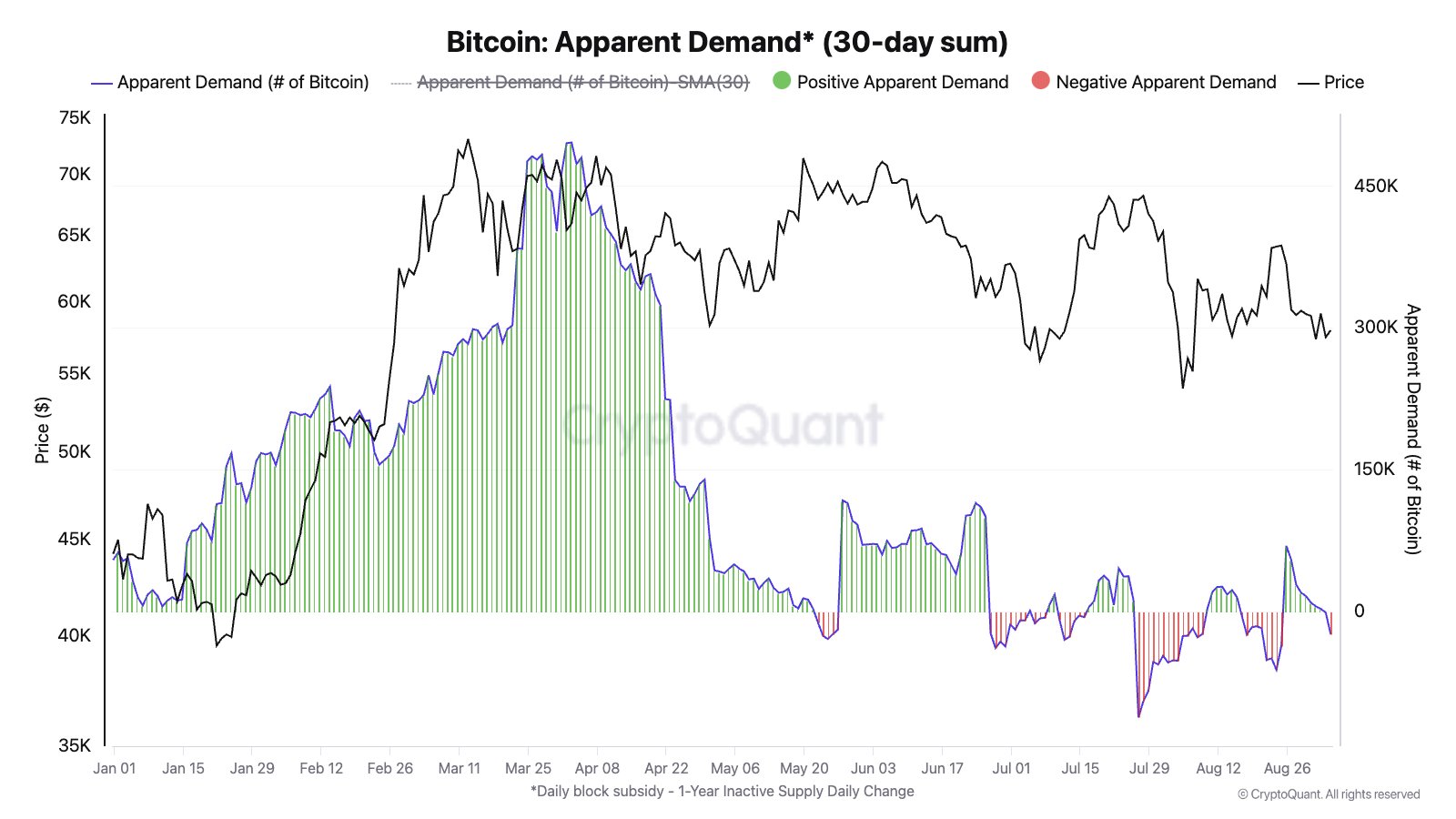

A scarcity of demand development is retaining Bitcoin’s (BTC) value down, based on the top of analysis on the digital asset analytics agency CryptoQuant.

Julio Moreno notes on the social media platform X that BTC demand is declining and “principally all valuation metrics are in bearish territory.”

