Tron (TRX) traders proceed to really feel bullish even because the market dips after sure on-chain developments assist investor sentiment stay excessive. In accordance with CoinGecko, the token has elevated greater than 24% since final week, an indication that traders on the platform have held TRX and collected to seize extra positive factors.

Associated Studying

Tron’s developments will assist TRX maintain in opposition to the downward trajectory the market has taken right this moment. Nevertheless, questions stay about whether or not the token will proceed to go in opposition to the broader market or observe the dip.

Tron On-chain Developments Drive TRX Sky Excessive

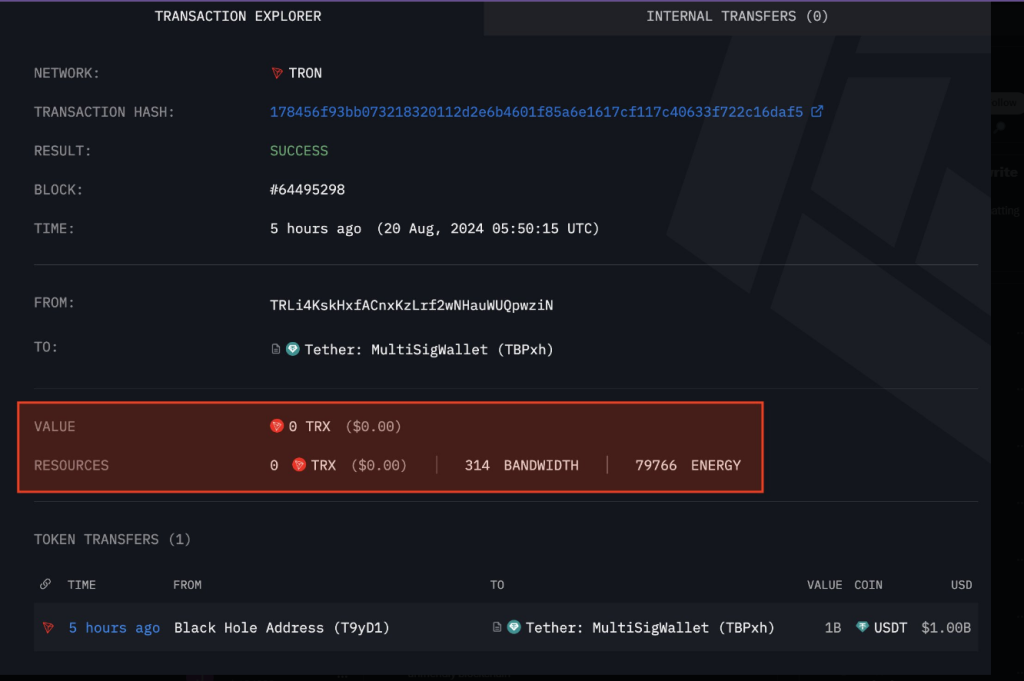

With Tron’s deal with stablecoin improvement made obvious by Tron founder Justin Solar final month, yesterday noticed an enormous win for the platform as Tether minted over $1 billion USDT with out paying any fuel charges on the platform. This positioned Tron within the crosshairs of critics as they questioned the “no fuel price” transaction with a person mentioning that they’re charged a greenback for a easy swap approval.

Our group is creating a brand new resolution that permits gas-free stablecoin transfers. In different phrases, transfers could be made with out paying any fuel tokens, with the charges being completely coated by the stablecoins themselves.

— H.E. Justin Solar 孙宇晨(hiring) (@justinsuntron) July 6, 2024

Regardless of this, Tron dealt with a 3rd of Visa’s annual settlement quantity whereas gaining over half a billion {dollars} in charges in as little as 3 months. This, based on Tron, makes it clear that “blockchain is greater than only a buzzword.”

TODAY: $1B USDT minted on TRON

They paid $0.00 in charges.

Wow pic.twitter.com/NuNYRuj1Yc

— Arkham (@ArkhamIntel) August 20, 2024

TRX To Face Attainable Downturn Quickly?

The token’s present place is a clumsy steadiness between the bulls making an attempt to interrupt by means of the $0.1665 ceiling and the bears additionally making an attempt the reverse by eyeing the $0.1583 ground.

Because it at the moment stands, TRX is on an untenable place because it forces the bulls to proceed shopping for with out regard to the token’s general momentum. The relative power index (RSI) helps this because it nears to push the bounds of the bullish momentum, with a attainable cool-down interval within the subsequent couple of days.

Accounting the market’s normal momentum, we’d see TRX stabilize on its present buying and selling vary between $0.1583 and $0.1665 within the brief time period. The RSI’s close to maxed-out worth signifies a attainable retracement to the $0.1532 ground earlier than opening the floodgates to the $0.1665.

Associated Studying

This state of affairs is feasible as TRX will finally lose its present momentum to observe the consensus dip inside the broader market. The dip, though bearish in some regards, will enable the bulls to relaxation earlier than increase the momentum for larger positive factors.

With enhancing macroeconomic situations additionally supporting this bullish thesis, we’d extra positive factors as capital from non-public fairness flows to extra dangerous funding merchandise like crypto. For now, monitoring the broader market will profit traders as TRX strikes to extra sustainable ranges.

Featured picture from Zipmex, chart from TradingView