The next is a visitor article from Vincent Maliepaard, Advertising Director at IntoTheBlock.

Financial dangers have led to just about $60 billion in losses throughout DeFi protocols. Whereas this quantity could seem excessive, it solely displays losses on the protocol degree. The precise whole is probably going a lot bigger when factoring in particular person person losses because of varied financial danger components. These private losses usually come up from risky market circumstances, complicated inter-protocol dependencies, and sudden liquidations.

Understanding Financial Danger in DeFi

Financial danger in DeFi refers back to the potential monetary loss because of hostile actions in market circumstances, liquidity crises, flawed protocol design, or exterior financial occasions. These dangers are multi-faceted and may stem from varied sources:

- Market Danger: Volatility within the worth of belongings can result in important losses. For instance, sudden value drops in collateralized belongings could cause liquidation occasions, resulting in a cascade of pressured promoting and additional value drops.

- Liquidity Danger: The lack to rapidly purchase or promote belongings with out inflicting a big influence on the worth. In DeFi, this could manifest throughout a market sell-off when liquidity swimming pools dry up, exacerbating losses.

- Protocol Danger: This danger arises from flaws or inefficiencies within the design of DeFi protocols. Impermanent loss, oracle manipulation, and governance assaults are examples of how protocol-specific dangers can materialize.

- Exterior Danger: Elements outdoors the protocol similar to actions by massive market gamers or modifications in macro charges and circumstances, can introduce important dangers which can be usually past the management of customers or a protocol.

The Layers Inside Financial Danger

In DeFi, financial dangers are pervasive, however they are often understood on two distinct ranges: protocol-level dangers and user-level dangers. Distinguishing between the 2 helps customers higher outline the dangers that have an effect on their methods and monitor key alerts to take preventative motion.

Protocol Stage Dangers

Protocols implement safeguards by variable parameters designed to restrict publicity to financial losses. A typical instance is the lending and borrowing parameters set by lending protocols, that are examined and calibrated to forestall dangerous debt from accumulating. These measures are usually utilitarian, aiming to guard the protocol from financial dangers on a broad scale, benefiting the most important variety of customers.

Whereas managing financial dangers is turning into more and more necessary for stopping large-scale losses on the protocol degree, the main focus is slender—on the protocol itself. They don’t tackle the dangers that particular person customers might introduce by making economically dangerous choices inside their very own methods.

Consumer Stage Dangers

Consumer-level dangers are sometimes diminished to the quantity of leverage a person takes in lengthy or quick positions, however this solely scratches the floor. Customers face a spread of extra dangers, similar to liquidations, impermanent loss, slippage, and the potential for locked lending liquidity. These particular person dangers don’t often fall underneath the scope of protocol danger administration, however can have a big monetary influence on particular person customers.

The excellent news is that these user-level financial dangers are extremely actionable. By understanding their very own danger profile, customers can actively handle and mitigate the dangers particular to their technique. This customized method to danger administration stays one of the crucial underutilized instruments obtainable to DeFi members immediately.

The interconnected nature of dangers throughout DeFi protocols

Financial danger administration is important when addressing dangers that span a number of DeFi protocols. Whereas protocol audits and danger parameters strengthen particular person protocols, DeFi customers usually interact with a number of protocols of their methods. This makes user-level danger administration essential.

Every extra protocol or asset introduces new danger components, not solely from that new protocol but additionally from how these protocols work together. Even when every protocol is safe by itself, dangers can emerge from how your technique combines these completely different protocols.

