An analyst has defined when the subsequent Bitcoin bull run peak would possibly seem, if the identical sample as in earlier cycles repeats this time as effectively.

This Is What Earlier Bitcoin Cycles Recommend Concerning Bull Run Prime

In a brand new put up on X, analyst Ali has mentioned about how the final two Bitcoin bull runs line up in opposition to one another and what it may imply for the present cycle of the cryptocurrency.

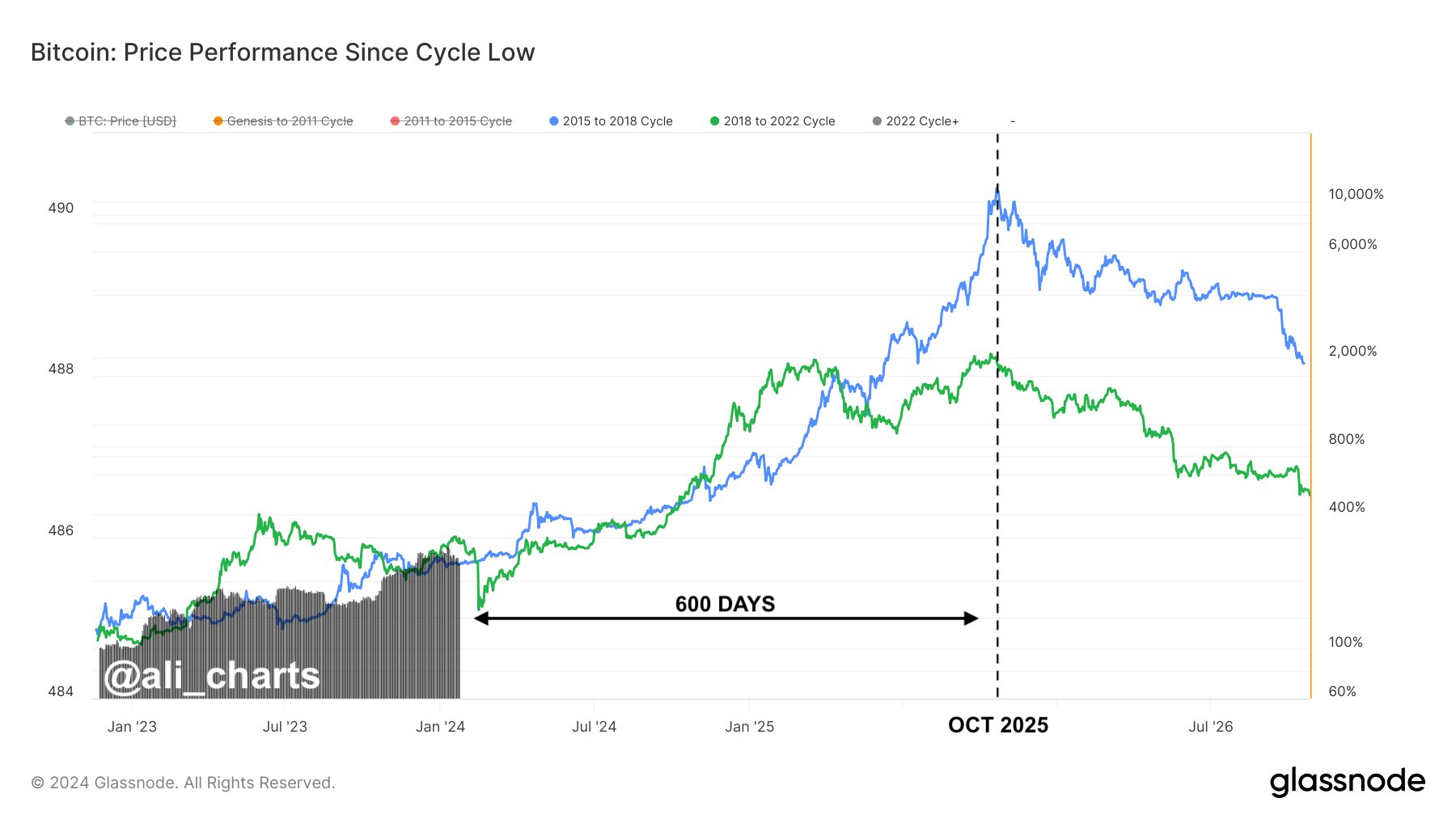

To make the comparability, the analyst has cited a chart that reveals the worth pattern in every of the cycles with the cyclical bottoms being the frequent start-point for all of them.

How the present BTC cycle strains up in opposition to the final two | Supply: @ali_charts on X

From the graph, it’s seen that the peaks of the final two Bitcoin bull runs took form at roughly the identical period of time for the reason that bottoms of the respective cycles.

For the present cycle, the low that adopted the FTX collapse in 2022 has been chosen as the underside. If the present cycle is lined up in opposition to these different two ranging from this backside, then it will nonetheless have roughly 600 days earlier than it reaches the identical level as when the final couple of bull runs hit their tops.

“If Bitcoin mirrors previous bull runs (2015-2018 & 2018-2022) from their respective market bottoms, projections counsel the subsequent market peak may land round October 2025,” says Ali. “This suggests BTC nonetheless has 600 days of bullish momentum forward!”

BTC Has Been At Danger Of Slipping Under A Historic Line Just lately

Whereas BTC might have a bullish outlook for the long run, its short-term worth pattern has been painful for buyers, because the cryptocurrency has seen a notable drawdown for the reason that spot ETFs discovered approval from the US SEC.

