Particular because of Robert Sams for the event of Seignorage Shares and insights concerning the way to appropriately worth risky cash in multi-currency programs

Observe: we aren’t planning on including value stabilization to ether; our philosophy has all the time been to maintain ether easy to attenuate black-swan dangers. Outcomes of this analysis will seemingly go into both subcurrencies or unbiased blockchains

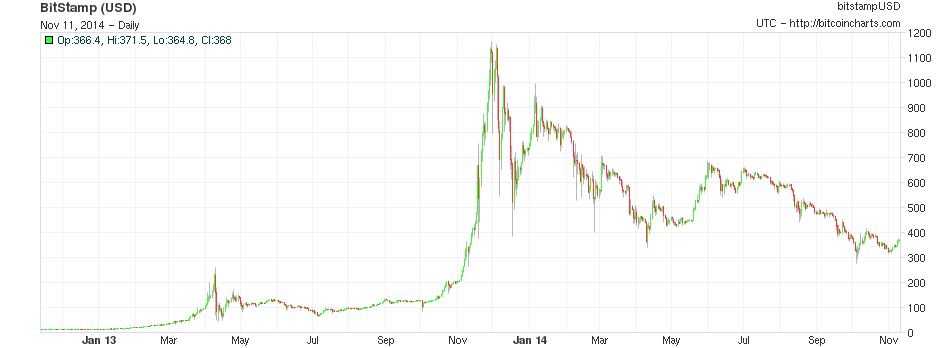

One of many foremost issues with Bitcoin for extraordinary customers is that, whereas the community could also be an effective way of sending funds, with decrease transaction prices, way more expansive international attain, and a really excessive stage of censorship resistance, Bitcoin the foreign money is a really risky technique of storing worth. Though the foreign money had by and huge grown by leaps and bounds over the previous six years, particularly in monetary markets previous efficiency isn’t any assure (and by environment friendly market speculation not even an indicator) of future outcomes of anticipated worth, and the foreign money additionally has a longtime repute for excessive volatility; over the previous eleven months, Bitcoin holders have misplaced about 67% of their wealth and very often the worth strikes up or down by as a lot as 25% in a single week. Seeing this concern, there’s a rising curiosity in a easy query: can we get one of the best of each worlds? Can we now have the total decentralization {that a} cryptographic fee community provides, however on the similar time have the next stage of value stability, with out such excessive upward and downward swings?

Final week, a crew of Japanese researchers made a proposal for an “improved Bitcoin”, which was an try to just do that: whereas Bitcoin has a set provide, and a risky value, the researchers’ Improved Bitcoin would differ its provide in an try to mitigate the shocks in value. Nonetheless, the issue of constructing a price-stable cryptocurrency, because the researchers realized, is way totally different from that of merely establishing an inflation goal for a central financial institution. The underlying query is tougher: how will we goal a set value in a manner that’s each decentralized and strong towards assault?

To resolve the difficulty correctly, it’s best to interrupt it down into two largely separate sub-problems:

- How will we measure a foreign money’s value in a decentralized manner?

- Given a desired provide adjustment to focus on the worth, to whom will we problem and the way will we take up foreign money models?

