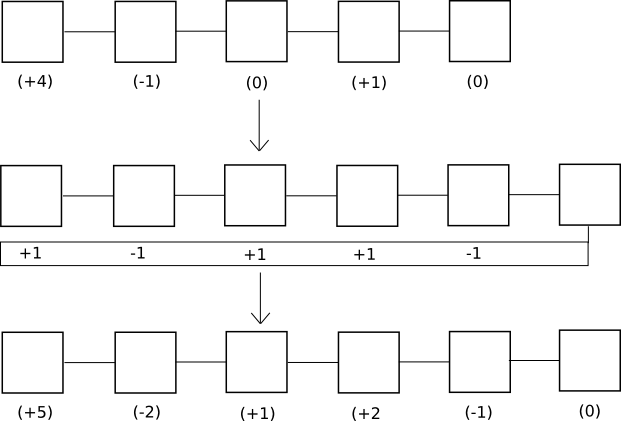

In by-block consensus, there’s as soon as once more the tug of conflict, although this time the “standing” is solely an arbitrary quantity that may be elevated or decreased by sure actions related to the protocol; at each block top, purchasers course of the block if the standing is optimistic and don’t course of the block if the standing is detrimental. Be aware that regardless that proof of labor is presently by-chain, it does not must be: one can simply think about a protocol the place as an alternative of offering a mum or dad block, a block with a legitimate proof of labor resolution should present a +1 or -1 vote on each block top in its historical past; +1 votes can be rewarded provided that the block that was voted on does get processed, and -1 votes can be rewarded provided that the block that was voted on doesn’t get processed:

After all, in proof of labor such a design wouldn’t work properly for one easy cause: if you must vote on completely each earlier top, then the quantity of voting that must be accomplished will enhance quadratically with time and pretty shortly grind the system to a halt. With consensus-by-bet, nevertheless, as a result of the tug of conflict can converge to finish finality exponentially, the voting overhead is way more tolerable.

One counterintuitive consequence of this mechanism is the truth that a block can stay unconfirmed even when blocks after that block are fully finalized. This may occasionally look like a big hit in effectivity, as if there’s one block whose standing is flip-flopping with ten blocks on high of it then every flip would entail recalculating state transitions for a complete ten blocks, however word that in a by-chain mannequin the very same factor can occur between chains as properly, and the by-block model truly offers customers with extra data: if their transaction was confirmed and finalized in block 20101, and so they know that no matter the contents of block 20100 that transaction could have a sure outcome, then the outcome that they care about is finalized regardless that elements of the historical past earlier than the outcome will not be. By-chain consensus algorithms can by no means present this property.

So how does Casper work anyway?

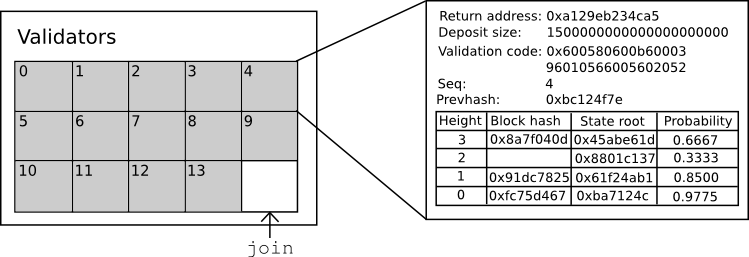

In any security-deposit-based proof of stake protocol, there’s a present set of bonded validators, which is saved monitor of as a part of the state; so as to make a guess or take one in every of various crucial actions within the protocol, you have to be within the set as a way to be punished when you misbehave. Becoming a member of the set of bonded validators and leaving the set of bonded validators are each particular transaction varieties, and important actions within the protocol resembling bets are additionally transaction varieties; bets could also be transmitted as impartial objects by means of the community, however they may also be included into blocks.