The cryptocurrency had earlier even slipped down in direction of the $38,500 mark earlier than making some restoration again across the $40,000 degree that it’s nonetheless buying and selling round.

BTC has made some restoration from its plunge a few days again | Supply: BTCUSD on TradingView

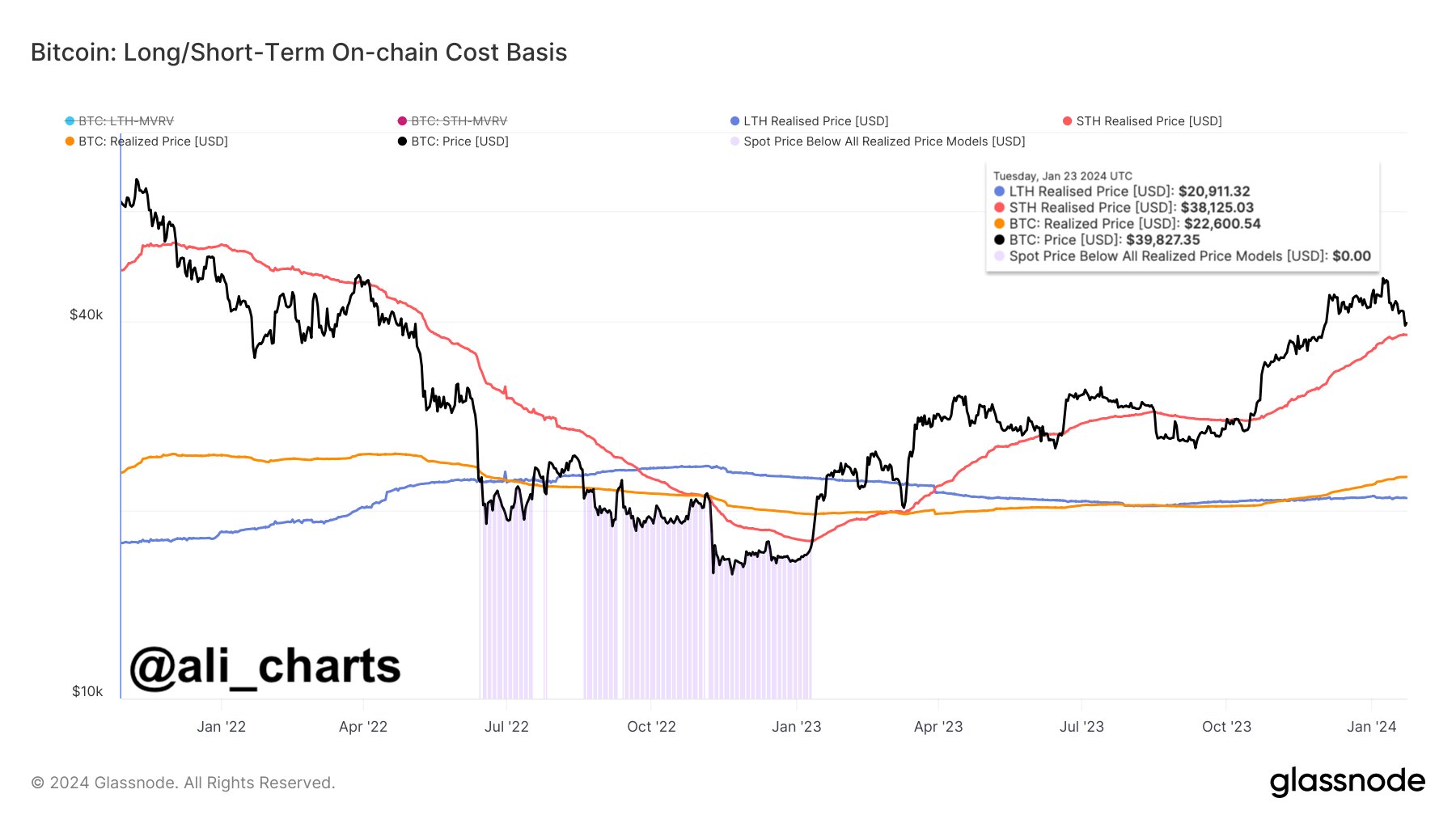

On this newest plunge, Bitcoin got here dangerously near retesting the “short-term holder realized worth,” a degree that has been important for the asset all through historical past.

The “realized worth” is a metric that retains observe of the worth at which the common investor within the Bitcoin market acquired their cash. The spot worth being above this worth naturally implies the common holder within the sector is carrying income, whereas it being beneath the road implies the dominance of losses.

As Ali has identified in one other X put up, the “short-term holder” group will discover themselves underwater if the cryptocurrency’s worth slips beneath the $38,130 degree.

The pattern within the realized worth of the short-term holders | Supply: @ali_charts on X

Brief-term holders (STHs) confer with the Bitcoin buyers who bought their cash inside the final 155 days. For the time being, their realized worth stands on the $38,125 degree. Traditionally, a sustained break beneath this line has usually meant an prolonged keep for the coin beneath it.

Thus far, BTC has averted a retest of this line, but when the present correction continues, it would even slip beneath it. “This potential BTC dip would possibly set off a brand new wave of panic promoting as these holders will search to attenuate losses,” explains the analyst.

Featured picture from Shutterstock.com, charts from TradingView.com, Glassnode.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site totally at your personal danger.