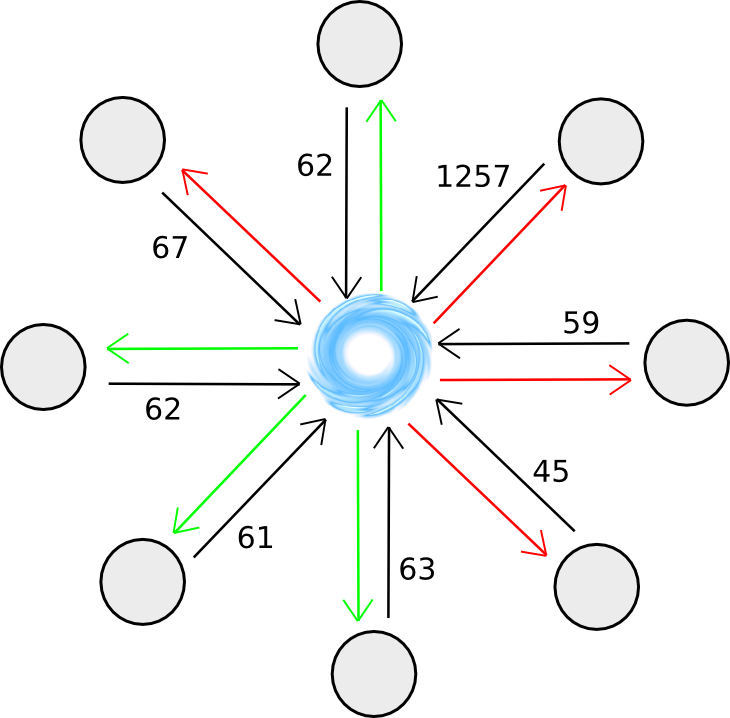

Decentralized Measurement

For the decentralized measurement downside, there are two identified main lessons of options: exogenous options, mechanisms which attempt to measure the worth with respect to some exact index from the skin, and endogenous options, mechanisms which attempt to use inside variables of the community to measure value. So far as exogenous options go, thus far the one dependable identified class of mechanisms for (probably) cryptoeconomically securely figuring out the worth of an exogenous variable are the totally different variants of Schellingcoin – basically, have everybody vote on what the result’s (utilizing some set chosen randomly primarily based on mining energy or stake in some foreign money to forestall sybil assaults), and reward everybody that gives a outcome that’s near the bulk consensus. If you happen to assume that everybody else will present correct info, then it’s in your curiosity to supply correct info so as to be nearer to the consensus – a self-reinforcing mechanism very similar to cryptocurrency consensus itself.

The primary downside with Schellingcoin is that it is not clear precisely how secure the consensus is. Significantly, what if some medium-sized actor pre-announces some various worth to the reality that might be helpful for many actors to undertake, and the actors handle to coordinate on switching over? If there was a big incentive, and if the pool of customers was comparatively centralized, it may not be too tough to coordinate on switching over.

There are three main components that may affect the extent of this vulnerability:

- Is it seemingly that the contributors in a schellingcoin even have a typical incentive to bias the lead to some path?

- Do the contributors have some widespread stake within the system that might be devalued if the system had been to be dishonest?

- Is it attainable to “credibly commit” to a selected reply (ie. decide to offering the reply in a manner that clearly cannot be modified)?

(1) is quite problematic for single-currency programs, as if the set of contributors is chosen by their stake within the foreign money then they’ve a powerful incentive to fake the foreign money value is decrease in order that the compensation mechanism will push it up, and if the set of contributors is chosen by mining energy then they’ve a powerful incentive to fake the foreign money’s value is simply too excessive in order to extend the issuance. Now, if there are two sorts of mining, certainly one of which is used to pick Schellingcoin contributors and the opposite to obtain a variable reward, then this objection not applies, and multi-currency programs may get round the issue. (2) is true if the participant choice is predicated on both stake (ideally, long-term bonded stake) or ASIC mining, however false for CPU mining. Nonetheless, we must always not merely depend on this incentive to outweigh (1).

(3) is maybe the toughest; it relies on the exact technical implementation of the Schellingcoin. A easy implementation involving merely submitting the values to the blockchain is problematic as a result of merely submitting one’s worth early is a reputable dedication. The unique SchellingCoin used a mechanism of getting everybody submit a hash of the worth within the first spherical, and the precise worth within the second spherical, kind of a cryptographic equal to requiring everybody to place down a card face down first, after which flip it on the similar time; nevertheless, this too permits credible dedication by revealing (even when not submitting) one’s worth early, as the worth could be checked towards the hash.

A 3rd choice is requiring all the contributors to submit their values immediately, however solely throughout a selected block; if a participant does launch a submission early they will all the time “double-spend” it. The 12-second block time would imply that there’s nearly no time for coordination. The creator of the block could be strongly incentivized (and even, if the Schellingcoin is an unbiased blockchain, required) to incorporate all participations, to discourage or stop the block maker from choosing and selecting solutions. A fourth class of choices includes some secret sharing or safe multiparty computation mechanism, utilizing a set of nodes, themselves chosen by stake (maybe even the contributors themselves), as a kind of decentralized substitute for a centralized server resolution, with all of the privateness that such an method entails.