In line with Serenity’s spirit of abstraction, all of that is carried out by way of a Casper contract, which has capabilities for making bets, becoming a member of, withdrawing, and accessing consensus data, and so one can submit bets and take different actions just by calling the Casper contract with the specified information. The state of the Casper contract appears as follows:

The contract retains monitor of the present set of validators, and for every validator it retains monitor of six main issues:

- The return deal with for the validator’s deposit

- The present dimension of the validator’s deposit (word that the bets that the validator makes will enhance or lower this worth)

- The validator’s validation code

- The sequence variety of the newest guess

- The hash of the newest guess

- The validator’s opinion desk

The idea of “validation code” is one other abstraction characteristic in Serenity; whereas different proof of stake protocols require validators to make use of one particular signature verification algorithm, the Casper implementation in Serenity permits validators to specify a chunk of code that accepts a hash and a signature and returns 0 or 1, and earlier than accepting a guess checks the hash of the guess in opposition to its signature. The default validation code is an ECDSA verifier, however one can even experiment with different verifiers: multisig, threshold signatures (doubtlessly helpful for creating decentralized stake swimming pools!), Lamport signatures, and many others.

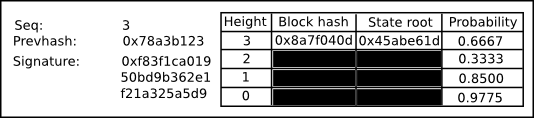

Each guess should comprise a sequence primary larger than the earlier guess, and each guess should comprise a hash of the earlier guess; therefore, one can view the sequence of bets made by a validator as being a type of “non-public blockchain”; seen in that context, the validator’s opinion is basically the state of that chain. An opinion is a desk that describes:

- What the validator thinks the almost definitely state root is at any given block top

- What the validator thinks the almost definitely block hash is at any given block top (or zero if no block hash is current)

- How seemingly the block with that hash is to be finalized

A guess is an object that appears like this:

The important thing data is the next:

- The sequence variety of the guess

- The hash of the earlier guess

- A signature

- An inventory of updates to the opinion

The operate within the Casper contract that processes a guess has three elements to it. First, it validates the sequence quantity, earlier hash and signature of a guess. Subsequent, it updates the opinion desk with any new data provided by the guess. A guess ought to usually replace a couple of very latest chances, block hashes and state roots, so a lot of the desk will usually be unchanged. Lastly, it applies the scoring rule to the opinion: if the opinion says that you simply imagine {that a} given block has a 99% probability of finalization, and if, within the specific universe that this specific contract is working in, the block was finalized, you then may get 99 factors; in any other case you may lose 4900 factors.

Be aware that, as a result of the method of working this operate contained in the Casper contract takes place as a part of the state transition operate, this course of is absolutely conscious of what each earlier block and state root is at the very least throughout the context of its personal universe; even when, from the standpoint of the surface world, the validators proposing and voting on block 20125 don’t know whether or not or not block 20123 will likely be finalized, when the validators come round to processing that block they are going to be – or, maybe, they could course of each universes and solely later determine to stay with one. With a purpose to stop validators from offering totally different bets to totally different universes, we have now a easy slashing situation: when you make two bets with the identical sequence quantity, and even when you make a guess that you simply can’t get the Casper contract to course of, you lose your complete deposit.

Withdrawing from the validator pool takes two steps. First, one should submit a guess whose most top is -1; this robotically ends the chain of bets and begins a four-month countdown timer (20 blocks / 100 seconds on the testnet) earlier than the bettor can get well their funds by calling a 3rd methodology, withdraw. Withdrawing could be accomplished by anybody, and sends funds again to the identical deal with that despatched the unique be a part of transaction.

Block proposition

A block comprises (i) a quantity representing the block top, (ii) the proposer deal with, (iii) a transaction root hash and (iv) a signature. For a block to be legitimate, the proposer deal with have to be the identical because the validator that’s scheduled to generate a block for the given top, and the signature should validate when run in opposition to the validator’s personal validation code. The time to submit a block at top N is set by T = G + N * 5 the place G is the genesis timestamp; therefore, a block ought to ordinarily seem each 5 seconds.

An NXT-style random quantity generator is used to find out who can generate a block at every top; basically, this includes taking lacking block proposers as a supply of entropy. The reasoning behind that is that regardless that this entropy is manipulable, manipulation comes at a excessive price: one should sacrifice one’s proper to create a block and accumulate transaction charges so as to manipulate it. Whether it is deemed completely needed, the price of manipulation could be elevated a number of orders of magnitude additional by changing the NXT-style RNG with a RANDAO-like protocol.

