Fast Take

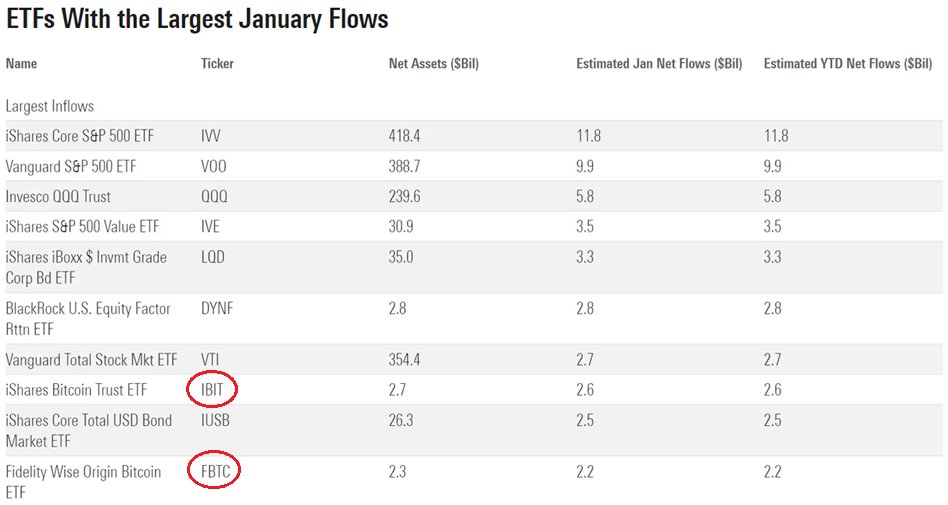

January ETF flows demonstrated a brand new pattern within the funding panorama. Though the iShares Core S&P 500 ETF ($11.8 billion) and the Vanguard S&P 500 ETF ($9.9 billion) led the month, two Bitcoin-focused ETFs carved out a notable place on the leaderboard, in accordance with Geraci.

Regardless of having a fraction of the online belongings, the iShares Bitcoin Belief ETF (IBIT) and the Constancy Smart Origin Bitcoin ETF (FBTC) had a formidable $2.6 billion and $2.2 billion in internet belongings, respectively, in accordance with Geraci. As compared, Vanguard’s Whole Inventory Mkt ETF (VTI) recorded solely marginally greater inflows at $2.7 billion.

This demonstrates a burgeoning investor curiosity in incorporating Bitcoin into their portfolios, even amid a decline in Bitcoin’s worth from $49,000 to roughly $39,000 inside the month.

Contemplating the very fact that there have been round 3,109 ETFs lively in america as of December 2023, in accordance with Y Charts, the notable efficiency of those two Bitcoin ETFs is a big indication of the evolving funding traits.

Whereas the market dominance of conventional fairness ETFs stays unchallenged, the spectacular debut of Bitcoin ETFs suggests a gradual acceptance of digital belongings within the mainstream finance sector, marking a brand new part within the digital asset funding period. On the similar time, the digital belongings business is ready on potential approval from the SEC on an Ethereum ETF.

The submit Two Bitcoin funds hit high 10 ETF inflows throughout all classes in January appeared first on CryptoSlate.