Lastly, a fifth technique is to do the schellingcoin “blockchain-style”: each interval, some random stakeholder is chosen, and instructed to supply their vote as a [id, value] pair, the place worth is the precise legitimate and id is an identifier of the earlier vote that appears appropriate. The motivation to vote appropriately is that solely assessments that stay in the principle chain after some variety of blocks are rewarded, and future voters will notice connect their vote to a vote that’s incorrect fearing that in the event that they do voters after them will reject their vote.

Schellingcoin is an untested experiment, and so there’s professional motive to be skeptical that it’ll work; nevertheless, if we would like something near an ideal value measurement scheme it is at the moment the one mechanism that we now have. If Schellingcoin proves unworkable, then we must make do with the opposite sorts of methods: the endogenous ones.

Endogenous Options

To measure the worth of a foreign money endogenously, what we basically want is to seek out some service contained in the community that’s identified to have a roughly secure real-value value, and measure the worth of that service contained in the community as measured within the community’s personal token. Examples of such companies embody:

- Computation (measured by way of mining issue)

- Transaction charges

- Information storage

- Bandwidth provision

A barely totally different, however associated, technique, is to measure some statistic that correllates not directly with value, often a metric of the extent of utilization; one instance of that is transaction quantity.

The issue with all of those companies is, nevertheless, that none of them are very strong towards speedy adjustments as a result of technological innovation. Moore’s Regulation has thus far assured that the majority types of computational companies turn out to be cheaper at a charge of 2x each two years, and it might simply velocity as much as 2x each 18 months or 2x each 5 years. Therefore, making an attempt to peg a foreign money to any of these variables will seemingly result in a system which is hyperinflationary, and so we’d like some extra superior methods for utilizing these variables to find out a extra secure metric of the worth.

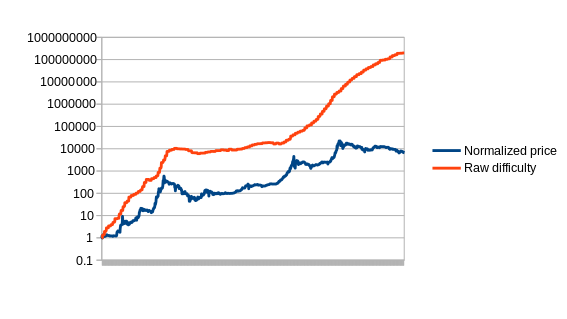

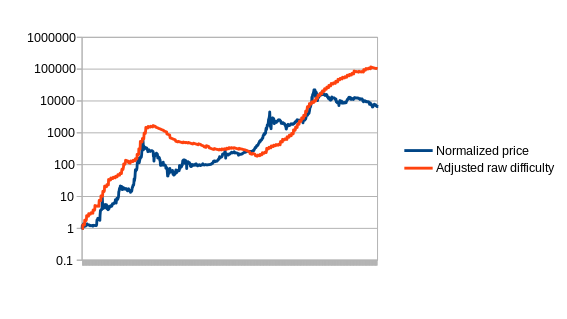

First, allow us to arrange the issue. Formally, we outline an estimator to be a perform which receives a knowledge feed of some enter variable (eg. mining issue, transaction value in foreign money models, and so on) D[1], D[2], D[3]…, and must output a stream of estimates of the foreign money’s value, P[1], P[2], P[3]… The estimator clearly can’t look into the longer term; P[i] could be depending on D[1], D[2] … D[i], however not D[i+1]. Now, to begin off, allow us to graph the only attainable estimator on Bitcoin, which we’ll name the naive estimator: issue equals value.

Sadly, the issue with this method is clear from the graph and was already talked about above: issue is a perform of each value and Moore’s legislation, and so it provides outcomes that depart from any correct measure of the worth exponentially over time. The primary fast technique to repair this downside is to attempt to compensate for Moore’s legislation, utilizing the problem however artificially decreasing the worth by some fixed per day to counteract the anticipated velocity of technological progress; we’ll name this the compensated naive estimator. Observe that there are an infinite variety of variations of this estimator, one for every depreciation charge, and all the different estimators that we present right here may even have parameters.