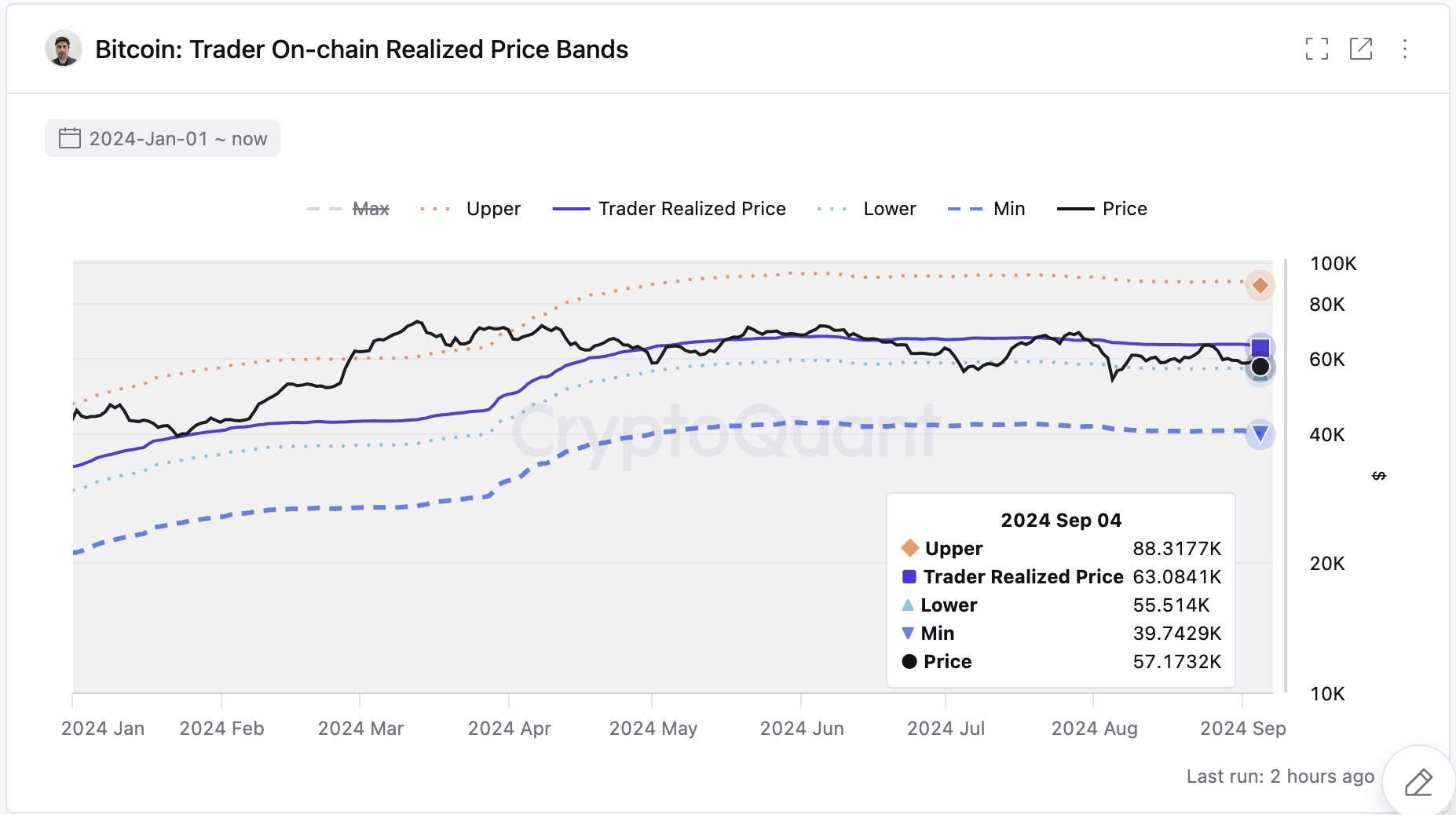

Moreno notes a key value degree to look at is $55,000, the dealer on-chain realized value decrease band.

The realized value is the typical value of Bitcoins in circulation calculated primarily based on the value at which they have been final moved.

BTC, at present priced at $53,836, is buying and selling beneath that mark at time of writing. The highest-ranked crypto asset by market cap is down greater than 4% up to now 24 hours and greater than 9% up to now week.

Earlier this week, Moreno simulated the value of Bitcoin for the month of September, with the simulation costs on common ending the month round $55,000.

“Costs would principally be between $44,000 and $66,000. These simulations solely take note of historic each day returns within the month of September.”