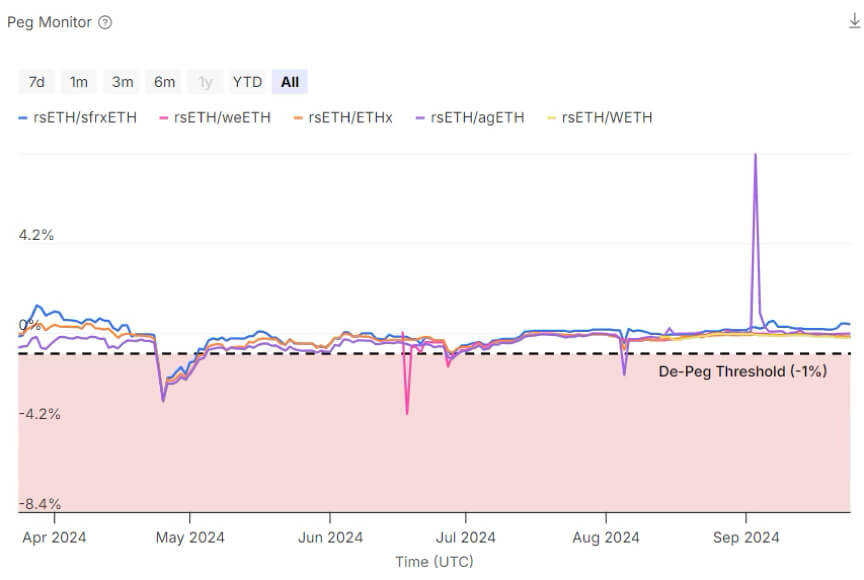

For instance, think about a state of affairs the place a person makes use of a Liquid Restaking Token (LRT) as collateral to borrow an asset, which is then deployed in a liquidity pool (LP) on an exterior automated market maker (AMM). The first concern may be the leveraged borrowing place, however there are extra dangers. The steadiness of the LRT’s peg may influence liquidation within the lending protocol, whereas the composition of the LP may have an effect on slippage and exit charges, probably inflicting capital loss when repaying the mortgage. These interconnected dangers don’t fall underneath any single protocol’s management and are subsequently finest managed by the person.

Steps to Perceive and Handle Financial Danger

Managing financial danger in DeFi requires a well-thought-out method, because the complexity of multi-protocol methods can introduce unexpected vulnerabilities.

- Deep Dive into Protocol Mechanics: Understanding the underlying mechanics of a protocol is step one in figuring out potential financial dangers. Buyers and builders ought to scrutinize the financial fashions, assumptions, and dependencies throughout the protocol.

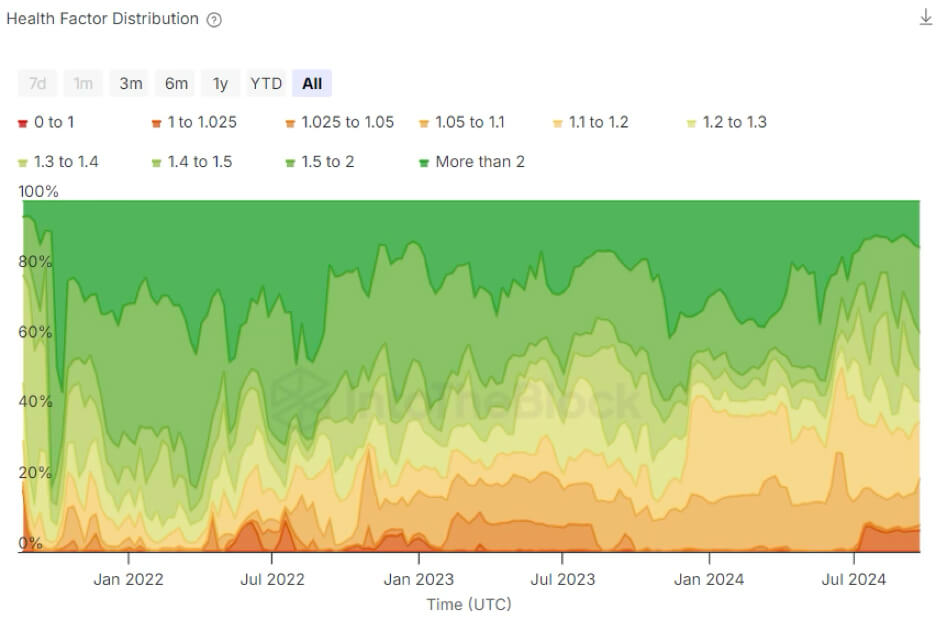

- Monitor Market Indicators: Maintaining a tally of market alerts, similar to asset volatility, liquidity, and total sentiment, is important. Analyzing on-chain knowledge particular to the protocols you’re utilizing is a sensible technique to keep knowledgeable. For example, in case you’re partaking with a lending technique on Benqi, monitoring the well being issue of loans on the platform is essential. This supplies insights into how steady your lending place is and helps you anticipate potential points earlier than they escalate.

- Create a holistic danger profile: Understanding how interconnected dangers might influence your total technique is essential to efficient danger administration. Whereas particular person methods differ, danger analytics can help in figuring out areas of concern. For instance, in case you’re utilizing a Liquid Restaking Token (LRT) as collateral to borrow belongings, monitoring the soundness of the LRT’s peg is important to keep away from sudden liquidations. Sudden spikes or volatility within the peg may sign a have to take precautionary measures, similar to decreasing publicity or growing collateral.

In abstract, managing financial danger in DeFi is about being proactive. By understanding protocol mechanics, maintaining an in depth watch on market indicators, and constructing a holistic view of potential dangers, customers can higher navigate the challenges of multi-protocol methods and defend their positions.