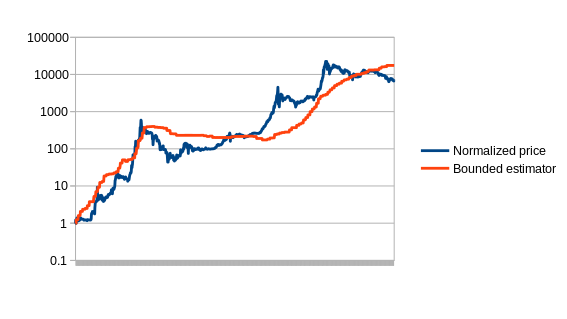

The way in which that we are going to choose the parameter for our model is through the use of a variant of simulated annealing to seek out the optimum values, utilizing the primary 780 days of the Bitcoin value as “coaching information”. The estimators are then left to carry out as they might for the remaining 780 days, to see how they might react to situations that had been unknown when the parameters had been optimized (this system, is aware of as “cross-validation”, is commonplace in machine studying and optimization principle). The optimum worth for the compensated estimator is a drop of 0.48% per day, resulting in this chart:

The subsequent estimator that we are going to discover is the bounded estimator. The way in which the bounded estimator works is considerably extra sophisticated. By default, it assumes that every one progress in issue is because of Moore’s legislation. Nonetheless, it assumes that Moore’s legislation can’t go backwards (ie. expertise getting worse), and that Moore’s legislation can’t go quicker than some charge – within the case of our model, 5.88% per two weeks, or roughly quadrupling yearly. Any progress exterior these bounds it assumes is coming from value rises or drops. Thus, for instance, if the problem rises by 20% in a single interval, it assumes that 5.88% of it is because of technological developments, and the remaining 14.12% is because of a value enhance, and thus a stabilizing foreign money primarily based on this estimator would possibly enhance provide by 14.12% to compensate. The idea is that cryptocurrency value progress to a big extent occurs in speedy bubbles, and thus the bounded estimator ought to be capable of seize the majority of the worth progress throughout such occasions.