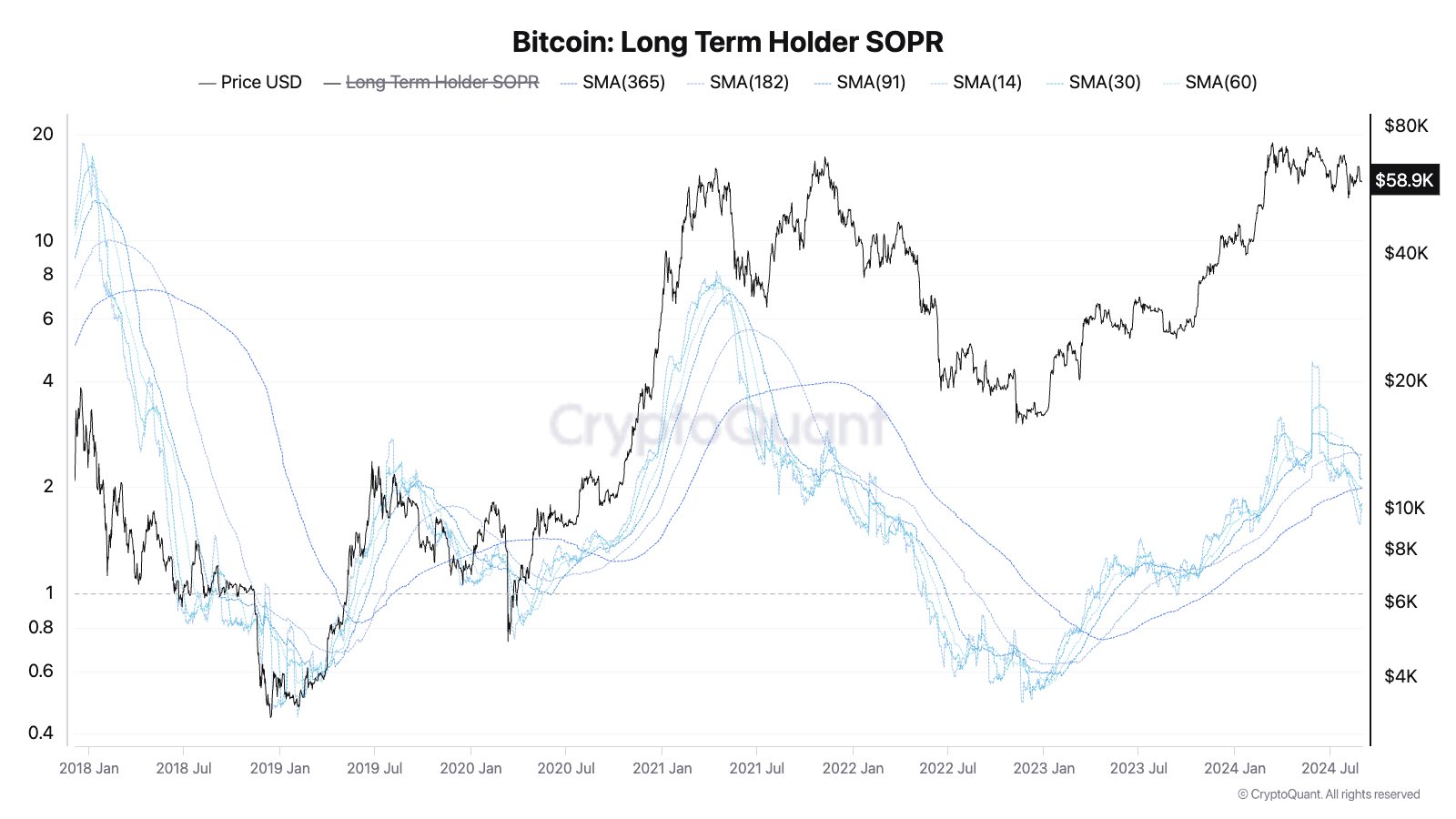

Moreno additionally famous final weekend that long-term BTC holders are spending at decrease revenue margins, a bearish indicator.

“Lengthy-term holder SOPR ribbons: most transferring averages are trending downwards since late July.

Shopping for sign could be when the transferring averages begin to pattern upwards.”

SOPR stands for spent output revenue ratio, which tracks whether or not cash are being bought at a revenue or loss.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney