Fast Take

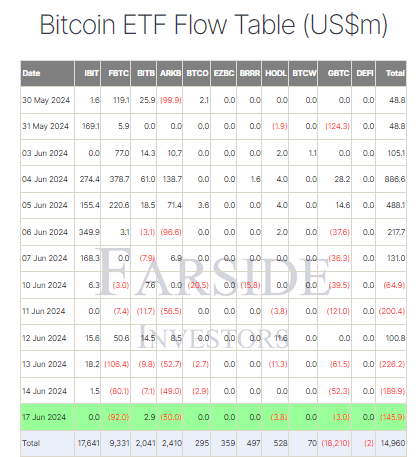

Farside information exhibits that on June 17, Bitcoin (BTC) exchange-traded funds (ETFs) skilled one other day of serious outflows, totaling $145.9 million. This marks the third consecutive buying and selling day of outflows and the fifth outflow prior to now six buying and selling days.

The most important outflow was from Constancy’s FBTC, which noticed a $92.0 million discount, bringing its whole web influx to $9.3 billion. Ark’s ARKB adopted with a $50.0 million outflow, lowering its whole web influx to $2.4 billion. Grayscale’s GBTC skilled a smaller outflow of $3.0 million, pushing its whole web outflows to $18.2 billion. In distinction, BlackRock’s IBIT recorded no inflows or outflows, sustaining its whole web influx at $17.6 billion. Total, the whole web inflows for BTC ETFs now stand at $15 billion.

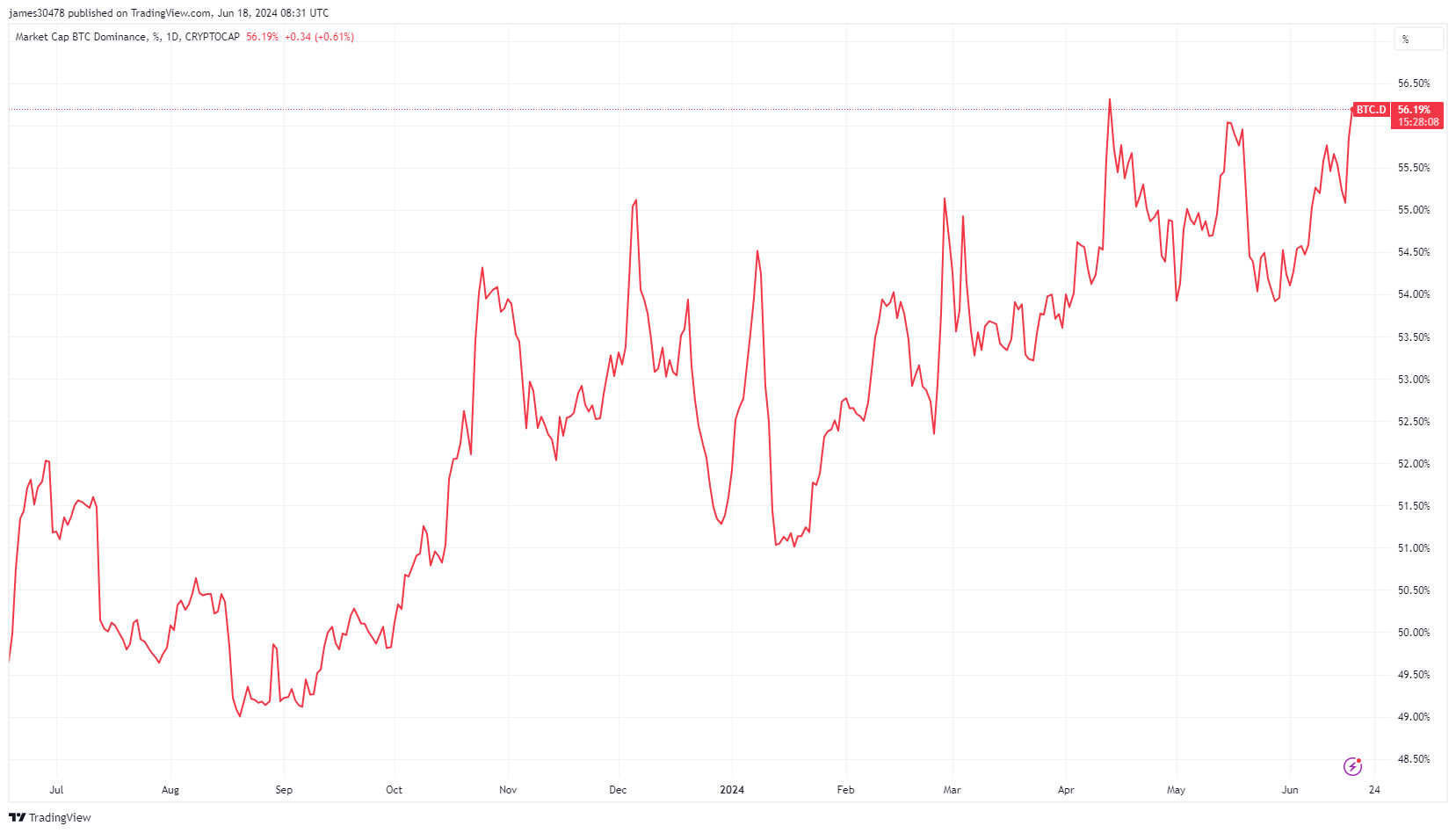

This development coincides with Bitcoin’s value drop to $64,600, its lowest since Could 16, reflecting a greater than 11% decline from its all-time excessive. Whereas Bitcoin’s dominance continues to climb, reaching 56.2%, it marks the second-highest stage of the 12 months.