The market is going through extreme volatility as the 2 important property, Bitcoin (BTC) and Ethereum (ETH), are in essential accumulation phases. Nevertheless, Bitcoin has carried out higher over the previous ten days, standing out amid the fluctuations.

Associated Studying

The ETH/BTC chart reveals this shift. On the time of writing, Ethereum’s worth in Bitcoin phrases was 0.043, its lowest since April 2021. This highlights Bitcoin’s dominance within the present market surroundings.

As costs transfer and traders search an edge, essential knowledge reveals a transparent choice for Bitcoin over Ethereum previously months. Whereas the market could seem calm, historical past reveals issues can activate a dime. Due to this fact, inspecting on-chain knowledge and fundamentals is significant to anticipate potential shifts.

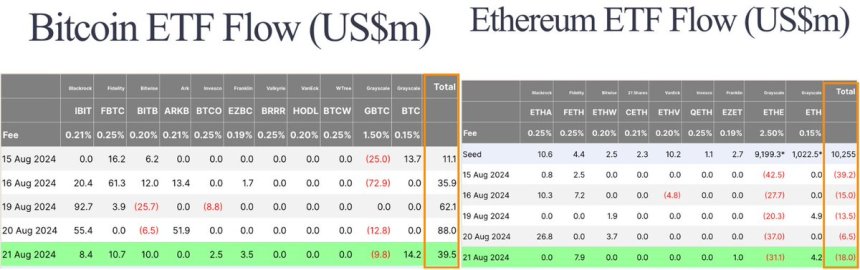

ETF Flows Exhibiting Bitcoin Dominance

Conventional traders are exhibiting an rising choice for Bitcoin over Ethereum, as evidenced by essential knowledge from Farside Traders, a London-based funding administration agency. In keeping with their experiences, Spot Bitcoin ETFs have skilled 5 consecutive inflows, whereas Ethereum ETFs have seen 5 straight days of outflows.

Whereas some market individuals consider that the outflows from Ethereum ETFs are as a result of promoting stress from Grayscale, analyst and investor Lark Davis has countered this argument. He factors out that “about 30% of ETH is already out of Grayscale’s $ETHE ETF,” implying that the outflows are pushed by broader market sentiment moderately than Grayscale’s affect.

BLACKROCK NOW HAS MORE CRYPTO THAN GRAYSCALE

Blackrock has now overtaken Grayscale in complete on-chain holdings. This makes Blackrock the most important ETF-related entity on Arkham.

Blackrock: $22,143,715,559

Grayscale: $21,996,062,828 pic.twitter.com/YrPZdrMObk— Arkham (@ArkhamIntel) August 22, 2024

This development underscores Bitcoin’s simple dominance available in the market, as conventional traders proceed to favor BTC over ETH throughout instances of uncertainty and volatility.

BTC Technical Ranges To Watch

Bitcoin’s worth is at the moment at $61,280 on the time of writing. It has been in a consolidation section since August 8, oscillating between the native resistance at $62,729 and the native help at $56,138 within the 4-hour timeframe. This era of sideways buying and selling has stored the market in suspense as traders watch carefully for the following vital transfer.

For a bullish affirmation, BTC wants to interrupt above the $63,000 degree and shut above the each day 200 Transferring Common (MA), a vital indicator that usually acts as help throughout bull markets and as resistance in intervals of deep corrections. The each day 200 MA has been a essential degree for figuring out the general development, and reclaiming it might sign a possible continuation of the bull market.

Associated Studying

Whereas Bitcoin’s present dominance available in the market is obvious, it’s necessary to notice that this dominance could not final eternally. The market stays dynamic, and shifts in sentiment or broader market circumstances may alter the panorama at any time.

Featured picture created with Dall-E, chart from Tradingview.com