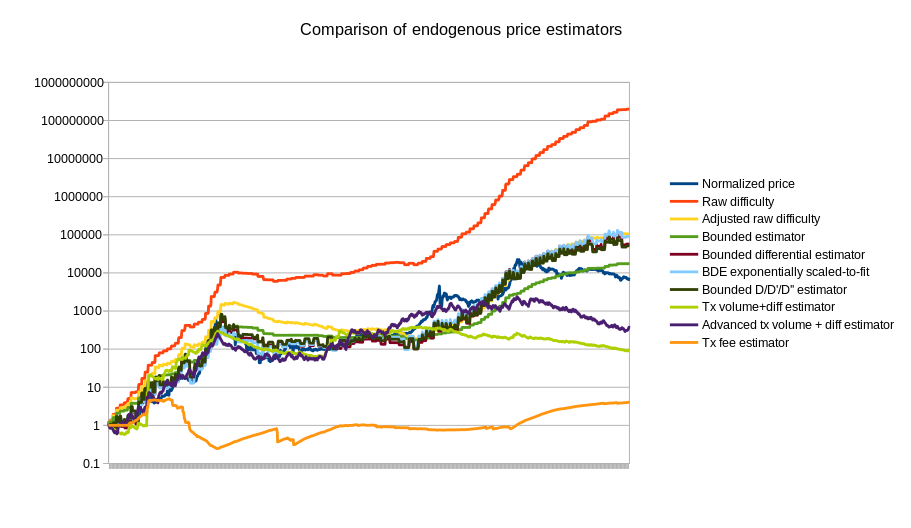

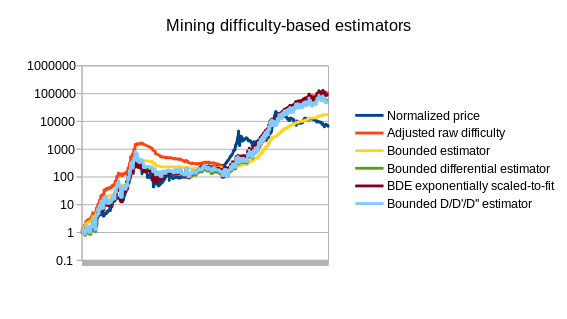

There are extra superior methods as effectively; one of the best methods ought to keep in mind the truth that ASIC farms take time to arrange, and likewise comply with a hysteresis impact: it is usually viable to maintain an ASIC farm on-line if you have already got it even when beneath the identical situations it could not be viable to begin up a brand new one. A easy method is wanting on the charge of enhance of the problem, and never simply the problem itself, and even utilizing a linear regression evaluation to undertaking issue 90 days into the longer term. Here’s a chart containing the above estimators, plus just a few others, in comparison with the precise value:

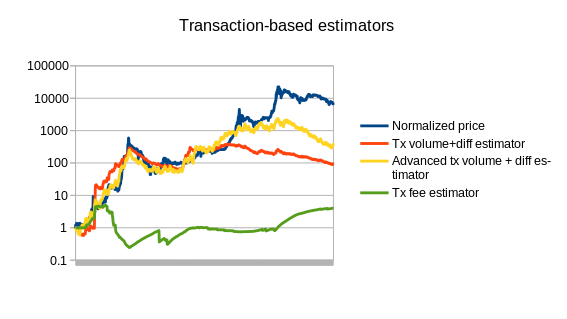

Observe that the chart additionally consists of three estimators that use statistics aside from Bitcoin mining: a easy and a complicated estimator utilizing transaction quantity, and an estimator utilizing the typical transaction charge. We will additionally cut up up the mining-based estimators from the opposite estimators:

|

|

See https://github.com/ethereum/economic-modeling/tree/grasp/stability for the supply code that produced these outcomes.

In fact, that is solely the start of endogenous value estimator principle; a extra thorough evaluation involving dozens of cryptocurrencies will seemingly go a lot additional. One of the best estimators might effectively find yourself utilizing a mix of various measures; seeing how the difficulty-based estimators overshot the worth in 2014 and the transaction-based estimators undershot the worth, the 2 mixed might find yourself being considerably extra correct. The issue can also be going to get simpler over time as we see the Bitcoin mining financial system stabilize towards one thing nearer to an equilibrium the place expertise improves solely as quick as the overall Moore’s legislation rule of 2x each 2 years.

To see simply how good these estimators can get, we will notice from the charts that they will cancel out at the very least 50% of cryptocurrency value volatility, and should enhance to ~67% as soon as the mining trade stabilizes. One thing like Bitcoin, if it turns into mainstream, will seemingly be considerably extra unstable than gold, however not that rather more unstable – the one distinction between BTC and gold is that the provision of gold can truly enhance as the worth goes greater since extra could be mined if miners are prepared to pay greater prices, so there’s an implicit dampening impact, however the provide elasticity of gold is surprisingly not that excessive; manufacturing barely elevated in any respect throughout the run-ups in value throughout the Nineteen Seventies and 2000s. The value of gold stayed inside a variety of 4.63x ($412 to $1980) within the final decade; logarithmically decreasing that by two thirds provides a variety of 1.54x, not a lot greater than EUR/USD (1.37x), JPY/USD (1.64x) or CAD/USD (1.41x); thus, endogenous stabilization might effectively show fairly viable, and could also be most well-liked as a result of its lack of tie to any particular centralized foreign money or authority.

The opposite problem that every one of those estimators need to take care of is exploitability: if transaction quantity is used to find out the foreign money’s value, then an attacker can manipulate the worth very simply by merely sending very many transactions. The typical transaction charges paid in Bitcoin are about $5000 per day; at that value in a stabilized foreign money the attacker would be capable of halve the worth. Mining issue, nevertheless, is way more tough to take advantage of just because the market is so massive. If a platform doesn’t need to settle for the inefficiencies of wasteful proof of labor, an alternate is to construct in a marketplace for different sources, akin to storage, as an alternative; Filecoin and Permacoin are two efforts that try to make use of a decentralized file storage market as a consensus mechanism, and the identical market might simply be dual-purposed to function an estimator.