The Validator Technique

So how does a validator function below the Casper protocol? Validators have two main classes of exercise: making blocks and making bets. Making blocks is a course of that takes place independently from every thing else: validators collect transactions, and when it comes time for them to make a block, they produce one, signal it and ship it out to the community. The method for making bets is extra difficult. The present default validator technique in Casper is one that’s designed to imitate features of conventional Byzantine-fault-tolerant consensus: have a look at how different validators are betting, take the thirty third percentile, and transfer a step towards 0 or 1 from there.

To perform this, every validator collects and tries to remain as up-to-date as potential on the bets being made by all different validators, and retains monitor of the present opinion of every one. If there are not any or few opinions on a selected block top from different validators, then it follows an preliminary algorithm that appears roughly as follows:

- If the block just isn’t but current, however the present time remains to be very near the time that the block ought to have been printed, guess 0.5

- If the block just isn’t but current, however a very long time has already handed for the reason that block ought to have been printed, guess 0.3

- If the block is current, and it arrived on time, guess 0.7

- If the block is current, but it surely arrived both far too early or far too late, guess 0.3

Some randomness is added so as to assist stop “caught” eventualities, however the primary precept stays the identical.

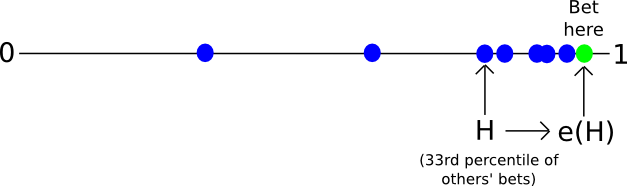

If there are already many opinions on a selected block top from different validators, then we take the next technique:

- Let L be the worth such that two thirds of validators are betting larger than L. Let M be the median (ie. the worth such that half of validators are betting larger than M). Let H be the worth such that two thirds of validators are betting decrease than H.

- Let e(x) be a operate that makes x extra “excessive”, ie. pushes the worth away from 0.5 and towards 1. A easy instance is the piecewise operate e(x) = 0.5 + x / 2 if x > 0.5 else x / 2.

- If L > 0.8, guess e(L)

- If H < 0.2, guess e(H)

- In any other case, guess e(M), although restrict the outcome to be throughout the vary [0.15, 0.85] in order that lower than 67% of validators cannot power one other validator to maneuver their bets too far

Validators are free to decide on their very own degree of danger aversion throughout the context of this technique by selecting the form of e. A operate the place f(e) = 0.99999 for e > 0.8 may work (and would in truth seemingly present the identical conduct as Tendermint) but it surely creates considerably larger dangers and permits hostile validators making up a big portion of the bonded validator set to trick these validators into shedding their complete deposit at a low price (the assault technique can be to guess 0.9, trick the opposite validators into betting 0.99999, after which soar again to betting 0.1 and power the system to converge to zero). Alternatively, a operate that converges very slowly will incur larger inefficiencies when the system just isn’t below assault, as finality will come extra slowly and validators might want to hold betting on every top longer.

Now, how does a consumer decide what the present state is? Primarily, the method is as follows. It begins off by downloading all blocks and all bets. It then makes use of the identical algorithm as above to assemble its personal opinion, but it surely doesn’t publish it. As an alternative, it merely appears at every top sequentially, processing a block if its likelihood is larger than 0.5 and skipping it in any other case; the state after processing all of those blocks is proven because the “present state” of the blockchain. The consumer can even present a subjective notion of “finality”: when the opinion at each top as much as some okay is both above 99.999% or beneath 0.001%, then the consumer considers the primary okay blocks finalized.

Additional Analysis

There’s nonetheless fairly a little bit of analysis to do for Casper and generalized consensus-by-bet. Explicit factors embody:

- Arising with outcomes to indicate that the system economically incentivizes convergence, even within the presence of some amount of Byzantine validators

- Figuring out optimum validator methods

- Ensuring that the mechanism for together with the bets in blocks just isn’t exploitable

- Growing effectivity. Presently, the POC1 simulation can deal with ~16 validators working on the identical time (up from ~13 per week in the past), although ideally we must always push this up as a lot as potential (word that the variety of validators the system can deal with on a reside community must be roughly the sq. of the efficiency of the POC, because the POC runs all nodes on the identical machine).

The following article on this sequence will cope with efforts so as to add a scaffolding for scalability into Serenity, and can seemingly be launched across the identical time as POC2.