The Issuance Drawback

Now, even when we now have a fairly good, and even good, estimator for the foreign money’s value, we nonetheless have the second downside: how will we problem or take up foreign money models? The only method is to easily problem them as a mining reward, as proposed by the Japanese researchers. Nonetheless, this has two issues:

- Such a mechanism can solely problem new foreign money models when the worth is simply too excessive; it can’t take up foreign money models when the worth is simply too low.

- If we’re utilizing mining issue in an endogenous estimator, then the estimator must keep in mind the truth that a few of the will increase in mining issue can be a results of an elevated issuance charge triggered by the estimator itself.

If not dealt with very rigorously, the second downside has the potential to create some quite harmful suggestions loops in both path; nevertheless, if we use a special market as an estimator and as an issuance mannequin then this won’t be an issue. The primary downside appears critical; the truth is, one can interpret it as saying that any foreign money utilizing this mannequin will all the time be strictly worse than Bitcoin, as a result of Bitcoin will finally have an issuance charge of zero and a foreign money utilizing this mechanism may have an issuance charge all the time above zero. Therefore, the foreign money will all the time be extra inflationary, and thus much less engaging to carry. Nonetheless, this argument isn’t fairly true; the reason being that when a consumer purchases models of the stabilized foreign money then they’ve extra confidence that on the time of buy the models should not already overvalued and subsequently will quickly decline. Alternatively, one can notice that extraordinarily massive swings in value are justified by altering estimations of the likelihood the foreign money will turn out to be 1000’s of occasions dearer; clipping off this chance will cut back the upward and downward extent of those swings. For customers who care about stability, this danger discount might effectively outweigh the elevated common long-term provide inflation.

BitAssets

A second method is the (unique implementation of the) “bitassets” technique utilized by Bitshares. This method could be described as follows:

- There exist two currencies, “vol-coins” and “stable-coins”.

- Steady-coins are understood to have a price of $1.

- Vol-coins are an precise foreign money; customers can have a zero or constructive steadiness of them. Steady-coins exist solely within the type of contracts-for-difference (ie. each unfavorable stable-coin is known as a debt to another person, collateralized by at the very least 2x the worth in vol-coins, and each constructive stable-coin is the possession of that debt).

- If the worth of somebody’s stable-coin debt exceeds 90% of the worth of their vol-coin collateral, the debt is cancelled and the whole vol-coin collateral is transferred to the counterparty (“margin name”)

- Customers are free to commerce vol-coins and stable-coins with one another.

And that is it. The important thing piece that makes the mechanism (supposedly) work is the idea of a “market peg”: as a result of everybody understands that stable-coins are speculated to be price $1, if the worth of a stable-coin drops beneath $1, then everybody will understand that it’ll finally return to $1, and so folks will purchase it, so it truly will return to $1 – a self-fulfilling prophecy argument. And for the same motive, if the worth goes above $1, it should return down. As a result of stable-coins are a zero-total-supply foreign money (ie. every constructive unit is matched by a corresponding unfavorable unit), the mechanism isn’t intrinsically unworkable; a value of $1 could possibly be secure with ten customers or ten billion customers (bear in mind, fridges are customers too!).

Nonetheless, the mechanism has some quite critical fragility properties. Certain, if the worth of a stable-coin goes to $0.95, and it is a small drop that may simply be corrected, then the mechanism will come into play, and the worth will shortly return to $1. Nonetheless, if the worth immediately drops to $0.90, or decrease, then customers might interpret the drop as an indication that the peg is definitely breaking, and can begin scrambling to get out whereas they will – thus making the worth fall even additional. On the finish, the stable-coin might simply find yourself being price nothing in any respect. In the actual world, markets do usually present constructive suggestions loops, and it’s fairly seemingly that the one motive the system has not fallen aside already is as a result of everybody is aware of that there exists a big centralized group (BitShares Inc) which is prepared to behave as a purchaser of final resort to keep up the “market” peg if obligatory.

Observe that BitShares has now moved to a considerably totally different mannequin involving value feeds offered by the delegates (contributors within the consensus algorithm) of the system; therefore the fragility dangers are seemingly considerably decrease now.

SchellingDollar

An method vaguely much like BitAssets that arguably works significantly better is the SchellingDollar (referred to as that manner as a result of it was initially supposed to work with the SchellingCoin value detection mechanism, nevertheless it can be used with endogenous estimators), outlined as follows:

- There exist two currencies, “vol-coins” and “stable-coins”. Vol-coins are initially distributed one way or the other (eg. pre-sale), however initially no stable-coins exist.

- Customers might have solely a zero or constructive steadiness of vol-coins. Customers might have a unfavorable steadiness of stable-coins, however can solely purchase or enhance their unfavorable steadiness of stable-coins if they’ve a amount of vol-coins equal in worth to twice their new stable-coin steadiness (eg. if a stable-coin is $1 and a vol-coin is $5, then if a consumer has 10 vol-coins ($50) they will at most cut back their stable-coin steadiness to -25)

- If the worth of a consumer’s unfavorable stable-coins exceeds 90% of the worth of the consumer’s vol-coins, then the consumer’s stable-coin and vol-coin balances are each decreased to zero (“margin name”). This prevents conditions the place accounts exist with negative-valued balances and the system goes bankrupt as customers run away from their debt.

- Customers can convert their stable-coins into vol-coins or their vol-coins into stable-coins at a charge of $1 price of vol-coin per stable-coin, maybe with a 0.1% trade charge. This mechanism is after all topic to the bounds described in (2).

- The system retains observe of the entire amount of stable-coins in circulation. If the amount exceeds zero, the system imposes a unfavorable rate of interest to make constructive stable-coin holdings much less engaging and unfavorable holdings extra engaging. If the amount is lower than zero, the system equally imposes a constructive rate of interest. Rates of interest could be adjusted by way of one thing like a PID controller, or perhaps a easy “enhance or lower by 0.2% on daily basis primarily based on whether or not the amount is constructive or unfavorable” rule.

Right here, we don’t merely assume that the market will hold the worth at $1; as an alternative, we use a central-bank-style rate of interest concentrating on mechanism to artificially discourage holding stable-coin models if the provision is simply too excessive (ie. higher than zero), and encourage holding stable-coin models if the provision is simply too low (ie. lower than zero). Observe that there are nonetheless fragility dangers right here. First, if the vol-coin value falls by greater than 50% in a short time, then many margin name situations can be triggered, drastically shifting the stable-coin provide to the constructive facet, and thus forcing a excessive unfavorable rate of interest on stable-coins. Second, if the vol-coin market is simply too skinny, then it is going to be simply manipulable, permitting attackers to set off margin name cascades.

One other concern is, why would vol-coins be precious? Shortage alone won’t present a lot worth, since vol-coins are inferior to stable-coins for transactional functions. We will see the reply by modeling the system as a kind of decentralized company, the place “making earnings” is equal to absorbing vol-coins and “taking losses” is equal to issuing vol-coins. The system’s revenue and loss situations are as follows:

- Revenue: transaction charges from exchanging stable-coins for vol-coins

- Revenue: the additional 10% in margin name conditions

- Loss: conditions the place the vol-coin value falls whereas the entire stable-coin provide is constructive, or rises whereas the entire stable-coin provide is unfavorable (the primary case is extra prone to occur, as a result of margin-call conditions)

- Revenue: conditions the place the vol-coin value rises whereas the entire stable-coin provide is constructive, or falls whereas it is unfavorable

Observe that the second revenue is in some methods a phantom revenue; when customers maintain vol-coins, they might want to keep in mind the chance that they are going to be on the receiving finish of this additional 10% seizure, which cancels out the profit to the system from the revenue current. Nonetheless, one would possibly argue that due to the Dunning-Kruger impact customers would possibly underestimate their susceptibility to consuming the loss, and thus the compensation can be lower than 100%.

Now, think about a method the place a consumer tries to carry on to a continuing proportion of all vol-coins. When x% of vol-coins are absorbed, the consumer sells off x% of their vol-coins and takes a revenue, and when new vol-coins equal to x% of the prevailing provide are launched, the consumer will increase their holdings by the identical portion, taking a loss. Thus, the consumer’s web revenue is proportional to the entire revenue of the system.

Seignorage Shares

A fourth mannequin is “seignorage shares”, courtesy of Robert Sams. Seignorage shares is a quite elegant scheme that, in my very own simplified tackle the scheme, works as follows:

- There exist two currencies, “vol-coins” and “stable-coins” (Sams makes use of “shares” and “cash”, respectively)

- Anybody can buy vol-coins for stable-coins or vol-coins for stable-coins from the system at a charge of $1 price of vol-coin per stable-coin, maybe with a 0.1% trade charge

Observe that in Sams’ model, an public sale was used to unload newly-created stable-coins if the worth goes too excessive, and purchase if it goes too low; this mechanism mainly has the identical impact, besides utilizing an always-available fastened value rather than an public sale. Nonetheless, the simplicity comes at the price of a point of fragility. To see why, allow us to make an analogous valuation evaluation for vol-coins. The revenue and loss situations are easy:

- Revenue: absorbing vol-coins to problem new stable-coins

- Loss: issuing vol-coins to soak up stable-coins

The identical valuation technique applies as within the different case, so we will see that the worth of the vol-coins is proportional to the anticipated complete future enhance within the provide of stable-coins, adjusted by some discounting issue. Thus, right here lies the issue: if the system is known by all events to be “winding down” (eg. customers are abandoning it for a superior competitor), and thus the entire stable-coin provide is anticipated to go down and by no means come again up, then the worth of the vol-coins drops beneath zero, so vol-coins hyperinflate, after which stable-coins hyperinflate. In trade for this fragility danger, nevertheless, vol-coins can obtain a a lot greater valuation, so the scheme is way more engaging to cryptoplatform builders trying to earn income by way of a token sale.

Observe that each the SchellingDollar and seignorage shares, if they’re on an unbiased community, additionally must keep in mind transaction charges and consensus prices. Luckily, with proof of stake, it needs to be attainable to make consensus cheaper than transaction charges, by which case the distinction could be added to earnings. This probably permits for a bigger market cap for the SchellingDollar’s vol-coin, and permits the market cap of seignorage shares’ vol-coins to stay above zero even within the occasion of a considerable, albeit not complete, everlasting lower in stable-coin quantity. Finally, nevertheless, a point of fragility is inevitable: on the very least, if curiosity in a system drops to near-zero, then the system could be double-spent and estimators and Schellingcoins exploited to demise. Even sidechains, as a scheme for preserving one foreign money throughout a number of networks, are vulnerable to this downside. The query is just (1) how will we reduce the dangers, and (2) provided that dangers exist, how will we current the system to customers in order that they don’t turn out to be overly depending on one thing that might break?

Conclusions

Are stable-value property obligatory? Given the excessive stage of curiosity in “blockchain expertise” coupled with disinterest in “Bitcoin the foreign money” that we see amongst so many within the mainstream world, maybe the time is ripe for stable-currency or multi-currency programs to take over. There would then be a number of separate lessons of cryptoassets: secure property for buying and selling, speculative property for funding, and Bitcoin itself might effectively function a novel Schelling level for a common fallback asset, much like the present and historic functioning of gold.

If that had been to occur, and notably if the stronger model of value stability primarily based on Schellingcoin methods might take off, the cryptocurrency panorama might find yourself in an fascinating state of affairs: there could also be 1000’s of cryptocurrencies, of which many can be risky, however many others can be stable-coins, all adjusting costs almost in lockstep with one another; therefore, the state of affairs might even find yourself being expressed in interfaces as a single super-currency, however the place totally different blockchains randomly give constructive or unfavorable rates of interest, very similar to Ferdinando Ametrano’s “Hayek Cash”. The true cryptoeconomy of the longer term might haven’t even begun to take form.